In our latest article on China’s Individual Income Tax law, we highlighted several crucial changes to China’s Individual Income Tax (IIT) law.

On 21 December 2018, China’s State Administration of Taxation (SAT) released the final draft to the IIT reform, providing further guidance on the procedures for itemized deductions (“Trial Implementation”), measures addressing the individual income tax withholding calculation and filing of individual income tax.

IIT Reform Timeline & Changes

At the start of the transition period, from October 1st to December 31st of 2018, two changes to the Individual Income Tax Law already came into effect. Firstly, the standard deductions for both local (Chinese) and foreign employees was increased to RMB 5.000 per month. Secondly, the income tax brackets were adjusted.

The most recent updates to the IIT law extends on several changes highlighted in the previous announcements and provides further clarification. We would like to highlight the following updates:

1. The Tax Residence in China – “Six-Year Rule”;

2. Individual Income Tax Calculation Method;

3. Itemized deductions for local employees (and foreign residents in China);

4. Procedures for claiming itemized deductions;

5. End of Expatriate Allowances – by 2022;

6. Annual Bonus Policy.

Tax Residence Rule

In our previous article about the IIT reform we discussed that individuals not domiciled in China will be classified as a resident taxpayer if they stay in China for over 183 days per year. We highlighted that contrary to previous expectations, foreign residents will still be able to enjoy the five-year rule.

According to the most recent update of the IIT Law, this policy will continue as the “six-year rule”. This means that foreign residents in China can be exempted from paying tax in China on foreign sourced income (income paid outside of China), but only if they have left the country for 30 days or more in a single trip in one calendar year, during the six-year period.

In order to enjoy these benefits, foreign residents in China are required to file such a trip in advance with the local tax bureau.

Individual Income Tax Withholding Calculation Method

Following the announcements by the State Administration of Taxation, individual income tax will be withheld based on the cumulative withholding method, which we describe below:

1. Withholding tax current period = cumulative tax payable – cumulative tax withheld in the previous period;

2. Cumulative tax payable = (cumulative taxable income * tax rate) – quick deduction;

3. Cumulative taxable income = cumulative income – cumulative applicable deductions.

This would basically mean that an individual with a significant salary and increase of salary (the calculation method for other comprehensive income categories are not based on the cumulative withholding method), could have a different amount of IIT that needs to be paid monthly. This would make it more challenging to calculate the taxes monthly and might require companies to hire a professional third party to support with the personal tax obligations.

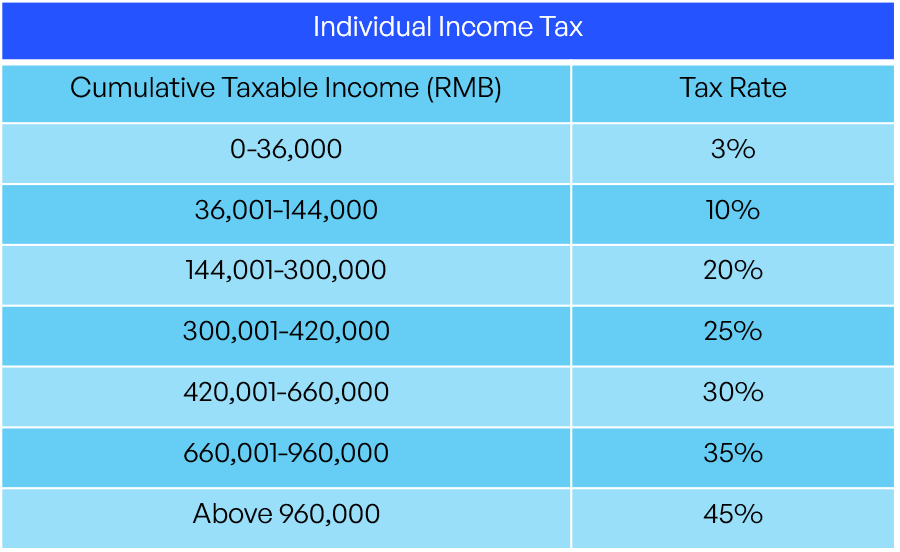

The below table provides an overview of tax rates applicable to income earned from comprehensive income.

Different from previous updates on the IIT reform, IIT would still be withheld separately for income from personal services, income from remuneration of manuscripts and income from royalties.

A China resident must also perform an annual reconciliation filing if:

- The taxpayer receives comprehensive income from two or more sources and the balance of his/her annual comprehensive income (after specific deductions) exceeds RMB 60.000;

- The taxpayer receives one or more types of income from personal services, income from remuneration of manuscripts and income from royalties; and his/her annual comprehensive income (after 20% expenses and specific deductions) exceeds RMB 60.000;

- The taxpayer’s IIT withheld during the year is lower than the IIT payable calculated by annual comprehensive income;

- The taxpayer applies for tax refunds.

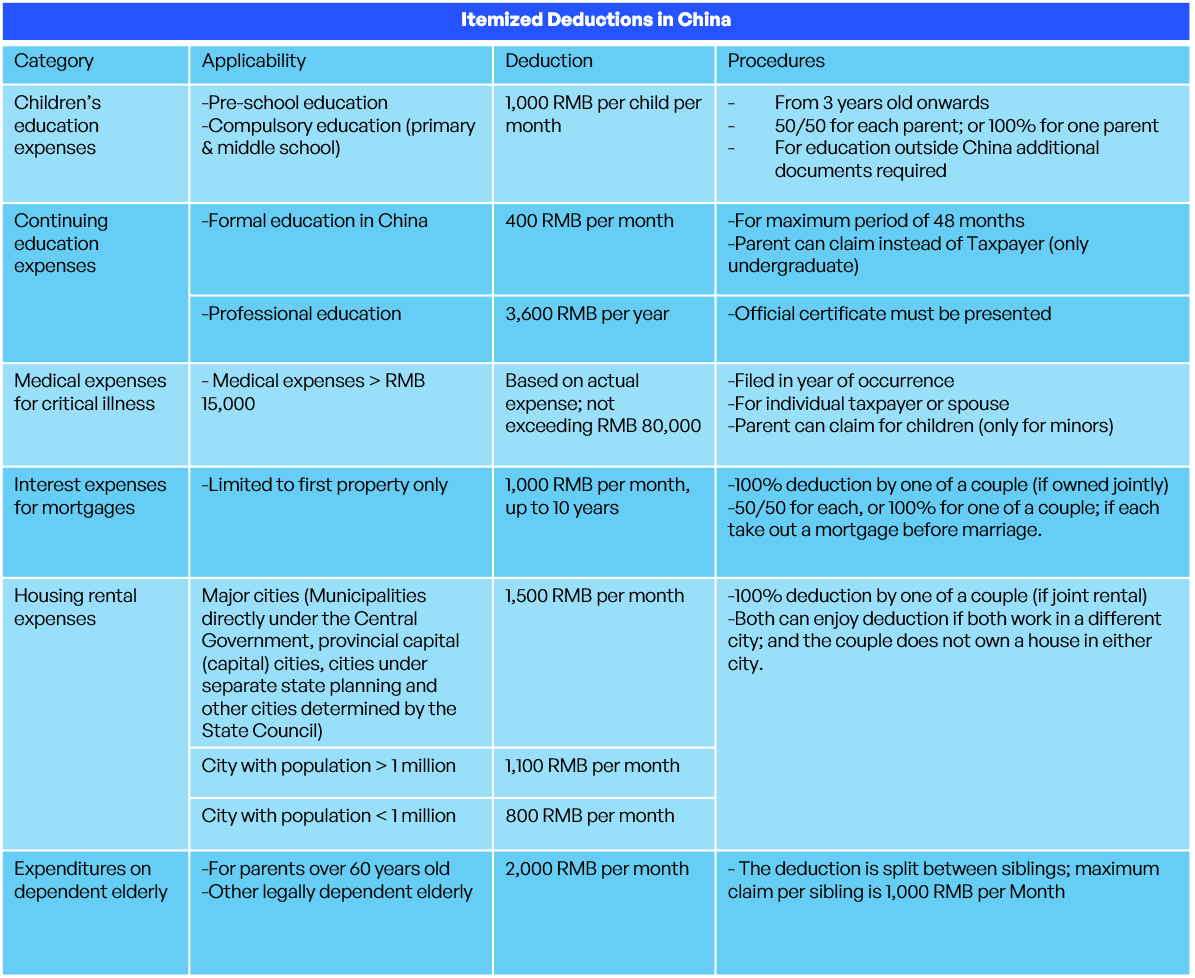

Itemized Deductions

According to the “Trial Implementation” there are 6 broad categories for itemized deductions. The Trial Implementation further explained the procedures and requirements for claiming itemized deductions. In the table below, you can find an overview of these categories and procedures as stipulated in the latest IIT update:

Announcement (2018) No. 60 by the SAT sets out several filing requirements for both individual taxpayers and their withholding agents (their employer).

Under the PRC Individual Income Tax Law the individual taxpayer can either choose to declare deductions by himself when making the annual reconciliation filing (as due to privacy concerns), or may ask their employer to make preliminary deductions on a monthly basis.

If the individual employee chooses to claim the deductions via their employer, they are required to confirm any changes to their itemized deductions the latest by December of the fiscal year. The new IIT Law also states that individual taxpayers bear the responsibility to ensure the authenticity, accuracy and completeness of the information provided when claiming itemized deductions.

The withholding agents must ask the individual taxpayer to provide all relevant information by filling in a standard Information Sheet of Special Additional Deductions for Individual Income Tax (if the individual taxpayer has chosen to ask their employer to make preliminary deductions). For this purpose, an APP issued by the tax authority can be used or filing can be made in person at the tax office. Both the individual taxpayer and withholding agent must retain all documents at the local tax bureau for a period of at least five years.

If foreign employees would like to make use of the itemized deductions, at this moment it is expected they will need to visit their local tax office to make the registration. Please carefully note if foreign employees would like to use the itemized deductions, they would not be able within the same fiscal year to use any of the expat tax benefits. Since the existing benefits for expatriates are more beneficial, it might not be interesting to claim the itemized deductions as implemented this year.

End of Expatriate Allowances – by 2022

Under the new IIT Law, expatriates in China may elect to keep the tax-exempt benefits they currently enjoy such as housing rent, relocation costs, home flight and laundry expenses. However, they can only keep these tax-exempt benefits until the end of the transition period, ending 31 December 2021.

Starting from 2022, expatriates can no longer claim all of the tax-exempt benefits and instead they will be subject to the same law as domestic (Chinese) taxpayers. This entails that after 2021 expatriates can claim itemized deductions instead.

According to the current announcement, only the housing allowance, language training fee and children’s education subsidy will be discontinued after 2021. Expatriates might still enjoy other categories of tax-exempt benefits such as relocation costs, home flight and laundry costs; but we are still awaiting further legislation.

Annual Bonus Policy

Until the end 2021, the current method of calculating the year end bonus as under Guoshuifa (2005) No.9 will still apply. This means that the IIT to the year end bonus can be calculated according the following methods:

1. If the comprehensive income of the month (in which the annual bonus is received) is equal or greater than the standard deduction: (year end bonus * applicable tax rate) – quick deduction.

2. If the comprehensive income of the month (in which the annual bonus is received) is lower than the standard deduction: ((year end bonus – (standard deduction – monthly comprehensive income) * applicable tax rate) – quick deduction.

The applicable tax rate and quick deduction should be the rate and deduction corresponding to the level of monthly taxable income equal to one-twelfth (1/12). In practice, this means dividing the amount by 12 to determine the applicable rates.

Annual bonuses received by any resident individual after 1 January 2022 have to add this to his/her consolidated income to calculate IIT.

Conclusion

Following all the reforms and updates to China’s Individual Income Tax Law, it is clear that there will be significant impact on both local and foreign employees working in China.

The above updates provide an overview of the recent changes according to the new IIT Law effective by 1st of January 2019. As we know from our experience with many other new laws and regulations in China, we will still have to wait how the central and local government will implement the new IIT regulations, and what changes we can still expect.

We expect this will certainly not be the last update on this subject and will keep you informed about any new updates and regulations concerning the Individual Income Tax Law.

If you have any questions about this subject, please do not hesitate to contact us at [email protected].