The second half of 2020 and the first half of 2021 proved to be a vital period for the Chinese economy, with a robust comeback from a year tainted by the COVID-19 pandemic. For many businesses operating in China, we saw an increase in business confidence as well as overall growth in their operations.

In its 6th consecutive year, we conducted the Sino Benelux Business Survey which shares insights on important economic developments, which had an impact on foreign invested companies operating in China. In the 2021 edition, we take a deep look at the impact of COVID, the bounce back from the pandemic, the effect of the challenges that have arisen, and the outlook foreign businesses have going forward. Request your free copy of the 2021 Sino Benelux Business Survey here.

What is the Benelux Business Survey in China?

The Sino Benelux Business Survey 2021 takes a comprehensive look at the performance of Belgian, Dutch and Luxembourgish businesses operating across China. The survey was conducted over a six-week period, starting from mid-March, continuing through until the end of April. With 160 respondents, the survey covered the following key themes:

- Business Demographics

- Business Performance

- The impact of COVID-19

- Business Sentiments

- Onward Expectations

Who were the Respondents?

Of the respondents surveyed, most of them identified as SME’s, with 60% of companies reporting an annual revenue of up to RMB 100 million. While most of the top industries remained consistent with the previous years, the importance of the Chinese market has significantly shifted over the course of the past 2 years. Results of the survey indicated that more businesses are considering China as a vital market in their global strategy.

The majority of respondents that participated in the survey are located in key economic areas of China, including Shanghai, Beijing, and the Greater Bay Area. The respondents represent a range of different industries, with most of the companies operating in Consumer and Industrial Goods and Services sectors.

The Impact of Covid-19

In the 2020 Sino Benelux Business Survey more than 90% of respondents expected COVID-19 to negatively impact their performance in 2020, with a further 50% anticipating a strongly negative impact. However, the results of the 2021 survey indicated that the impact felt by the respondents was not as severe as initially anticipated, especially in the 2nd half of 2020.

The main negative drivers were consistent with more than 70% of respondents, all of which could be concluded to have arisen as a result of the pandemic. The most notable negative drivers include:

- travel restrictions

- a decrease in demand

- supply chain disruptions

With regards to direct effect on profitability, the overall sentiment is that the Benelux businesses were resilient through the challenges. Even though 43.6% of respondents had experienced a decrease in profits as a direct result of COVID, more than 26% did not experience any change. We further observe that 30% of respondents had even seen an increase in annual profits.

Despite the negative effects the COVID-19 pandemic had caused, most of the respondents had received some sort of support or relief from Chinese authorities, while just over a quarter were unaware that any form of support was being offered.

Performance of Foreign SMEs in China

With the first quarter of 2020’s performance still fresh in mind, businesses anticipated an increase in performance over the same period in 2021. However, the increase in performance over Q1 far exceeded the expectations of managers and leaders, with the economy as a whole growing 18% compared to the same period in the previous year. While the results must be viewed with the context of 2020 in mind, the recovery experienced by many businesses provided a positive outlook for most foreign businesses operating in China in 2021.

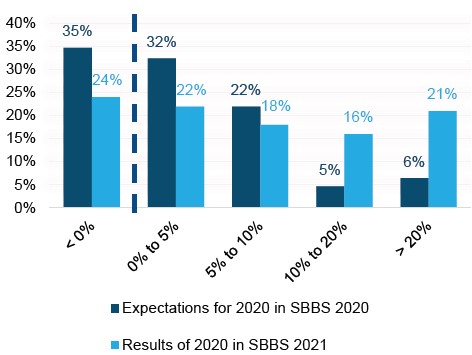

In 2020, 35% of the respondents expected their revenue to shrink, however only 24% experienced a decrease in revenue. With the grim outlook many business managers and leaders had, the results showed Benelux businesses had remained resilient, and a large portion exceeded expectation, as per the illustration below.

Revenue growth rate compared to expectations in 2020

Greater Focus on Quality

The survey revealed that Benelux companies place emphasis on the quality of the product or service they offer, to differentiate themselves from other players in the Chinese market. Most businesses pointed to the use of technology as the leading positive driver, especially to overcome the newly arisen challenges. The most significant negative drivers have remained the same over the past 6 years.

The Future for Foreign Businesses in China

In a global context and considering the current challenges faced by many other countries, many business leaders share the sentiment that China has become an increasingly important place to conduct business. The outlook for growth and profitability has been accelerated by the events of the first half 2020.

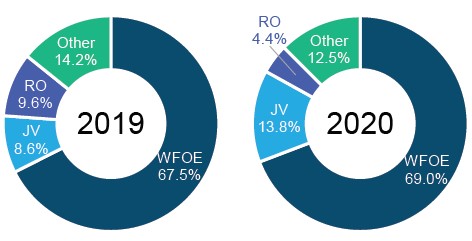

Despite the poor start to the previous year, as it drew to a conclusion, the research found that more foreign companies are looking for more long-term stability. More companies had setup Wholly Foreign Owned Entities (WFOE’s) and entered through Joint Ventures (JVs), as opposed to setting up branch offices or using other short-term solutions. The increase in the setting up of Joint Ventures can mainly be attributed to the opening of specific industries to foreign investment by means of a Joint Venture. The setup of JVs and WFOEs is indicative of the longer-term outlook of Benelux Businesses in China.

Modes of entry of Benelux businesses in China

While a mostly positive outlook and a continued trend of growth remains, China’s updates to the Individual Income Tax Law, which takes effect on the 1st of January 2022, will have a bearing effect on foreign businesses going into the new year. With the effect of increased costs for both employers and employees, we can expect to see a reaction from the market in the coming year.

Final Thoughts

As observed, the expectations of business managers and leaders has become more positive over the past year. With an increase in revenue and a positive perception of the market, Benelux business firms seem to have enhanced focus on the Chinese market for the foreseeable future. While growth has slowed in China over the 3rd quarter, the economy is still expected to experience growth in the last part of 2021 and heading in to 2022.

To read the full 2021 Sino Benelux Business Survey submit your request to receive a copy for free.

What is the Benelux Chamber of Commerce in China?

The Benelux Chamber of Commerce (BenCham) is an organization that is supported by official representations of Belgium, the Netherlands, and Luxembourg in China. The aim of the BenCham is to promote and connect people, companies, and opportunities in China. MSA has been a proud partner of BenCham and continues to promote relations through endeavors like the Sino Benelux Business Survey.

How MS Advisory Can Help Your Business in China

MSA has been assisting SME’s across multiple industries in China with all their accounting, financial advisory and business advisory needs. For nearly a decade, we have been dedicated to delivering high quality results through transparency, experience, and attention to detail. Get in touch with us today and let us provide you with the understanding you need to enhance your operation in China.