In December 2019, the State Administration of Taxation issued a tax circular on the final settlement of individual income tax in 2019. The circular serves to further clarify the process of annual tax settlement and to establish a reasonable and orderly system for the settlement and payment of comprehensive income from personal income tax.

After the end of 2019, individuals need to aggregate income received from January 1 to December 31, from four types of income sources. As discussed in our earlier article, the four categories of comprehensive income include wages and salary, remuneration for personal services, income from remuneration for manuscripts and income from royalties. The purpose of the annual IIT filing is to perform a reconciliation of tax paid versus tax payable. Based on the earned comprehensive income minus the standard and special deductions, the final taxable amount for the year 2019 will be obtained. Differences from the prepaid tax amount for 2019 will result in a tax refund or supplement. In this article we discuss the taxable income and deduction and the process for the annual IIT settlement.

Taxable Income and Deductions

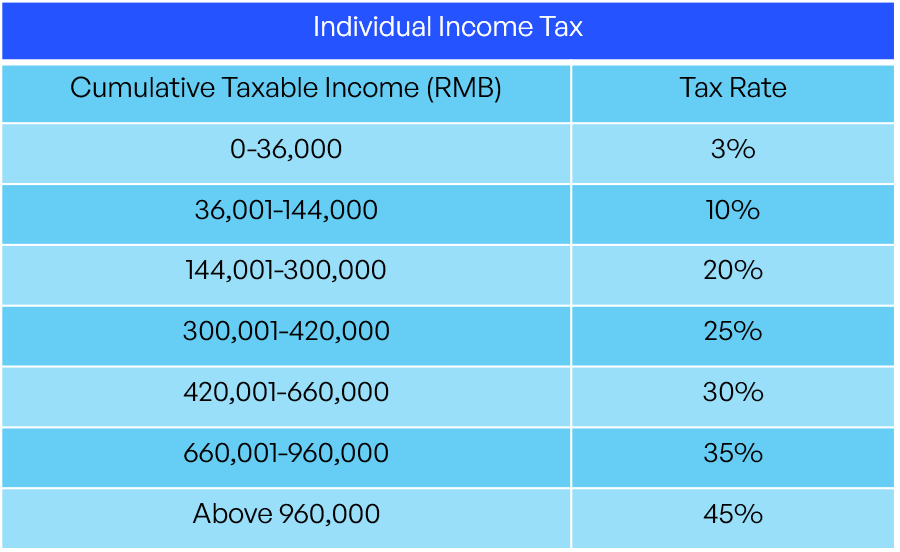

All of the four above mentioned income sources are consolidated into comprehensive income and the following tax rates are applicable:

However, according to the Individual Income Tax Law, the amount of comprehensive income is not fully taxable. The IIT Law provides several deductions to reduce the amount of taxable income. Firstly, there is a standard deduction of RMB 5,000 per month lowering the taxable amount. On top of that, individuals can make use of special itemized deductions. As discussed in our earlier article on IIT, these include children’s education expenses, continuing education expenses, medical expenses for critical illness, interest expenses for mortgages, housing rental expenses and expenditures on dependent elderly. However, foreigners can make use of special ‘allowances’, instead of aforementioned itemized deductions. They cannot enjoy both the special allowances and the itemized deductions. The special allowances include expenses for housing rent, relocation costs, home flight and laundry expenses. Foreigners can still use these deductions until the end of 2021. From 2022 they can only make use of the above mentioned six types of special itemized deductions.

After adjusting the comprehensive income for the standard deductions and any special additional deductions, the taxable income is determined. The annual IIT filing is done to determine whether the individual has indeed paid the correct amount of taxes over the taxable income of the full year.

Exemptions on the Annual Filing

Individuals are exempt from the annual IIT filing for comprehensive income received during 2019 if one or more of the following applies:

- The individual’s annual comprehensive income does not exceed RMB 120,000;

- The individual’s annual tax reimbursement amount does not exceed RMB 400;

- The individual has paid a pre-tax amount that is in line with annual payable tax amount or does not apply for an annual tax refund.

Therefore, individuals that exceed the amounts specified at the first two points above or individuals that pre-paid a too high or low amount of IIT will have to do an annual IIT filing. Moreover, if the withholding agent that should withhold IIT on behalf of the individual failed to correctly withhold taxes, the individual cannot be exempted from the filing.

The Annual IIT Filing Process

The annual Individual Income Tax filing has to be completed between March 1 and June 30 of the following year. Meaning that the annual IIT filing for the year 2019 has to be performed between March 1 and June 30 of 2020. If an individual is not domiciled in China and leaves the country before the 1st of March of the following year, he/she must handle the annual IIT filing before their departure.

There are three methods to perform the annual IIT filing, namely;

- The individual can do the annual IIT filing him/herself;

- The annual IIT filing can be done through the withholding agent;

- Individuals can entrust a professional service agency to do the annual IIT filing on behalf of the individual through a power of attorney.

Regardless of the way chosen, there are three channels to file the annual IIT reconciliation;

- Online application (including mobile personal income tax app);

- Directly filing at tax office in person;

- Post the application by mail to the relevant tax office.

The online application provides prefilling service for taxpayers to smoothen the annual IIT filing process. However, only foreigners with a permanent residency can immediately register for the app. Foreigners without a permanent residency, will have to register at the tax office once, to be able to use the app. This must be done at the tax bureau of the withholding agent. If this is not convenient, directly filing at the tax office will be the second-best option, as they will have the same information available. Lastly, for the application by mail individuals have to supply information on income and taxes paid themselves. The application by mail has to be posted to the tax authority in the district where the employer is registered. In case there is no employer, it must be sent to the tax authority in the district where the individual’s residence is registered.

IIT Refund or Supplement

In case an individual is eligible to receive an IIT refund, an eligible bank account opened in China must be supplied. If the individual paid personal income tax in advance, but income did not exceed RMB 60,000 (so there is no taxable income), the tax refund will be processed through a simple declaration form. If the individual is eligible for an IIT refund due to different circumstances, the tax authorities will review the information and in accordance determine whether they accept the annual Individual Income Tax reconciliation declaration and subsequently transfer the IIT refund.

Individuals that did not pay a sufficient amount of taxes can pay the annual IIT supplement through online banking, pay by bank card at the tax office, pay at bank counters or via other non-bank payment institutions.

Conclusion

With the annual IIT declaration period coming up soon, it is important for individuals to get a good picture of their income over the year and see whether an annual Individual Income Tax filing has to be done. Moreover, companies should be ready to provide support to employees with the annual IIT filing, by supplying them with the necessary information and possibly assisting them in the filing process, by either filing on their behalf or training them to do the filing themselves.

If you have any questions about the annual filing or Individual Income Tax in China in general, please do not hesitate to contact us.