Corporate Income Tax (CIT) is generally applicable to all companies in China or those with business activities in China. A sound understanding of China’s Corporate Income Tax framework is essential to ensure full compliance in China. As such, this article discusses all key characteristics of China’s CIT framework, including the classification of taxpayers in China, the CIT calculation method, applicable CIT deductions and exemptions, applicable CIT and preferential CIT rates and withholding CIT rates.

Corporate Income Tax in China: Everything You Need to Know

Companies operating within the People’s Republic of China that earn income generally must pay Corporate Income Tax (CIT), also referred to as Enterprise Income Tax (EIT). The Corporate Income Tax is governed by The Law of the People’s Republic of China on Corporate Income Tax. The law is applicable to all companies except for individual proprietorship enterprises and partnerships.

China’s Corporate Income Tax is levied as a percentage of a company’s calculated net income in a financial year. All reasonable business costs and losses incurred during this fiscal year must be deducted from the total annual income in order to derive a company’s taxable income. In order to determine the applicable tax rate we must review a company’s net profits.

In China, companies are required to pay CIT to the Chinese tax authorities on a quarterly basis and possible adjustments are in the next subsequent fiscal year while completing the annual CIT filing. A sound understand of China’s Corporate Income Tax framework is essential to ensure compliance for foreign-invested companies with activities in China, and therefore we discuss the key characteristics of China’s Corporate Income Tax framework in this article.

Corporate Taxpayers in China

For the purposes of the Chinese CIT Law, companies are classified as resident enterprises and non-resident enterprises. Resident enterprises include both enterprises established in China in accordance with Chinese law and enterprises established in accordance with foreign law, but which are actually under the administration of institutions in China.

Non-resident enterprises are enterprises which are set up in accordance with the law of a foreign country or region and whose actual administrative institution is not in China, but which have institutions or establishments in China, or which have no such institutions or establishments but have income generated from inside China.

Both resident enterprises and non-resident enterprises are subject to Corporate Income Tax, albeit with differences in CIT obligations. Resident enterprises are taxable on their worldwide income, therefore including income generated both in China and abroad. A non-resident enterprise without establishment in China is only taxed on its China-source income, whereas a non-resident enterprise with establishment in China is taxable on the income derived directly from or related to its Chinese establishment, whether Chinese or non-Chinese income.

As mentioned before, individual proprietorship enterprises and partnerships are not required to pay CIT, because profits from these forms of enterprises are treated as personal income.

China CIT Calculation Method

In China, the following formula for the calculation of CIT payable is applicable:

- CIT Payable = CIT Taxable income * Applicable Tax rate – Tax Exemptions or Reductions (if applicable)

Furthermore, CIT Taxable Income in China is determined according to the following formula:

- CIT Taxable Income = Total Annual Income – Expenses/Costs – Carry Forward Losses

Here it is important to note that in China losses can be carried forward for a maximum of 5 years. Moreover, in China costs (expenses) can only be deducted when companies can provide evidence of the expense by way of providing the relevant fapiao (in order to learn more about China’s invoicing system, i.e. the fapiao system, please read our full article on fapiao).

CIT Exemptions/Reductions in China

As mentioned above, in China the amount of CIT payable can be reduced through certain applicable tax exemptions or reductions. Below we highlight the statutory and additional deductions available in line with Chinese law which could lower the CIT burden of a company.

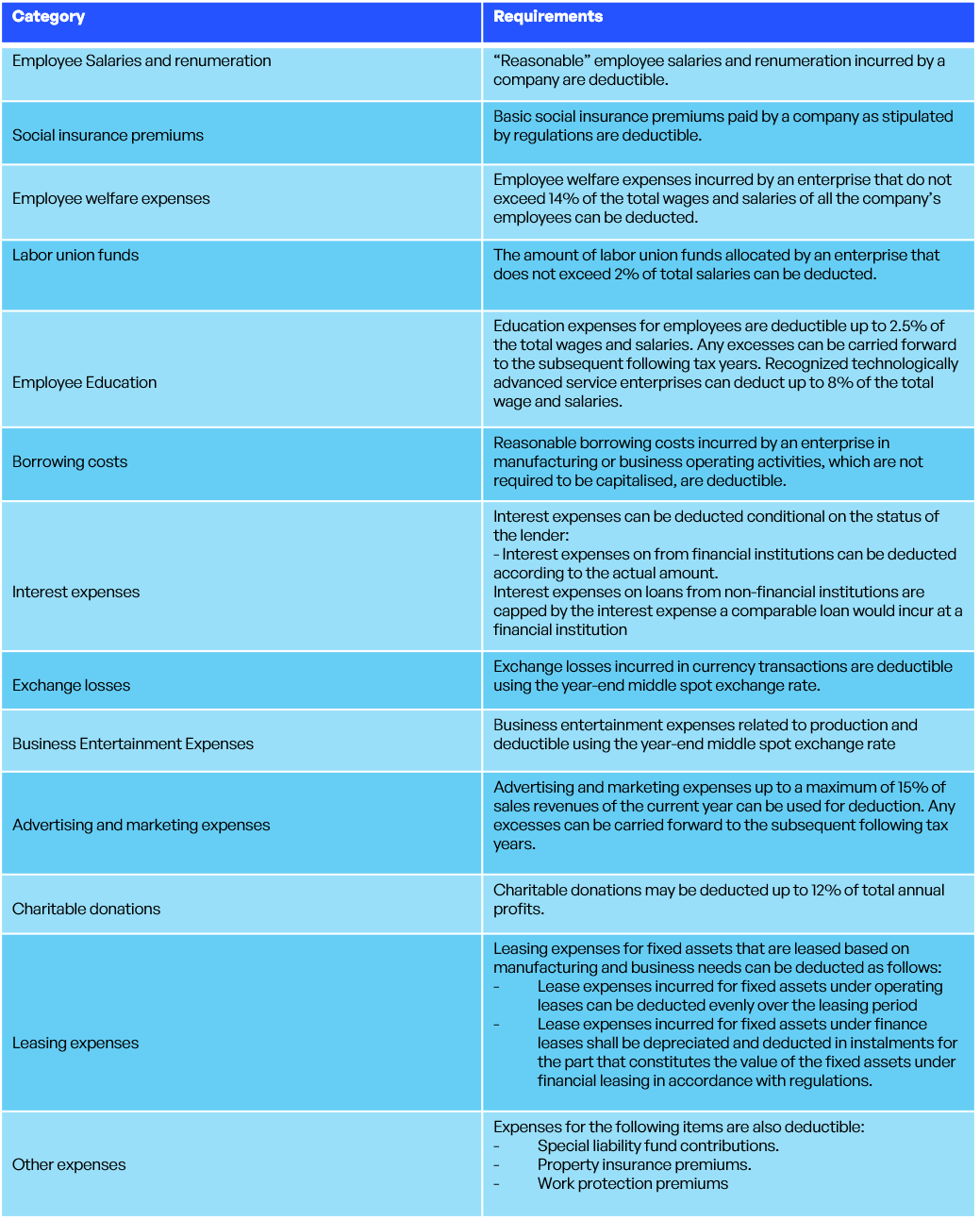

Statutory Deductions

According to the “Regulations for the Implementation of the Corporate Income Tax Law of the People’s Republic of China”, the following statutory deductions are applicable:

Additional Deductions

The following additional deductions are applicable to reduce CIT payable for businesses in China:

- Research and development expenses incurred in the development of new technologies, new products, and new processes, can be deducted if not capitalized as intangible assets. Originally 50% of these expenses could be deducted, however, according to regulation released in 2018 (Caishui (2018) No. 99) this has been increased to 75%.

In the 2021 Government Work Report this policy was extended until 31 December 2023. Additionally, the Government Work Report also stipulated that for manufacturing enterprises, R&D expenses can be deducted for 100%. This policy does not have an expiry date.

- 100% of the salary expenses paid to disabled persons and other employed persons encouraged by the state to be placed, can be deducted from taxable income.

What CIT Rates are Applicable in China?

The standard China CIT rate for both foreign and domestic enterprises is 25%. However, for non-resident enterprises without establishment in China that are taxed on their China-sourced income, the applicable CIT rate is 20%.

Small and Low-profit Companies

According to additional regulations implemented by the Chinese State Administration of Taxation (STA), a special beneficial tax policy exists for small and low-profit companies. According to the regulation, to qualify as a small and low-profit company, businesses must satisfy the following criteria:

- Company’s annual taxable income is below RMB 3.000.000.

- Company’s employee count is below than 300 persons.

- Company’s total assets are below RMB 50.000.000.

For qualified small and low-profit companies, the following CIT rate is applied:

- Company profit below RMB 1 million – effective CIT rate of 5%;

Based on a 20 percent CIT rate applied to 12.5 percent of a company’s taxable income amount for the proportion of their taxable income up to RMB 1 million. This rate is effective from 1 January 2021 to 31 December 2022.

- Company profit between RMB 1 million and RMB 3 million – effective CIT rate of 5%;

Based on a 20 percent CIT rate applied to 50 percent of a company’s taxable income amount for the proportion of their taxable income between RMB 1 million and RMB 3 million. This rate is effective from 1 January 2022 to 31 December 2024.

- Company profit above RMB 3 million – standard CIT rate of 25%.

The abovementioned preferential policy for small and low-profit enterprises will remain in effect in its current form until 31 December 2021 (according to Caishui [2019] No. 13). We do note that the 2019 announcement effectively extended an original preferential policy from a 2018 announcement.

During the year 2021 updates from the Chinese STA are expected as to whether the preferential policy will expire or be extended upon the end of its currently planned effective date. In the 2021 Government Work Report the CIT rate for companies with profit below RMB 1 million was halved from 5% to 2.5%, which will be valid until 31 December 2022. No announcements were made by the Chinese authorities as of yet with respect to the other (preferential) rates.

Other Preferential Rates

In addition to the preferential policy for small and low-profit companies, companies in certain industries or specific regions in China are also eligible for several preferential tax policies. These tax relief policies include among others:

- Companies qualifying as “high-tech” as determined by the Chinese tax authorities can enjoy a 15% standard CIT rate.

- Integrated circuits design companies and key software companies in China are eligible for a reduced CIT rate of 10%, after an exemption for the initial 5 years of its operations.

- Companies engaging in encouraged industries in China’s western regions (Chongqing, Sichuan, Guizhou, Yunnan, Tibet, Shaanxi, Gansu, Ningxia, Qinghai, Xinjiang, Inner Mongolia and Guangxi) can enjoy a reduced standard CIT rate of 15%.

- Free Trade Ports of Free Trade zones, such as Hainan Free Trade Port, or Lingang New Area in Shanghai, offer reduced CIT rates to companies engaged in particular encouraged industries.

Filing and Payment of China Corporate Income Tax

According to Chinese law, Corporate Income Taxes must be filed and paid on quarterly basis. However, it is possible for large enterprises to file and pay CIT on a monthly basis, whereas this is not advisable for SMEs due to the additional administrative burden.

Companies are required to submit their tax declarations for the pre-payment of CIT and pay advance taxes within 15 days after the end of each month or quarter (subject to change depending on Chinese national holidays). Generally, the tax payable will automatically be withdrawn from the company’s bank account after signing of a triparte agreement between the tax authority and the company’s local bank.

Annually, companies are required to settle and file annual Corporate Income Tax payments within five months after the end of the tax year (deadline of May 31st). Because of discrepancies between Chinese accounting standards and Chinese tax law, the actual amount of CIT taxable income may be different from the total profits based on the accounting standards. This means an adjustment on the provisional CIT filings completed throughout the fiscal year may be required.

In case of deficient payment or overpayment, companies can apply for reimbursement or payment of supplementary tax. Read our article on annual audit and compliance in China to learn more about China’s annual statutory requirements.

Withholding CIT in China

Withholding tax is a Corporate Income Tax levied on non-resident enterprises without permanent establishments in China, that generate China-sourced income. There are several categories of China-sourced income, such as:

- Dividend income derived from equity investments (e.g. foreign-invested enterprises (FIEs)).

- Royalty income (e.g. licensing a trademark).

- Interest income derived from the provision of funds.

- Other income that may be deemed taxable by the Chinese tax authority.

Withholding tax is withheld by the entity in China, meaning that the Chinese entity acts as the withholding agent.

The CIT withholding tax rate consists of the CIT rate of 25% times the deemed profit rate. The deemed profit rate ranges from 15%-50% and will be determined by the local Chinese tax authority. Based on our experience, it is common for the tax bureau to accept a 40% deemed profit rate, resulting in a withholding tax rate of 10%.

It is however possible to apply for a lower deemed profit rate, but the company will have to provide proof to apply for a lower profit rate. Furthermore, we must note that the approval on the applicability of a lower deemed profit rate remains fully to the discretion of the local in-charge tax officer. If a foreign company is a resident in a country or area that has a ‘double tax’ treaty (i.e. DTA) with the People’s Republic of China, and where a lower withholding tax rate is specified within the DTA for certain criteria, the foreign company can apply to use the reduced withholding tax rate.

Conclusion on China’s Corporate Income Tax

A sound understanding of China’s Corporate Income Tax framework is essential to ensure compliance for foreign-invested companies with activities in China. In China, Corporate Income Tax is applicable to all companies in China or those receiving income from China. To remain compliant with Chinese legislation, companies are required to complete the filing and payment of CIT on a quarterly basis, generally within 15 days after the completion of the quarter. Whereas in China a standard CIT rate of 25% is applicable, several beneficial tax policies are in place of which companies can take advantage. We advise all companies with activities in China to carefully analyze any preferential policies it may be able to utilize, in order to lower the tax burden on income received in China.

If you have any questions about the filing or specific calculation of your company’s Corporate Income Tax in China, or you have any other taxation related enquiries, please do not hesitate to contact us.