Foreign companies that wish to do business in China, may decide to establish a legal presence to enter the Chinese market. The establishment of a Foreign Invested Entity in China is subject to various laws, regulations and governmental authorities. The time required to establish a fully operational subsidiary in China depends in part on the chosen investment vehicle and business activities.

In order to provide foreign investors a thorough understanding of the steps that are required to set up a fully operational entity in China, this article provides a 10-step overview below on the corporate establishment procedures and provide our insight on the time required to establish a legal entity in China.

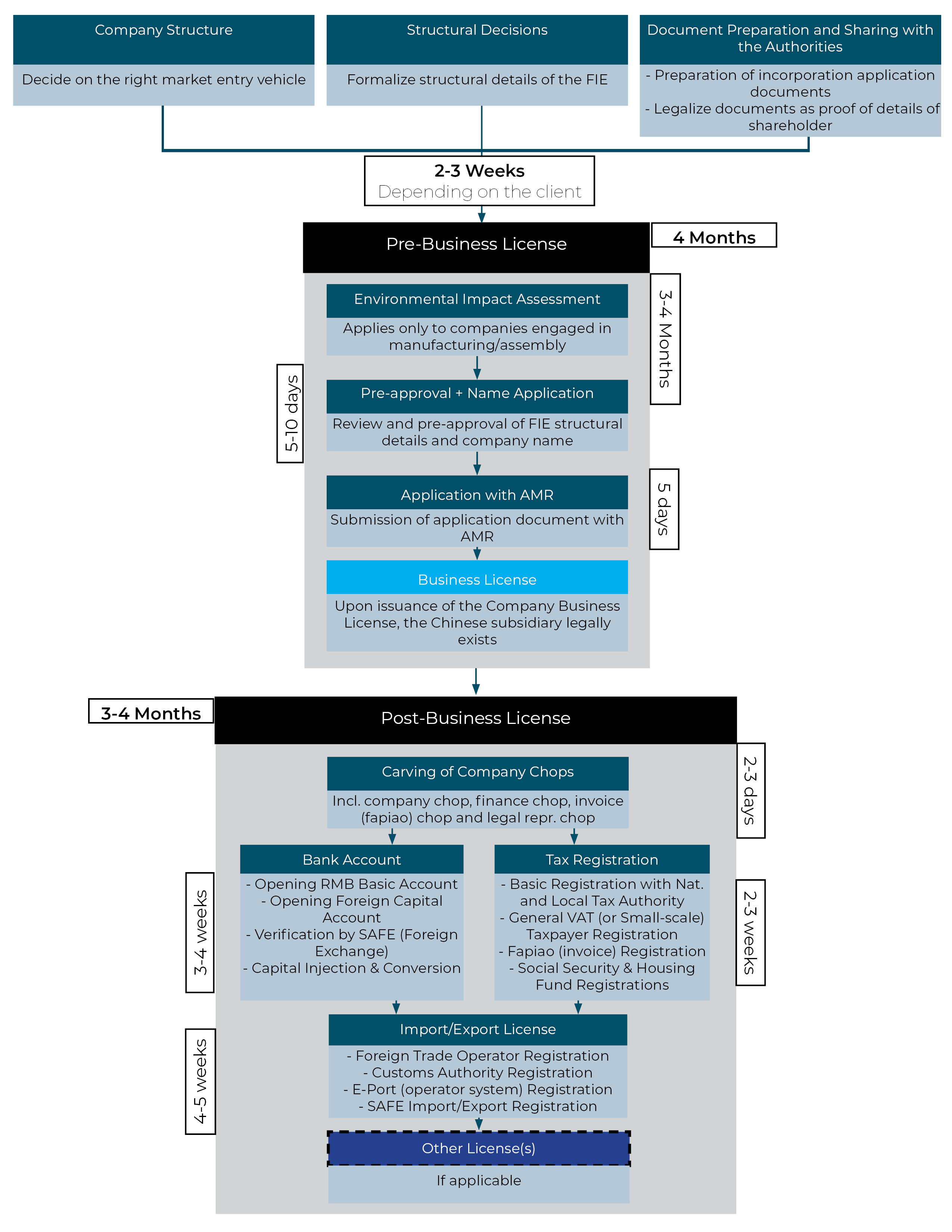

Corporate Establishment Procedures

Step 1. Choosing the Company Structure

When foreign investors are considering establishing a company in China, it is essential to decide on the right market entry vehicle. The most suitable company structure when setting up a company in China depends on multiple factors, with the intended business activities and industry in China in which a foreign investor wishes to operate being the most important considerations. The three main company structures available for foreign investors to set up a presence in China are:

- A Wholly Foreign Owned Enterprise or WFOE (request our WFOE White Paper for more information);

- A Sino-Foreign Joint Venture (JV);

- A Representative Office (RO).

To learn more about the available company structures in China for foreign investors, please refer to our article with a comparison of China company structures.

Step 2. Document Preparation & Legalization in Country of Shareholder

For the establishment of a legal entity in China several documents must be provided as evidence of the details of the foreign investor, such as proof of its incorporation and status of the shareholding company, which individuals have authority to sign documents on behalf of the company and the identity of key registered personnel.

Since China is not part of the apostille convention, documents from foreign countries are only legally valid in China when these are legalized by a Chinese embassy/consulate in a foreign country. The method to legalize documents varies per country, but commonly includes the following steps:

- Notarization by a public notary;

- Legalization by Foreign Affairs authority of the foreign country;

- Legalization by Chinese embassy/consulate in the foreign country.

Because these procedures can be time-consuming, we advise to start the process of procuring these documents and completing the legalization procedures as soon as the decision to set up a subsidiary in China has been taken. Whilst documents are in preparation, the company can simultaneously decide on the structure details as discussed in the next step below.

Step 3. Decide on Structural Details of the Chinese Subsidiary

Before proceeding with the application procedures with the Chinese authorities, the following structural details must be decided upon:

- Company name in Chinese

- Company name in English (optional)

- Business scope

- Registered personnel

- Registered address

- Registered capital & total investment

It should be noted that all structural details are subject to approval by the in-charge Chinese authorities. In particular, the Chinese name and business scope will be critically reviewed. Therefore, we normally propose to prepare several Chinese names considering the possibility that the authorities will reject proposed names; and we advise that the process of drafting of a business scope may require discussion with the local Administration for Market Regulation (AMR) to define an acceptable business scope within the limits of the catalogue of permittable business activities.

Step 4. Pre-approval and Name Registration

When all structural details have been decided, the company can file an online pre-approval for the structural decisions as enumerated upon at Step 3 and company name registration. Although legalized documents are not yet required at this stage, the company is required to upload scans of the identification documents of the intended registered personnel and a copy of the lease agreement for its intended registered among others.

Upon review, the authorities may reject the pre-application if any of the structural details cannot be accepted for failing to meet prescribed (local) requirements. After correcting any possible issues in discussion with the AMR, the company can resubmit the application until it receives approval.

Once the pre-application is approved, the system will generate the official application documents, which must be printed and physically signed by the registered personnel. As the applications documents in combination with documents evidencing details of the investor will be physically required during applications with the AMR, they must be couriered to China together. It should be noted that application procedures differ throughout China and (pre-)application procedures may differ per locality.

Step 5. Application with the Administration for Market Regulation (AMR)

Upon receipt of the signed application documents and legalized documents from the investor in China, the official application with the AMR can be started. Upon receiving approval from the AMR, the business license will be issued and at this moment the Chinese subsidiary legally exists. If no further feedback however, the entity is not operational yet.

In addition to the paper business license, the authorities have now also started implementing the use the electronic business license. As it is expected that the licenses will soon be implemented nationwide as the main license to handle company matters, we advise companies to immediately apply for the electronic business license during incorporation as well.

Step 6. Carving of Company Chops

After issuance of the business license, the company can proceed with the carving of the company chops, which serve as signatures on behalf of the company and can make documents binding (read our article on company chops for further information). The various company chops are required for the completion of subsequent application procedures.

Step 7. Bank Account Opening

For any Chinese subsidiary to be fully operational, it will be required to inject capital and set up the following bank accounts:

- RMB Basic Bank Account – which is used for daily (current account) transactions.

- Foreign Capital Account – which solely serves to receive the company’s capital via capital injection.

It should be noted that a foreign-invested enterprise is legally required to inject the full amount of registered capital within a 30-year period, meaning you are not per se required to inject all capital in one time. Before the Chinese subsidiary can use capital funds in China, it must be converted from the foreign capital account into RMB on the RMB basic account.

Step 8. Tax Registrations

Any foreign-invested company in China is required to meet tax filing compliance requirements and therefore is required to commence with basic tax registrations within 30 days after the entity legally exists. In order to meet these legal requirements and to become fully operational, a company must apply for the following tax registrations:

- Basic registration with National and Local Tax Authority.

- Registration for General VAT Taxpayer Status – required to deduct input VAT from output VAT – or Small-scale Taxpayer Status.

- VAT invoice “Fapiao” registration – required to be able to issue fapiao (official Chinese invoice).

- Company registration at the Social Security & Housing Fund – required to meet the company’s obligations to pay contributions for social security and housing fund on behalf of its employees.

- Foreign Experts Bureau Registration – If a Chinese subsidiary intends to hire foreign nationals, it must additionally complete a registration with the local Foreign Experts Bureau.

Step 9. Import/Export License Application (if applicable)

If a company wants to be able to import and export goods, it is required to apply for an import/export license with the customs authority and obtain access to the E-port operator system. Furthermore, the company is required to complete a registration with the State Administration for Foreign Exchange (SAFE) in order to be eligible to receive funds or make payments for goods that have been exported and imported respectively.

Step 10. Applications for Other Licenses (if applicable)

In several industries additional licenses may be required to operate, for example a food & beverage license, alcohol distribution license, and specific professional licenses (e.g. an accounting license).

Time Required to Establish a Company

Although the time required to establish a legal entity in China depends in part on the chosen investment vehicle and planned business activities, it takes on average 2 to 4 months to set up a fully operational legal entity. The above time estimate includes the preparation of documents from the shareholder and making of structural decisions, as well as operationalization of the entity which includes bank- and tax registrations. Whereas some service providers in China may claim they can establish a WFOE within 1 month, we must note that this generally speaking solely encompasses the time required to apply for the company’s Business License and complete the legal incorporation (steps 4 & 5), meaning it excludes prior decision-making and operationalization.

In order to provide a better overview of the potential time required to establish a legal entity in China we provide the below overview separated by steps of the incorporation process:

- Step 1, 2 & 3: Company Structure, Document Preparation/Legalization and Structural Decision-making – approximately 2-3 weeks, depending on the company;

- Step 4: Pre-approval + Name Application – approximately 5-10 working days;

- Step 5: Application with AMR – approximately 5 working days;

- after application with AMR the company’s Business License will be issued and the Chinese subsidiary legally exists.

- Step 6: Carving of Company Chops – approximately 2-3 working days;

- Step 7: Bank Account Opening – approximately 3-4 weeks;

- Step 8: Tax Registrations – approximately 2-3 weeks;

- part of the bank account opening procedures and tax registrations can occur in parallel.

- Step 9: Import/Export License – approximately 4 weeks;

- Step 10: Other licenses – depending on license.

Closing Remarks

The above 10 steps provide a comprehensive overview of the required procedures for the establishment of a foreign-invested company in China. Whereas the official incorporation of a company in China, from the moment of submission of the application with the Administration of Market Regulation until the obtention of the business license, can take as little as one week, the full process to establish a fully operational legal entity in China takes 2 to 4 months depending on the chosen investment vehicle and planned business activities.

As foreign investors are generally largely unfamiliar with the exact requirements to establish an entity in China, we advise to engage a third-party to support in the process. At MSA we specialize in the incorporation of all types of foreign-invested entities in China, including WFOEs, Joint Ventures and Representative Offices. Our support includes advice on the optimal company structure, the required legal documents, structural company decisions, as well as the applications with the AMR, MOFCOM, bank, tax bureau, customs authority, as well as any other required authorities.

To learn more on how we support foreign companies with the establishment of a company in China, refer to our Corporate Services page or contact us directly.