Calculate Tax on Bonus In China, as in many other countries, it is common practice for employers to provide its employees with an annual bonus based on their annual performance. When considering the appropriate amount of the annual bonus it is important for employers to understand the calculation of Individual Income Tax (IIT) on bonuses, particularly considering regulatory changes to China’s Individual Income Tax framework in recent years (for a complete overview of China’s IIT framework, please read our full article on Individual Income Tax in China). Therefore, this article will provide further insight into the taxation of annual bonuses in China.

**Updated on 20 Sept, 2023**

Applicable Legislation to Calculate Tax on Annual Bonuses in China

China’s new Individual Income Tax Law which was implemented as of January 1st 2019, and the subsequent clarifications from the Chinese Ministry of Finance (MoF) and State Administration of Taxation (SAT) of March 14th 2019, introduced the policies determining the taxation of annual bonuses in China.

The newly implemented Chinese Individual Income Tax Law set out a 3-year transition policy from January 1st 2019 until December 31st 2021, during which the former preferential tax policy for calculating IIT over annual bonuses (Guoshuifa (2005) No. 9) will remain applicable. In essence, this policy stipulates that a beneficial tax rate would be applied for a one-time annual bonus, meaning this preferential tax rate can only be applied once per calendar year for each individual taxpayer.

The period of the preferential policy which was set to come to an end as of 31 December 2021, has been extended for a period of 2 years and is now set to come to an end as of 31 December 2023.

The extension of the favorable policy on bonuses is only applicable to the 1st bonus received in a year. Should an employee be entitled to receive an additional 2nd bonus throughout the year, the amount of such an additional bonus will also be added to the employee’s monthly taxable income and will be taxed together with their regular monthly income according to the Cumulative Withholding Tax Calculation Method.

Calculating Individual Income Tax on Annual Bonus in China

The first step in order to determine the tax liability over an annual bonus paid in China is to establish whether the individual receiving the bonus is a tax resident or a non-resident, as a different tax calculation will be applicable in accordance with the aforementioned clarifications from the MoF and SAT.

As per Chinese IIT legislation, an individual is considered a tax resident of China if the individual has resided in the country for 183 days or more during a single calendar year. Consequentially, an individual which has resided in China for less than 183 days in a calendar year is considered a non-resident.

The annual tax payable for an individual will now consist of:

(Gross comprehensive yearly income including the annual bonus – yearly social security contributions – standard deductions – other relevant deductions) * the relevant tax rate – quick deduction = Annual tax payable

Practical Example of How the Policy Change Affects Salary

Example 1:

- Party A is a resident taxpayer in China and has a gross monthly income of RMB 25,000 with a one-off annual bonus of RMB 50,000.

The applicable formula for the calculation is:

Tax contribution payable = tax payable on salary + tax payable on annual bonus

We are able to see from the example that Party A will receive RMB 5,210 less than they would have received up to 31 December 2023.

Example 2:

- Party B is a resident taxpayer in China and has a gross monthly income of RMB 50,000, with a one-off annual bonus of RMB 50,000.

From this example we are able to see that Party B will receive RMB 10,210 less than they would have received up to 31 December 2023.

Annual Bonus Calculation During the Preferential Period

Tax Liability on Annual Bonus for Tax Resident

Assuming that an individual’s monthly salary is greater than the IIT exemption threshold, the preferential tax policy stipulates that the amount of Individual Income Tax due on an annual bonus is calculated according to the following method:

- IIT on annual bonus: (taxable income from bonus * applicable tax rate) – quick deduction.

- Taxable income from bonus: annual bonus / 12

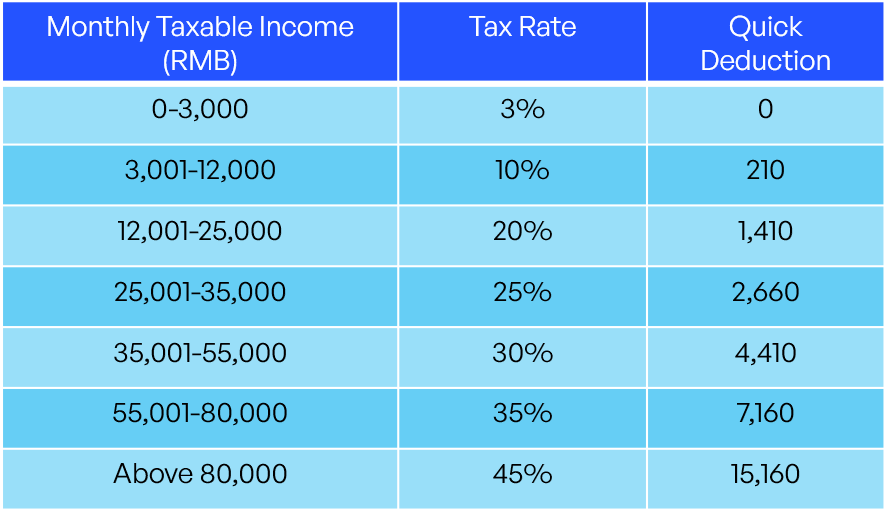

As can be observed from the above calculation method, the applicable tax rate and quick deduction applied to an annual bonus can be obtained by dividing the amount of annual bonus by 12 and thereby deriving the monthly taxable income of the annual bonus. The corresponding tax rate quick deduction can be found in the table below:

By means of an illustration, the amount of Individual Income Tax due on an annual bonus of RMB 50.000 paid to an expatriate in Shanghai would be calculated as following:

- Taxable income from bonus: RMB 50.000 / 12 = 4.166,67.

- IIT on annual bonus: (RMB 50.000 * 10%) – RMB 210 = RMB 4.790.

- Net bonus received by employee: RMB 50.000 – RMB 4.790 = RMB 45.210.

Tax Liability on Annual Bonus for Non-resident

For an individual who is considered a non-resident, first one must calculate the amount of income from bonuses sourced from China. This calculation is the following:

- China-sourced bonus income: annual bonus * (workdays spent in China in sourcing period / total days in sourcing period).

Subsequently, in order to determine the applicable tax rate and corresponding quick deduction one must divide the amount of China-sourced bonus income by 6. As a result, the amount of Individual Income Tax due on an annual bonus paid to a non-resident can be Calculate Tax on Bonus as following:

- IIT on annual bonus: (taxable income from bonus * applicable tax rate) – quick deduction.

- Taxable income from bonus: China-sourced bonus / 6.

Who is Affected by the IIT Policy Changes

In regard to the annual bonus payment, the change can have an effect on both employers and employees. An important element to define is who is the tax bearing party in the employment relationship. If the IIT contributions are paid by the employer (I.e., the employment contract was negotiated on net salary), the employee’s net salary will not be affected by the change. However, in most cases IIT contributions are paid by the employee and therefore the employee will receive a lower annual net income as a result.

Employees are advised to review their current labor agreement and determine whether the way their payment terms are currently structured keeps them in the same tax bracket or pushes them into a higher bracket. If this change does push them into a different bracket, they may want to look into the possibility of adjusting certain terms of the labor contract.

Employers are advised to notify employees of the changes that will take effect from the 1st of January 2022, to avoid any disputes or issues that may arise. Employers can re-examine their current payroll policies and assess if any changes can be made to allow their employees to receive the maximum benefit before the policy has taken effect.

Conclusion

With the implementation of the new Individual Income Tax framework as of January 1st 2019, the Chinese authorities have sought to improve the country’s legal framework for governing IIT. Here it is important for employers to understand the methods the Chinese IIT framework sets forth for calculating taxes on annual bonuses paid in China in order to determine the appropriate amount of remuneration for its staff.

Under currently applicable legislation, the preferential tax policy for calculating IIT over annual bonuses remains in effect until the end of 2021. The preferential policy stipulates that a beneficial tax rate is applicable to one-time annual bonuses, whereas any additional bonuses paid throughout the calendar year will be added to a taxpayer’s monthly income and will be taxed together with that monthly income. Although the current preferential tax policy is set to end by December 31st 2023, it is possible that the preferential policy will be further extended, awaiting further announcements from the Chinese taxation authorities.

If you have any questions about the taxation of annual bonuses in China or Individual Income Tax in general, then please visit our IIT & Payroll Services page or contact us directly.