The People’s Republic of China levies a wide range of taxes including income related taxes such as Corporate Income Tax (CIT) and Individual Income Tax (IIT). As part of China’s increasing efforts to attract Foreign Direct Investment and technology, special economic zones or Free Trade Zones are intended to function as areas of rapid economic growth by using tax and relevant business incentives.

According to the Foreign Investment Law, foreign investors including foreign individuals and foreign enterprises can directly invest in China unless their investment is restricted or prohibited according to the Negative List for Market Access. Foreign investment that is not subject to restrictive measures can benefit from administrative and taxation benefits in China’s Free Trade Zones. In this article, we take a closer look at the latest updates in three of China’s most well-known areas for foreign investment.

Free Trade Zone : Shanghai Pilot Free Trade Zone

“Preferential Corporate Income Tax Policies for Enterprises in Key Industries in Lingang New Area”

In August 2019, China’s State Council approved the establishment of a new area “the Lingang New Area” in the Shanghai Pilot Free Trade Zone (SPFTZ) in the Pudong District of the city, with the main goal to build a special economic zone that can have a strong international market influence and competitiveness. The “General Plan for Lingang New Area of Shanghai Free Trade Zone” was released on 6 August 2019 as a guiding document to create an international competitive tax system and facilitate capital flows and foreign investment.

This resulted in the notice Cai Shui [2020] No 38., effective from 1 January 2020, which stipulates enterprises engaged in the production, development, or research and development of products in four key industries – integrated circuits (IC), artificial intelligence (AI) biomedicine, and civil aviation – are eligible for a reduced corporate income tax (CIT) rate of 15 percent in the first five years since its establishment. The enterprise must have a legal entity registered in the Lingang New Area from 1 January 2020.

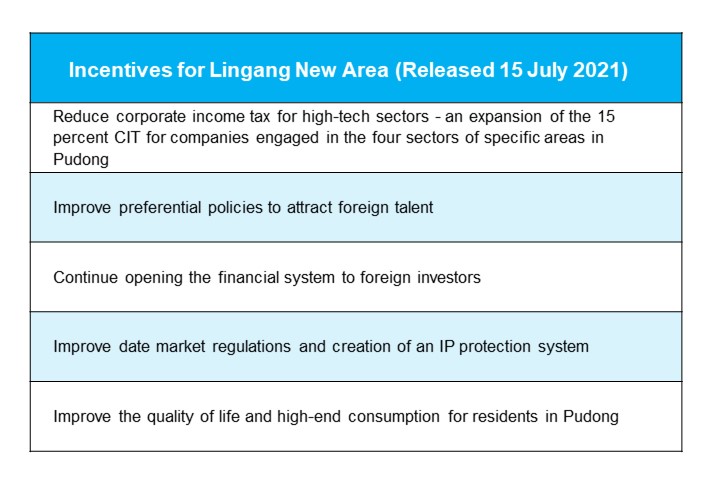

During the first half of 2021, China’s and Shanghai’s local government have continued to develop preferential policies to upgrading the industrial structure and boost its economic development. Pudong’s Lingang New Area released on 15 July 2021 updated guidelines for the area’s future growth and development. While the policy’s guidelines still taking shape and details about implementation are still required, Pudong’s Lingang New Area remains an area for foreign companies looking for new opportunities in growth and innovation to closely monitor.

Free Trade Zone 2 : Guangdong – Hong Kong – Macau Greater Bay Area

Update 1: New Financial Guidelines & Pilot Project to Ease Cross Border Capital Flows

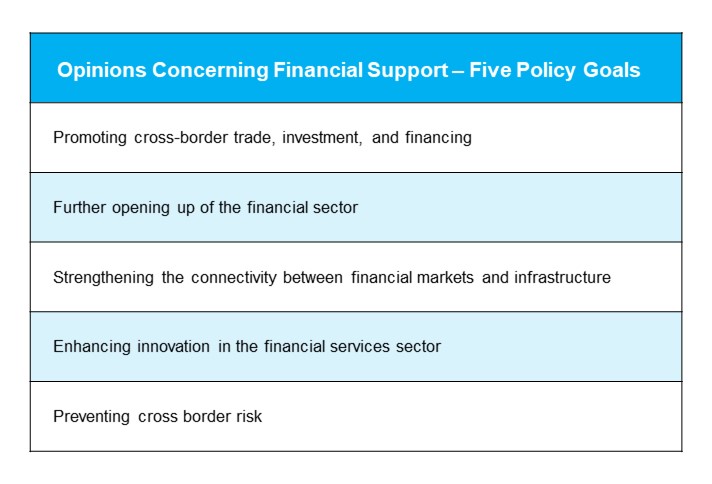

On 14 May 2020 the People’s Bank of China, along with other regulators in the banking, insurance and securities sector, released new guidelines “Opinions Concerning Financial Support for the Establishment of the Guangdong – Hong Kong – Macao Greater Bay Area”. There are 26 measures outlined in 5 policy goals to further address the market opening and financial reform of the area, with one of the main priorities to boost cross-border capital flows.

One of the main challenges the Greater Bay Area has been facing is the integration of the three different regions and its different currencies: Hong Kong Dollar, Macanese Pataca and the Chinese RMB. The most notable policy development for foreign invested companies are the measures boosting cross-border capital flows, a common challenge for many. Banks will facilitate issuing more cross-border border loans to ease the requirements for cross-border RMB transactions and improve foreign exchange systems for certain trade formats, including E-Commerce.

To experiment with the new policies, a pilot project is launching in Shenzhen, where certain selected companies are allowed to buy foreign currency up to a certain limit and are allowed to deposit the money into their domestic bank accounts for overseas payments. During the pilot project, the method of foreign exchange settlement will be simplified to facilitate and ease the flow of income from capital projects amongst others. Other measures that will be tested include aggregating the foreign and local currency into one bank account, which is currently not possible. This should result in an increased efficiency of a company’s turnover of capital and reduce costs related to financial transactions. More cross-border financial policies will be introduced during the pilot to attract more companies to set up their regional or global headquarters in the city.

Update 2: Individual Income Tax (IIT) Subsidy Administrative Measures

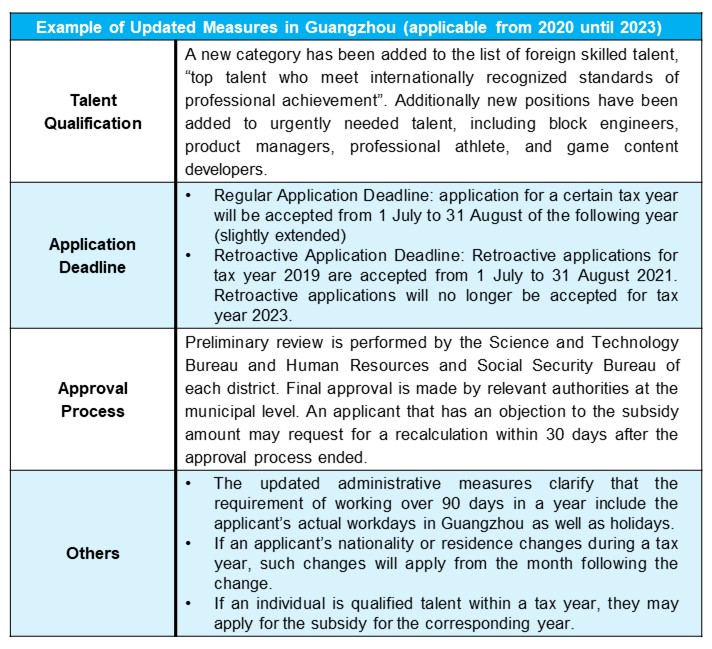

To support the continuous development of the Greater Bay Area (GBA) and attract skilled and urgently needed foreign talent, the nine key cities in the GBA in Mainland China are providing Individual Income Tax subsidies for qualified talents from 2019 until 2023. The nine key cities in the GBA in Mainland China are Guangzhou, Huizhou, Dongguan, Shenzhen, Jiangmen, Zhuhai, Zhongshan, Foshan, and Zhaoqing.

Recently, the governments of certain cities have further updated the administrative measures and application guidelines based on their experience in 2020 when the rules were first implemented. These new updates include:

Free Trade Zone 3 : Hainan Free Trade Port

Exploring Opportunities under the new innovative tax system

On 1 June 2020, the “Overall Plan for the Construction of Hainan Free Trade Port” was released to transform the Southern province of Hainan into a free trade port (FTP) – making it the largest FTZ in China.

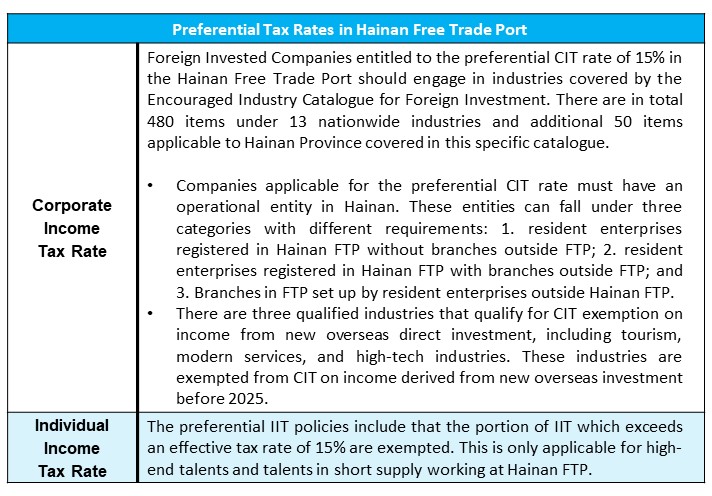

The issuance of Caishui [2020] No. 31 and Caishuio [2020] No. 32 lay down the preferential policies for Corporate Income Tax and Individual Income Tax in the Hainan Free Trade Part. In order to facilitate the implementation of the preferential policies, the National Development and Reform Commission (NDRC), the Ministry of Finance (MOF), the State Taxation Administration (STA) as well as other relevant ministries and local authorities issued multiple sets of policy guidelines.

Key Takeaways

China’s largest Free Trade Zones – Shanghai’s Pilot Free Trade Zone and Greater Bay Area Free Trade Zone – and Free Trade Zones such as Hainan Free Trade Port continue to develop and implement preferential policies for domestic and foreign investment companies active in specific industries to boost its economic growth and competitiveness.

Shanghai FTZ: Shanghai released in July 2021 40 new favorable policies to support the development of the 2-year-old Lingang New Area focusing on building a more open industrial system and continue to advance China’s efforts of opening its market to foreign investors. According to the available statistics by the Lingang New Area, already up to 2,200 foreign-invested companies have set-up their operations in the zone, making it an area in China to closely monitor for foreign companies.

Hainan FTZ: Three industries including tourism, modern services and high-tech services are exempt from CIT on income generated from new overseas direct investment. In the Catalogue of Encouraged Industries are the encouraged industries listed that are entitled to 15% CIT rate. The mains goals of the Hainan Free Trade Zone are increasing the consumer market, stimulate the flow of duty-free goods and boost Hainan’s international tourism. All of these play a crucial role in the development of the Hainan Free Trade Zone.

Greater Bay Area FTZ: The GBA FTZ aims at further increasing its attractiveness for domestic and foreign investment by making the flow of goods, people and capital easier. Through the new draft guidelines for cross-border transactions, mainly the financial industry is receiving additional support for cross border financial services, transactions and investments. The pilot program itself in the GBA for capital flows will first test the reform measures such as integrating different currencies into one bank account and if successful, we might see further implementation nationwide. Lastly, the updated IIT administrative measures also continue supporting the efforts in attracting foreign talent.

If you have any questions about Free Trade Zones in China and the opportunities it may bring for your company, please do not hesitate to contact us.