Once a company has obtained the business license in China and tax registration has been completed, your company would be required to file monthly, quarterly and annual compliance requirements. In this article we will deal with the compliance requirements surrounding: Corporate Income Tax (CIT), Value Added Tax (VAT) and Surtaxes, Individual Income Tax (IIT), the Housing Fund, and Social Security in China.

ONGOING COMPLIANCE REQUIREMENTS IN CHINA

Each company in China would normally need to complete the tax filing on the 15th of the next month (i.e. for November tax payment, the tax filing deadline is December 15th). This can be different when public holidays take place and will be notified by the Tax Authorities. Organizations in China will need to pay for Housing Fund contributions at the end of the month, whereas contributions for Social Security need to be paid on or before the 10th after every next month (for the preceding month).

Corporate Income Tax (CIT: 25%), Value Added Tax (VAT: normal products 16%, services 6%, and agricultural products and specific goods 10%, Small Scale Taxpayer 3%), Surtax (in between VAT * 6-13%), and Individual Income Tax (depending on salary, ranges from 3% to 45%) needs to be filed on a monthly, quarterly, and annual basis.

VAT TAXPAYERS

VAT taxpayers are divided into VAT General Taxpayers and VAT Small-scale Taxpayers. Taxpayers with annual turnover exceeding of 5 million RMB are classified as VAT general taxpayers, or when applying for the General VAT Taxpayer status.

Although the tax burden on small scale taxpayers is low with 3%, tax laws of China allow only the general taxpayer to deduct input VAT from output VAT, which reduces the overall tax burden of the company.

ANNUAL COMPLIANCE REQUIREMENTS IN CHINA

Every foreign invested company in China is required to prepare an audit report, complete the Corporate Income Tax filing and Audit Reporting procedures at the MOFCOM, AIC, and SAFE among others. Penalties are imposed on corporations that fail to abide the deadline schedule as prescribed by the authorities.

The annual audit report must be prepared by a CPA registered audit firm in China to ensure the company is following China Accounting Standards. WFOEs in China are required to present their audited financial statements to the State Administration of Taxation (SAT).

The deadline for annual compliance requirements would normally be that the (1) audit report must be completed by February/March during the fiscal year, (2) the annual corporate income tax filing must be completed between March and by end of May of the year, and (3) the annual publication report must be completed between March and June.

Please have a look at our article on Annual Compliance Requirements for more information.

OVERVIEW

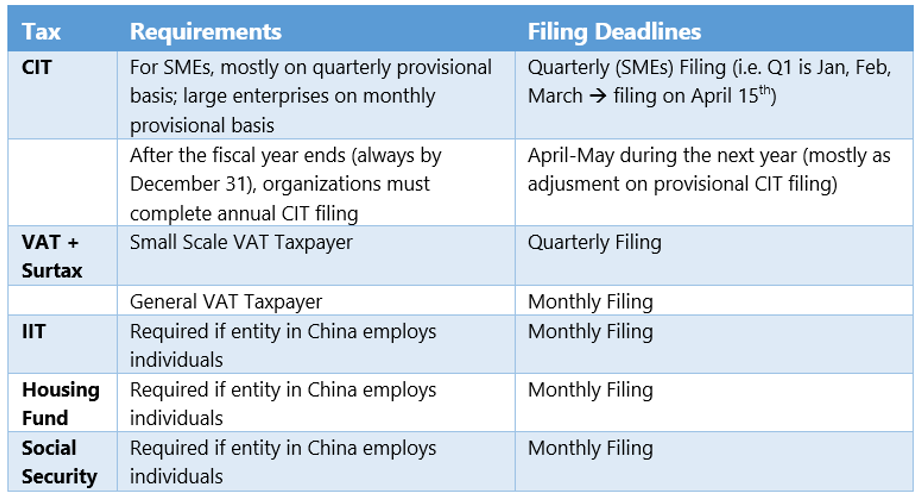

In the table below, you may find a summary of the standard tax deadlines which most types of companies must meet in China:

CONCLUSION

It is crucial for foreign invested enterprises to ensure that they meet the monthly, quarterly and annual compliance requirements to avoid penalties and ensure the continuation of their operations in China. If foreign companies are unfamiliar with these procedures, they should seek advice from well-established firms specializing in these topics.

If you have any questions about this subject, please do not hesitate to contact us at [email protected].