In unseren vorherigen Artikeln haben wir die zugrunde liegende Strukturen und Mechanismen des chinesischen Social-Credit-Systems für Unternehmen (Corporate Social Credit System, CSCS) erörtert und sind zu dem Schluss gekommen, dass das Ziel des CSCS die Durchsetzung bestehender und neuer Vorschriften ist. Darüber hinaus haben wir in unserem zweiten Artikel erläutert, inwieweit die Durchsetzung dieser Vorschriften künftig strenger und systematischer erfolgen wird, wobei das CSCS die Compliance der Firmen anhand von Ratings und einem System von schwarzen Listen bewertet.

In diesem abschließenden Artikel in unserer Reihe zum chinesischen Social-Credit-System für Unternehmen gehen wir auf die Folgen für Unternehmen ein, wenn diese ein negatives Rating erhalten oder auf eine schwarze Liste gesetzt werden. Wir bieten in diesem Artikel auch eine Darstellung und Zusammenfassung der im Rahmen des CSCS zur Verfügung stehenden Abhilfemaßnahmen, um schlechte Ratings und Schwarze-Listen-Einträge zu korrigieren.

STRAFEN IM RAHMEN DES SOCIAL-CREDIT-SYSTEMS

Im Zusammenhang mit dem CSCS können Unternehmen sowohl Bestrafungen als auch Belohnungen erfahren, wobei wir zuerst die negativen Ausprägungen beschreiben werden. Insbesondere Unternehmen, die auf schwarze Listen gesetzt werden, werden von der Regierung einer Reihe von Disziplinarmaßnahmen unterzogen, aber auch schlechte Bonitätsratings können bereits negative Folgen haben.

Nachfolgend finden Sie eine Zusammenfassung der wichtigsten Disziplinarmaßnahmen, mit denen Firmen mit schlechter Bonität konfrontiert werden:

- Beschränkungen bei der Ausgabe von Aktien.

- Keine Beteiligung an Ausschreibungen zu staatlichen Projekten.

- Einschränkungen bei der Beantragung von staatlichen Mitteln.

- Restriktionen bei der Beantragung von Steuervergünstigungen und andere behördliche Disziplinarmaßnahmen.

- Eingeschränkter Zugang zu Krediten.

- Eingeschränkter Zugang zu Flugtickets (für Mitarbeiter in Schlüsselpositionen).

- Eingeschränkter Zugang zu Luxusprodukten wie hochpreisigen Platzreservierungen in Zügen sowie Tickets für Hochgeschwindigkeitszüge (für Mitarbeiter in Schlüsselpositionen).

Unternehmen und ihre Mitarbeiter in Schlüsselpositionen, die sich weigern, Verwaltungsstrafen auf sich zu nehmen, wiederholt strafbare Handlungen begehen oder große Verluste verursachen, werden für einen bestimmten Zeitraum aus Märkten und Branchen ausgeschlossen, bevor sie gegebenenfalls dauerhaft aus dem Markt gedrängt werden.

Über die von den Behörden verhängten Strafen hinaus wirken sich niedrige Ratings für Unternehmen auch im Markt aus. Wenn potenzielle Kunden oder Partner Überprüfungen mit Hilfe der verfügbaren Systeme durchführen und feststellen, dass ein Unternehmen als „schlecht“ eingestuft wird, könnten sie sich dagegen entscheiden, Geschäfte mit der betreffenden Firma zu tätigen. Dies könnte sogar bei Unternehmen mit mittlerem Rating der Fall sein. Die Tatsache, dass das System öffentlich zugänglich ist, kann daher zusätzlich zu den staatlichen Sanktionen eine Negativspirale aus gesellschaftlichen Konsequenzen zur Folge haben.

Die Regierung wird zudem eine strikte Aufsicht einführen und die disziplinarischen Anstrengungen in Bezug auf die Sicherheit von Leben und Eigentum der Menschen intensivieren. Beispielweise könnten Unternehmen, die in Branchen wie Lebens- und Arzneimittel, Umwelt und Ökologie, städtische Sicherheit und anderen tätig sind, verstärkten Kontrollen unterzogen werden.

In den folgenden Abschnitten stellen wir weiter einige direkte und indirekte Konsequenzen heraus, mit denen Firmen im Zuge des Social-Credit-Systems konfrontiert werden können und die wir als besonders wichtig erachteten.

A. STAATLICHE INSPEKTIONEN

Das Rating, das ein Unternehmen erhält, hat direkten Einfluss darauf, wie oft es von den zuständigen Behörden kontrolliert wird. Unternehmen mit guten Bewertungen werden weniger häufig überprüft, was die Auswirkungen der Inspektionen auf den normalen Betrieb des Unternehmens verringert. Unternehmen mit schlechten Ratings werden dagegen häufiger inspiziert und dies daher gegebenenfalls stärker als Belastung für ihre normalen Abläufe wahrnehmen.

Um Korruption oder enge Beziehungen zwischen Unternehmen und Behördenmitarbeitern zu vermeiden, werden der Inspekteur und die zu kontrollierende Firma nach dem Zufallsprinzip zugeordnet. Die Informationen zu den Inspektionen sind öffentlich einsehbar. Dieses Prinzip wird als „doppelt zufällig, eins offen“ bezeichnet und ist auch Bestandteil der Verwaltungsversion des Social-Credit-Systems.

B. VERBINDUNG MIT PERSÖNLICHER BONITÄT VON PERSONAL IN SCHLÜSSELPOSITIONEN

Es ist wichtig zu beachten, dass die Bonitätsdatensätze eines Unternehmens mit den Bonitätsdaten seines Schlüsselpersonals, insbesondere denen seines eingetragenen gesetzlichen Vertreters, verknüpft sind. Diese Verbindung funktioniert in zweifacher Hinsicht. Zum Ersten wird, wenn ein Unternehmen in einer schwarzen Liste erfasst wird, die persönliche Bonität seines gehobenen Managements herabgestuft und es besteht sogar die Gefahr, dass dieses ebenfalls auf die schwarze Liste gesetzt wird. Der gesetzliche Vertreter einer Firma der schwarzen Liste kann beispielsweise kein gesetzlicher Vertreter eines neuen Unternehmens werden.

Die Tatsache, dass eine Person auf einer schwarzen Liste steht, kann noch weiterreichende Konsequenzen haben. Beispielsweise berichtete Credit China, dass der gesetzliche Vertreter eines Unternehmens der schwarzen Liste in bestimmten Fällen Einwanderungsverfahren nicht abschließen könne. Zudem können Personen über Komplikationen beim Kauf von Flug- oder Bahntickets hinaus, auch Schwierigkeiten beim Erwerb von Versicherungen oder Immobilien entstehen.

Zum Zweiten wirkt sich umgekehrt die Bonität des gesetzlichen Vertreters als natürliche Person auch auf die Bonität des Unternehmens aus. Wenn beispielsweise ein gesetzlicher Vertreter persönlich als Steuerzahler mit D-Rating eingestuft wird (auf einer Skala von A bis D ist A ausgezeichnet und D schlecht), bewertet die Steuerbehörde sein Unternehmen ebenfalls als D-Steuerzahler.

Da Firmen auf eine schwarze Liste gesetzt werden können, wenn sie unter ihrer registrierten Adresse nicht erreichbar sind oder keine Jahresberichte einreichen, ist es von größter Bedeutung, sich aller Gesellschaften bewusst zu sein, denen Sie als Person zugeordnet sind, und sicherzustellen, dass diese sich regelkonform verhalten. Ebenso ist es für Unternehmen wichtig, die soziale Bonität potenzieller Führungskräfte zu überprüfen.

C. WECHSELWIRKUNGEN UND UMFASSENDE BELASTUNGEN DURCH DAS CSCS

Nach dem „einheitlichen Rahmen für Belohnungen und Bestrafungen“ bedeutet, von einer Behörde auf eine schwarze Liste gesetzt zu werden, von vielen, wenn nicht allen, staatlichen Stellen bestraft und eingeschränkt zu werden. Die Rahmenordnung wird durch eine Reihe von Absichtserklärungen (Memoranda of Understanding, MoU) unterstützt, die von mehreren Behörden unterzeichnet wurden und zusichern, die schwarzen und roten Listen der jeweils anderen zu vollstrecken. Derzeit haben zwischen 20 und 30 staatliche Stellen MoU unterzeichnet. Mehr als 50 dieser Vereinbarungen wurden bereits für die Implementierung des Systems unterzeichnet. Beispielsweise haben die Steuerbehörde und die Zollverwaltung ein MoU unterzeichnet. Wenn ein Unternehmen von der Steuerbehörde auf die schwarze Liste gesetzt wird, kann es vom Zoll nicht mehr als zugelassener Wirtschaftsbeteiligter (authorized economic operator, AEO) behandelt werden.

Ein großes Risiko im Zusammenhang mit dieser gegenseitigen Abhängigkeit besteht darin, dass ein kleines Vergehen in einem Bereich das gesamte Verwaltungssystem durchdringen und das Unternehmen in nahezu allen Aspekten seines Geschäfts beeinträchtigen kann. Dies könnte eine unheilvolle Abwärtsspirale für Unternehmen auslösen, die einen Fehler machen. Aufgrund der verhältnismäßigen Empfindlichkeit des Social-Credit-Systems gegenüber Verstößen ist es von größter Bedeutung, die Vorschriften vollständig einzuhalten und potenzielle Probleme zu vermeiden.

Ein weiteres wichtiges Risiko, das vielen Firmen nicht bewusst ist, besteht darin, dass auch das Rating von Geschäftspartnern das eigene Rating beeinflussen kann. Unzureichende Aufmerksamkeit in Bezug auf die Aktivitäten der Geschäftspartner kann sich daher negativ auf ein Unternehmen auswirken. Ein Unternehmen muss daher nicht nur seine eigenen Ratings, sondern auch die seiner Partner im Auge behalten. Dies stellt selbstredend eine weitere Belastung dar aufgrund der Zeit, die hierfür erforderlich ist. Problematisch ist dies insbesondere für kleinere Unternehmen, denen weder das Personal noch die finanziellen Mittel dafür zur Verfügung stehen.

Zugegebenermaßen bietet das chinesische CSCS den Vorteil einer einfacheren Due Diligence bei der Auswahl neuer Geschäftspartner. Eine gründliche Überprüfung anhand der verfügbaren Datenbanken sollte Firmen mit „Unregelmäßigkeiten“ aufdecken, so dass Unternehmen diese Firmen meiden können.

BELOHNUNGEN IM RAHMEN DES SOCIAL-CREDIT-SYSTEMS FÜR UNTERNEHMEN

Obwohl Chinas CSCS auf dem gemeinsamen Straf- und Belohnungsmechanismus aufbaut, wird argumentiert, dass im System der Schwerpunkt auf Strafen liegt und dass Belohnungen zahlenmäßig geringer und schwer zu quantifizieren sind. Zugestandenermaßen ist es einfacher zu beobachten und zu messen, wenn ein Unternehmen sich nicht vertrauenswürdig oder nicht konform verhält, als wenn ein Unternehmen die Erwartungen übertrifft.

Während eines Briefings im Juli 2019 über die Umsetzung des Systems erkannte Lian Weilang, stellvertretender Direktor der Staatlichen Kommission für Entwicklung und Reform, dieses Problem an und betonte, dass die Regierung ihre Anstrengungen zur Ausgestaltung von Belohnungen verstärken werde. Laut Lian können die Belohnungen als „drei besser, zwei niedriger“ zusammengefasst werden, was sich auf bessere Verwaltungsdienstleistungen, bessere Finanzierungsdienstleistungen und bessere öffentliche Dienstleistungen sowie geringere Regulierungskosten und geringere Transaktionskosten bezieht.

Diese Maßnahmen würden den ausgezeichneten Unternehmen das Leben erleichtern, jedoch scheint es sehr schwierig zu sein, ein ausgezeichnetes Rating zu erhalten. In der ersten Runde der Bonitätsprüfung von mehr als 19.000 Unternehmen der Kohleindustrie wurden nur 98 mit ausgezeichnet, aber 1.868 mit schlecht bewertet. Obgleich die Kohleindustrie im Allgemeinen aufgrund der Umweltauswirkungen nicht das beste Beispiel ist, um „ausgezeichnete“ Unternehmen zu finden, zeigt dies doch, dass es außergewöhnlich ist, ein ausgezeichnetes Rating zu erhalten.

Wir gehen davon aus, dass der Großteil der Firmen in China in die beiden mittleren Rating-Kategorien eingestuft wird. Es gibt keine spezifischen Strafen oder Belohnungen für Unternehmen dieser beiden Kategorien, daher können letztere als reine Anzeichen dafür angesehen werden, ob ein Unternehmen einer ausgezeichneten oder schlechten Bewertung näher ist.

WIEDERHERSTELLUNG DER BONITÄT UND ABHILFEMASSNAHMEN

Ein wichtiger Schwerpunkt für die Regierung im Zusammenhang mit dem CSCS ist die Möglichkeit zur Wiederherstellung der Bonität. Es ist eine Sache, eine Auflistung von nicht vertrauenswürdigem Verhalten zu erstellen; die Regierung erkennt jedoch an, dass ein System für Unternehmen, um Fehler zu korrigieren und die Auswirkungen negativer Konsequenzen zu beseitigen, ebenso unerlässlich ist.

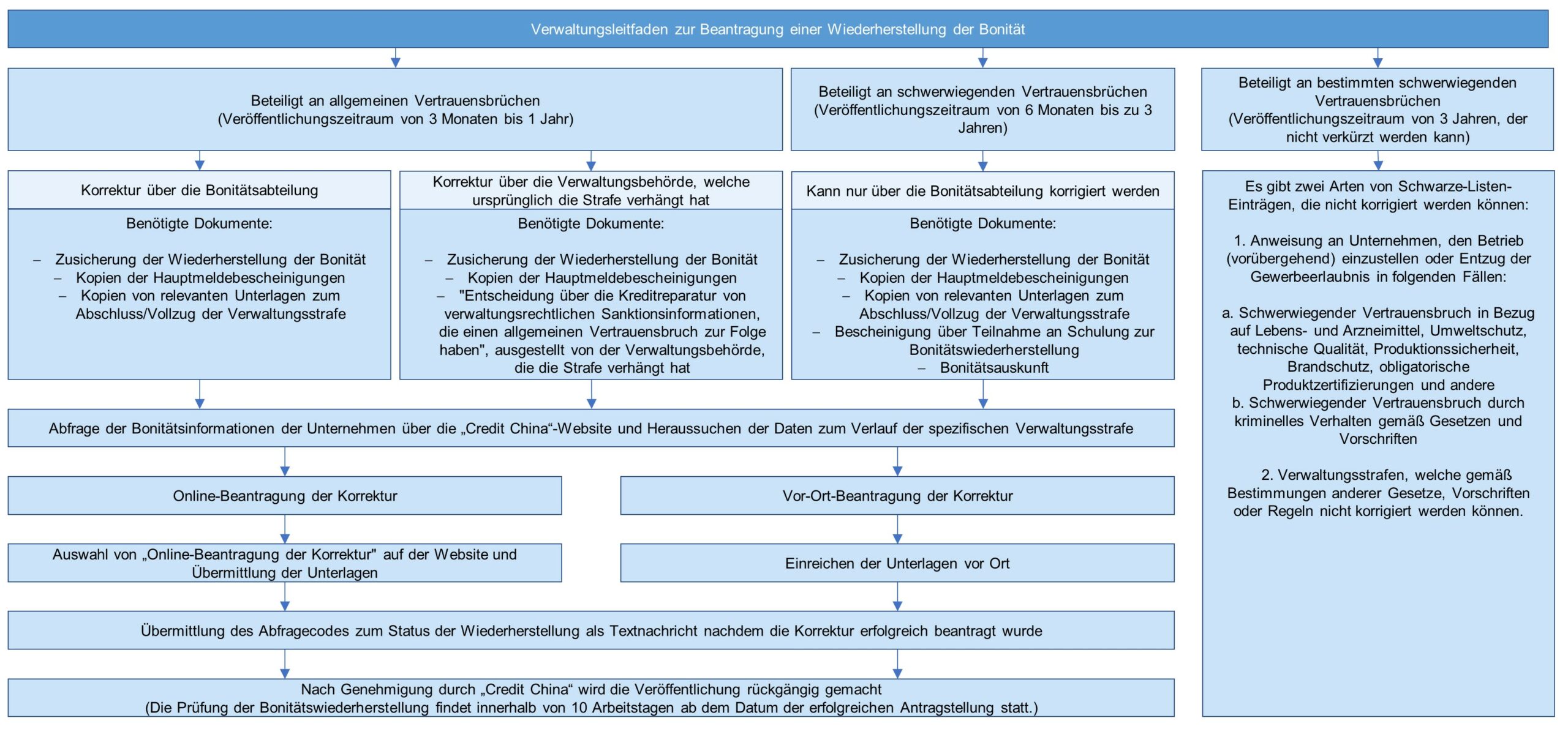

Daher wurde ein Prozess zur Bonitätswiederherstellung eingerichtet. Hierbei können einige Schwarze-Listen-Einträge behoben, andere dagegen nicht korrigiert werden. Einträge im Zusammenhang mit Verstößen gegen die öffentliche Sicherheit oder schwerwiegenden Straftaten können nicht bereinigt werden, ein solcher Datensatz wird drei Jahre in öffentlichen Datenbanken verfügbar bleiben. Diejenigen Einträge, die korrigiert werden können, verbleiben üblicherweise für einen bestimmten Zeitraum im System. Wie in der folgenden Abbildung zu sehen ist, hängt die Zeitspanne, die ein Datensatz im System verbleibt, von der Art des Eintrags ab.

Um ein Bonitätsrating zu korrigieren, ist für ein Unternehmen nicht möglich, das ursprüngliche Problem einfach zu beheben und damit automatisch auch die Bonität wiederherzustellen. Vielmehr müssen Unternehmen einen Antrag auf Wiederherstellung ihrer Bonität stellen. Abhängig von der Art der negativen Bewertung und dem Weg der Antragstellung müssen bestimmte Dokumente vorgelegt werden. Wie aus der Abbildung hervorgeht, erfordert ein Eintrag aufgrund von schwerwiegenden Vertrauensverstößen mehr Unterlagen. In solchen Fällen muss das Schlüsselpersonal eine Schulung zur Bonitätswiederherstellung absolvieren, welche von einem dafür lizenzierten und zertifizierten Anbieter durchgeführt wird, und die dazugehörige Teilnahmebescheinigung einreichen. Zudem muss eine Bonitätsauskunft vorgelegt werden.

FAZIT

Wie in unserem vorherigen Artikel dargestellt, gewinnt, wenngleich das Social-Credit-System für Unternehmen nicht zwangsläufig viele neue Vorschriften einführt, die Einhaltung bestehender Vorschriften zunehmend an Bedeutung.

Obwohl die Anforderungen, die Firmen erfüllen müssen, in bestehenden und neuen Vorschriften klar definiert sind, existiert derzeit keine spezifische Datenbank, in der alle diese Anforderungen zusammengefasst sind. Die damit verbundene erhebliche Belastung kann sich negativ für Unternehmen auswirken, insbesondere für kleine und mittlere Unternehmen, die nur eingeschränkt über das erforderliche Personal und die Mittel verfügen, um alle Anforderungen zu erfüllen. Wir fordern jedoch alle Unternehmen nachdrücklich dazu auf, ihren aktuellen Social-Credit-Status zu ermitteln und die Unternehmensprozesse zu überprüfen, da Chinas CSCS ab 2020 vollständig implementiert sein wird.

Darüber hinaus sind wir der Ansicht, dass das CSCS mit seinen begrenzten Aussichten auf Belohnungen bei gleichzeitig hohem Risiko von Strafen wahrscheinlich ein Verhalten fördert, welches eher darauf abzielt, eine schlechte Bewertung zu vermeiden als nach Spitzenleistungen zu streben.

Wenn Sie weitere Fragen zum chinesischen Social-Credit-System für Unternehmen haben, und wie sich dieses auf Ihre Firma auswirken kann, wenden Sie sich bitte an [email protected] oder sehen Sie sich unsere Services zu Corporate Social Credit System Services an.

UNSERE ARTIKEL ZUM CHINAS SOCIAL-CREDIT-SYSTEM FÜR UNTERNEHMEN

Teil 1 Zugrunde liegende Struktur und Mechanismen für Unternehmen

Teil 2 Wie fuktionieren die Ratings und schwarzen Listen?

Teil 3 Konsequenzen für Firmen (Strafen und Belohnungen)