China’s social security system is a complicated but unavoidable requirement that can confuse many foreign-invested companies and their employees. With China frequently updating its labor laws and regulations, detailed attention to the labor and employment laws is crucial for staying compliant and operating your business in China.

Since the implementation of the Social Insurance Law, Interim Measures and the RenSheTingFa No 11.3 by the central government on 15 October 2011, foreign employees in China are required to contribute to social security in line with the treatment of domestic employees. Compared to other cities such as Beijing, Tianjin, Guangzhou, and Shenzhen where foreign employees have been treated as domestic employees for the purpose of contributing to the social security system, in Shanghai these regulations have not been enforced and thus foreign employees have not been required to make these social security contributions. Similarly, employers who employ foreign employees have not been required to make the employer contributions to social security for these foreign employees.

However, the key notice facilitating preferential treatment for foreign employees and their employers with regards to the exemption for contributing to the social insurance in Shanghai expired on August 15, 2021. Therefore, in this article we provide a key explainer of China’s social security system and how these important changes may impact the employer and employees in Shanghai.

China’s Social Security Explained

When China opened its market in 1978, the economy rapidly developed and the need for an improved welfare system for urban worker was a key component of economic reforms. This new social security system emerged through a series of specific regulations and provisions in the 1994 Labor Law and the 2008 Labor Contract Law. It was however until 2011 that these separate laws were merged into a comprehensive national framework, namely the Social Insurance Law (or 社会保险法 in Chinese).

Different than the Individual Income Tax (IIT) Regulations, contributing to social security results in indirect benefits to employee and is complimentary to direct salary benefits. For the employer however, it increases the total employment cost of each employee. With increasing labor costs in China, the country’s mandatory social security contributions have placed an additional burden for companies’ salary structure and operational costs.

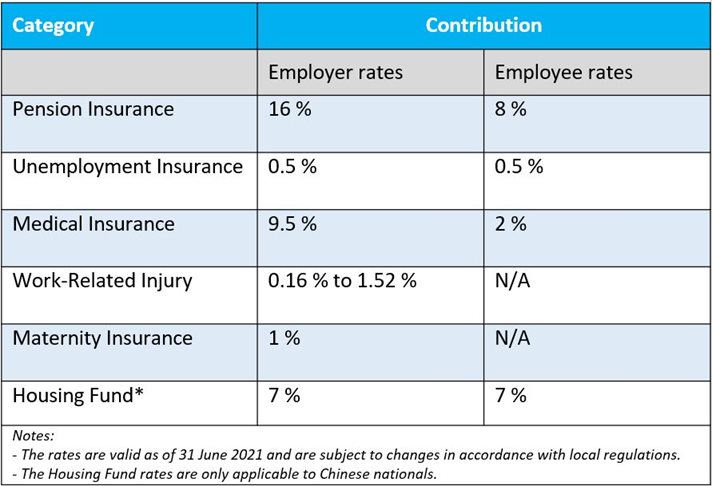

The pillars of the Social Insurance Law are Pension, Medical Insurance, Unemployment Insurance, Work Related-Injury Insurance, Maternity Insurance and the Housing Fund.

Employers and employees make joint contributions for pension, medical, unemployment insurance, and the housing fund, whereas the contributions for work-related injury and maternity insurance are solely born by the employer. Foreigners can opt not to participate in the housing fund scheme, which is a mandatory component of China’s social security system for Chinese domestic employees.

More detailed information on China’s Social Security and Housing Fund system can be found in our full article.

Social Security Contributions in Shanghai

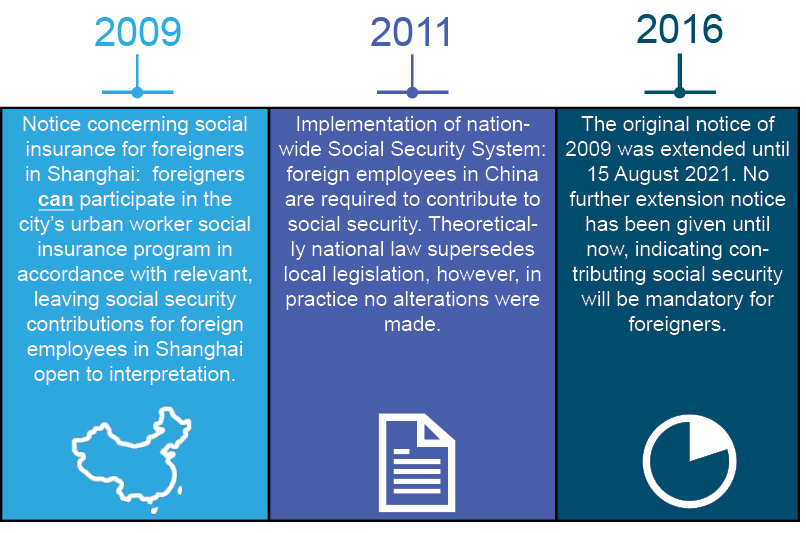

In 2009, the Shanghai Municipal Bureau of Resources and Social Security issued the notice stipulating foreigners can contribute to the social security system, leaving social security contributions for foreign employees in Shanghai open to interpretation. In practice, most foreign employees and their employers in Shanghai have chosen to opt out of the social insurance contributions.

The notice concerning the Participation of Urban Workers in Social Insurance for Foreigners Working in Shanghai, Persons Obtained Overseas Permanent (Long-term) Right of Residence, and Taiwan, Hong Kong and Macao Residents states that “foreign nationals who come to Shanghai with an Employment Permit can participate in the city’s urban workers social insurance program in accordance with relevant regulations. The basic endowment insurance, basic medical insurance and work-related injury insurance shall be stipulated in the labor (employment) contract.” This resulted in foreign employees and their employers to interpret that social security contribution is not a mandatory requirement in Shanghai and has since been tentatively accepted by the Shanghai Labor Bureau.

Later in 2011, following the implementation of the Social Insurance Law and after the “Interim Measures for Foreigners Working in China to Participate in China’s Social Insurance” were issued by the Ministry of Human Resources and Social Security, the Shanghai Municipal Bureau of Human Resources and Social Security did not modify the provision released in 2009. Additionally, we must note that according to the official website of Shanghai Municipal Bureau of Human Resources all domestic employers hiring foreign employees should pay social insurance – which is different than the 2009 notice. In the situation where the national law conflicts with a local law, the national law supersedes the local legislation. This would indicate that foreigners must contribute to the social security system in Shanghai in accordance with the Social Insurance Law and Interim Measure.

Nevertheless, in 2016 the original notice by the Shanghai Municipal Bureau of Resources and Social Security released in 2009 had been extended until 15 August 2021, meaning that in practice foreign employees and their employers in Shanghai continued to be exempt from paying social securities. At this moment it is uncertain whether the notice will be extended again, however, upon expiration it would be mandatory for foreign employees and their employers to contribute to social security in accordance with national regulations.

IMPACT OF SOCIAL SECURITY CONTRIBUTIONS FOR FOREIGN EMPLOYEES AND EMPLOYERS

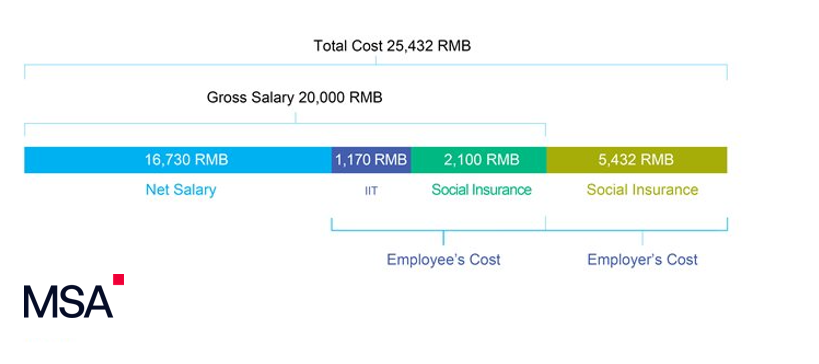

In this section we highlight the method to calculate social securities and provide a scenario for social security contributions in which we compare the impact for both the employee and the employer considering current exemption for foreign employees with a situation in which social security contributions are made in line with national legislation.

An employee’s social security contributions are deducted directly from the gross salary while the employer’s contributions are added as an additional cost to the gross salary, which results in an increase in total employment cost of each employee.

It is important to note that:

- The contribution base is assessed on the employment income and the maximum employment income is capped at three times (300%) of the City Average Salary (CAS) of the prior year. Per July 2, the maximum cap is RMB 31,014 and minimum cap is 5,975.

- The employer is required to withhold the applicable social security contributions for the employee and have the funds available to cover both the monthly employer and employee costs. The payments are settled with the local security bureau monthly.

- The 2021 Shanghai Social Security Contribute rates are as below.

2021 Shanghai Social Security Contribution

The following two scenarios will illustrate the total costs of employment for a foreign employee in Shanghai with a gross monthly salary of 20,000 RMB, considering scenarios with- and without social security contributions.

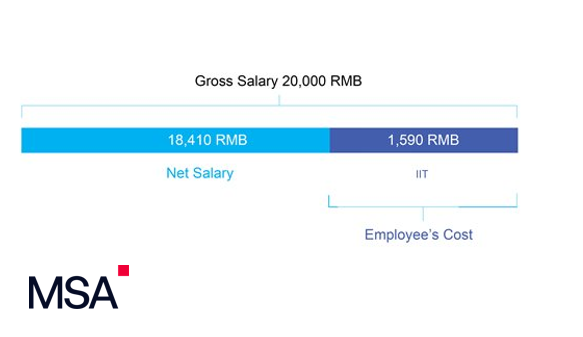

Total Costs without social Security – Foreign Employee in Shanghai (July 2021, RMB)

Note: The above example is the average over a full year. The exact monthly amounts will differ due to China’s accumulative IIT system, which causes the net salary of an individual to decrease throughout the year.

In the scenario in which foreign employees in Shanghai earning a gross salary of RMB 20,000 do not contribute to social securities in line with China’s national legislation, the total net salary received will be RMB 18,410 whereas total employer costs are equal to the gross salary.

Total Costs with Social Security – Foreign Employee in Shanghai (July 2021, RMB)

From the above example we can observe that when foreign employees must contribute to social securities, an employee with a gross salary of 20,000 RMB will received a reduced net salary of RMB 16,730, a reduction of 9.13%. On the other hand, total employer costs increase with RMB 5,432 or 27.16%.

Social Security Exemptions for Foreign Employees

In order to avoid foreign employees having to pay full social security contributions in two countries, China has entered into social security agreements with 12 countries, of which 11 have been implemented. The countries with which the agreements have been implemented include Germany, South Korea, Denmark, Canada, Finland, Switzerland, the Netherlands, Spain, Luxembourg, Japan and Serbia. Furthermore, China has already signed an agreement with France, but this agreement is not yet in effect. The agreement will come into effect after both countries have completed the necessary domestic procedures for implementation.

According to the social security agreements, foreign employees who are citizens or assigned by employers of one state can be partly exempted from social security contributions in the other state. For social security in China, the agreements generally specify only exemptions to pension and unemployment insurance, depending on the country.

However, the social security exemptions only apply to a specific group of labor categories. The labor categories that are eligible for exemptions differ per country, which are defined in each specific agreement. Generally, most agreements include dispatched personnel, persons employed on aircrafts and/or ships and government, diplomatic and consular employees. To learn more about whether you can apply for exemptions, refer to our Payroll, IIT & Social Security services page or contact us.

Conclusion

In line with China’s national regulations on social securities, all employers and employees must contribute to social insurance in China. With the potential end to the preferential treatment of foreign employees in Shanghai regarding social security contributions per August 15, 2021, foreign employers and employees should have a thorough understanding of the social security system and the potential impact of the end of the preferential treatment.

Not complying can results in penalties for both the employer and employee. By law, the employee will be responsible for the individual social security contributions via retroactive payment. Whereas the employer will be responsible for the remaining portion of employer contributions to social insurances via retroactive payment as well as penalties for the failure of payment or late payment.

However, to date there have not been any official updates from authorities as to whether foreigners will now be required to contribute to social security.

If you have any questions about the social security system in China and the implication it has on your company or employees, please do not hesitate to contact us.