In order for foreign companies to hire local employees in China it should be noted that they must have established a Chinese subsidiary and completed relevant registrations with Chinese authorities, such as the company registration with the Social Security and Housing Fund bureaus (to learn more about establishing a Chines entity, please refer to our free WFOE White Paper). Please note however that not all foreign-invested entities can directly hire local staff, notably a Representative Office (RO).

Furthermore, all employers must abide by PRC rules and regulations when hiring local Chinese and foreign employees. Among others, the employer must comply with relevant labor laws and tax laws, including requirements to contribute to social security insurances and the housing provident fund. On the other hand, employees have to pay Individual Income Tax (IIT) and contribute as well to their own individual social security and housing fund schemes.

It is becoming increasingly important to understand the Chinese social security system and housing fund scheme in order to make a thorough consideration of the compensation structures for hiring employees and because the Chinese authorities are increasingly focusing on compliance and enforcement. Therefore, this article provides a comprehensive overview of China’s social security system and housing provident fund and important considerations from an employer perspective.

Foundations of the Chinese Social Security System

Prior to the establishment of the current Chinese social security system the Chinese government, largely via its system of State-Owned Enterprises (SOEs), provided a welfare system for workers. As the Chinese economy developed and was increasingly liberalized throughout the 1990s and 2000s, China’s new social security system emerged through a series of regulations and provisions.

Notable aspects of China’s current social security system were introduced with the Labor Law (1994) and the Labor Contract Law (2008), however only in 2011 were these new rules and regulations codified and compiled into a comprehensive national framework with the introduction of the Social Insurance Law.

Although the Social Insurance Law is promulgated by the central government, China’s social security system is administered at the provincial- and city-level. As a result, the benefits for employees as well as employee and employer contribution rates and the contribution base differ per locality. In addition, since the system is administered locally the contributions to both the social insurances and housing fund can only be made in the city where the entity (in other words the employer) is registered.

Components of China’s Social Security System

China’s social security system is comprised out of five distinct categories of social insurances as well as the mandatory housing provident scheme. The categories of social insurance are:

- Pension;

- Medical Insurance;

- Unemployment Insurance;

- Maternity Insurance;

- Work-related Injury Insurance.

In the section below we will enumerate upon each of the different social insurances.

1. Pension

The pension insurance provides financial support to senior citizens upon retirement. Both employees and employers are required to make contributions, where the employee contribution is based on individual wages (at up to 8%) and the employer contributions are calculated as a percentages of total wages paid to their workforce. In March 2019, China cut the employer contribution rates to the pension insurance from up to 20% to 16% across all provinces in an effort to support businesses and easing the social security burden for SMEs.

The portion of pension insurance contributed by employees is deposited into a personal account and upon retirement the balance of the personal account plus interest can be accessed in monthly installments over a ten-year period. Employer contributions to the pension insurance are deposited in a collective pool, from which retirees receives monthly pension payments until death. The general pension payments are based on number of years of employment, average wage and locality, and the government is legally obliged to cover any shortfalls to the funds contributed by the employer.

2. Medical Insurance

Part of the costs of medical expenses in the event of illness or injury are covered by the medical insurance to which both employees and employers must contribute. Again, employees contribute based on their wages (up to 2%) which are deposited into their individual medical account. The employer contribution to the medical insurance fund is calculated as a percentage based on the total amount of wages paid to their workforce (between 6% and 12%) and a proportion is deposited into the employee’s individual medical account and the remainder is deposited into the public medical fund.

The employee’s individual medical account is supposed to cover the costs of any medical expenses up to 10% of the average local annual wage. If the employee’s individual medical account does not have sufficient funds to cover the medical expenses below the threshold, they must pay for these costs themselves. The funds in the public medical fund should cover any costs above the 10% threshold and up to a maximum of five times the average local annual wage.

3. Unemployment Insurance

When an individual becomes unemployed they can claim unemployment benefits on the condition that unemployment insurance contributions have been made for a period of at least 1 year, and they have the right to receive unemployment benefits for a period up to a maximum of 12 to 24 months. Again, both employees and employers need to contribute to unemployment insurance.

4. Maternity Insurance

The maternity insurance covers a lump sum of maternity related medical costs and covers as well the payment of salary for the duration of maternity leave. In departure from other social insurances, only the employer contributes to the maternity insurance fund and this contribution is generally below 1% of total wages paid to eligible employees.

5. Work-related Injury Insurance

Also, the contributions to the work-related injury insurance fund are made solely by the employer and the amount of contributions depends on the nature of work carried out by its employees. As such the contribution rate is between 0.1% and 2% of an employee’s gross salary. In the event of a work related injury, the fund covers associated costs. In addition, an employer must pay the salary of an employee during the period of recovery. In order for an individual to be eligible for work-related injury insurance compensation they must prove they have an employment relationship and that the injury was sustained at the place of work.

Housing Fund

In addition to the above social insurances, employers are also required to make contributions to the statutory housing provident fund. The housing fund requires employees and employers to contribute funds and encourage employees to purchase a house. The funds accrued in the housing fund account may be used to purchase a house, make an initial down-payment, as well as repayment of mortgages.

The housing fund is fundamentally different from the other social insurances and is officially not part of China’s social security system. The reason is twofold, namely 1) all of the contributions made by both the employer and employee accrue directly to the employee and 2) the fund is administered by the Ministry of Housing and Urban-Rural Development rather than the Ministry of Human Resources and Social Security.

How to Calculate Social Security Contributions

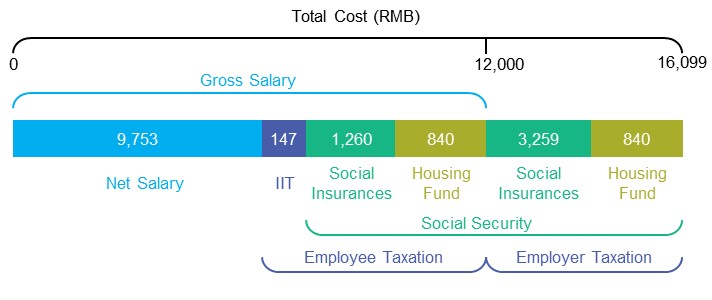

As aforementioned, both employees and employers must contribute to the Chinese social security and housing fund scheme. Whereas employee contributions to social security and the housing fund are generally considered indirect employee benefits, the employer contributions are a cost for the employer.

As a result, the total cost of employment can be calculated by adding the costs of employer contributions to the social security and housing fund to the gross salary, and the employee’s net salary is similarly derived by subtracting IIT and employee social insurances and housing fund contributions from the gross salary as represented by the figure below:

In order to calculate the correct amount of social security contribution it is important to understand the relevant local legislation as well as the contribution base figure. The contribution base is calculated as following:

- Social Security Contribution Base = employee’s average wage in previous year / 12;

Furthermore, it is important to note that the contribution base is capped by a floor and ceiling which cannot be exceeded. The minimum contribution base is decided by the local Chinese authorities and generally is either equal to the local minimum wage or a certain percentage of the average local wage. On the other hand, the maximum contribution base is capped at 300% of the average local wage.

Every year the base for the social security contributions as well as the base for the contributions to the housing fund are adjusted. Under normal circumstances the social security contribution base is adjusted per the 1st of April of the year and the base for contributions to the housing fund are adjusted per the 1st of July. Please note that these dates may differ per locality.

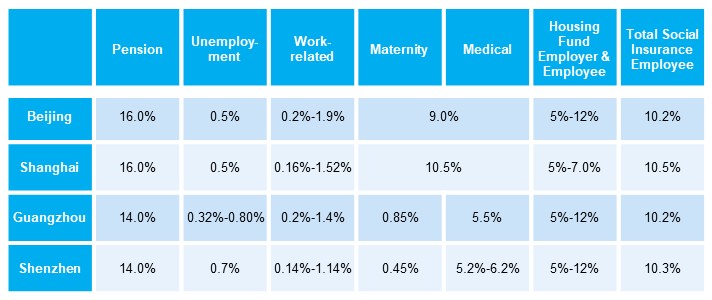

Since China’s social security system is administered at the provincial- and city-level, the employee and employer contribution rates vary depending on where the company is registered and thus where these contributions are made. The below table provides an overview of social security contribution rates for employers as well as a sum of the total employee contribution rates in key Chinese cities:

Overview of Employer- and Employee Contribution Rates

Note: contribution rates as published per July, 2021.

In order to pay social insurances, employers are required to register any new staff with the local social security and housing fund bureaus to initiate or be linked with the employee’s respective social security and housing fund accounts. Registration of new staff with these respective bureaus is not possible between the 25th of the month and the 5th of the next month in order to facilitate former employers to make relevant contributions and complete the deregistration of employees.

Furthermore, although both employees and employers are required to make social security contributions, it is the employer’s responsibility to calculate and withhold the correct amount of contributions for both parties. Here it should be noted that it is only possible for one employer to make these contributions in one specific month and the social security and housing fund contributions must be paid monthly between the 1st and 15th of the next month.

In practice, some employers may mutually agree with their employees to not contribute to the social security and housing fund schemes in order to minimize labor costs and maximize the employee’s net salary, however, this practice is illegal.

Foreign employees have been required to participate in the Chinese social security system as of 2011, however, since the system is managed at a local level, there are some differences between cities. For example, in departure from other cities, foreign employees and their employers in Shanghai are exempted from making social security and housing fund contributions.

Conclusion

When hiring employees in China, employers must abide by relevant labor laws and tax laws and as such are as well required to make contributions to social security and the housing provident fund. As compliance is becoming increasingly important, it is essential for the management of foreign-invested enterprises to have a thorough understanding of the Chinese social security system and housing fund scheme.

China’s social security system is comprised of five distinct social insurances, namely 1) pension insurance, 2) medical insurance, 3) unemployment insurance, 4) maternity insurance and 5) work-related injury insurance, and additionally the mandatory housing fund. Both employers and employees are required to contribute to these social insurances where the employer generally acts as the withholding agent. It is also important to note that the Chinese social security system and housing fund are administered at a local level and consequently the contribution rates vary depending on the locality.

If you have any questions about social securities, the housing fund or payroll in China, please do not hesitate to contact us at [email protected] or refer to our IIT & Payroll Services page.