China Individual Income Tax Settlement

In this article, we take a deeper look at the specificities of taxable income, deductions, individuals with tax filing exemptions, and the standard processes for annual IIT settlement.

Expert Corporate Services

For over a decade, we have been offering full-service accounting and strategic advisory to SMEs in China and APAC.

Back

In this article, we take a deeper look at the specificities of taxable income, deductions, individuals with tax filing exemptions, and the standard processes for annual IIT settlement.

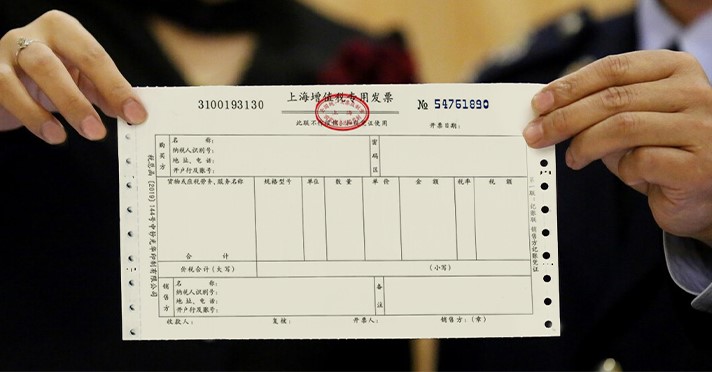

With the e-fapiao being more widely applied, companies doing business in China need to understand how the e-fapiao works, the advantages and disadvantages, the process to follow, and more. Read our complete guide to e-fapiaos in China and find out all you need to know.

With the Chinese government increasing their efforts on the monitoring of tax evasion, it has become even more important for companies and individuals to ensure they remain compliant with tax laws in China. Learn more about tax evasion, the consequences of it and how to avoid tax evasion in China.

There has been a great deal of public interest on the preferential tax policy for foreigners in China and whether it will be extended beyond December of 2021. In the past China has allowed expatriate employees to lower their tax burden by claiming a portion of their salary as tax-exempt allowances. After deliberation from the State Administration of Tax, the policy on non-taxable benefits has been approved for a further 2 years, Ending 31 December 2023.

We explore the tax system in China, giving you a brief understanding of the different tax categories that may apply to individuals and businesses, how tax laws are passed, as well as how the system works.

China’s Corporate Income Tax (CIT) is generally applicable to all companies in China or those with business activities in China. A sound understanding of China’s Corporate Income Tax framework is essential to ensure full compliance in China. As such, this article discusses all key characteristics of China’s CIT framework, including the classification of taxpayers in China, the CIT calculation method, applicable CIT deductions and exemptions, applicable CIT in China and preferential CIT rates and withholding CIT rates.

According to China’s existing Individual Income Tax (IIT) law, which came into effect on 1 January 2019, expatriates in China can continue to claim these tax-exempt expatriate allowances until the end of the transition period, ending 31 December 2021.

In our article we discuss how the Individual Income Tax on bonuses is calculated following the end of the preferential tax rate according to China’s Individual Income Tax framework.

We provide an overview of everything you need to know about China’s Individual Income Tax system.

We discuss what a fapiao is, how it is different from an invoice, how to use fapiaos and where their importance comes from.

In December 2019, the State Administration of Taxation issued a tax circular on the final settlement of individual income tax in 2019. The circular serves to further clarify the process of annual tax settlement and to establish a reasonable and orderly system for the settlement and payment of comprehensive income from personal income tax.

Recent updates to China’s Individual Income Tax provide further clarification regarding IIT exemptions on foreign-sourced income and the Tax Residence rule. These updates also provide further guidance for calculating IIT for individuals not domiciled in China.

GET STARTED WITH MSA. TODAY.

By subscribing, I accept MSA Privacy Policy.

The Preferred Partner for SMEs in China

Headquarters

No. 668 East Beijing Road

Room A, 21st Floor, East Building

Huangpu District, Shanghai

© MSA 2024 – Privacy Policy