Companies planning to enter the Chinese market have several vehicles of entry available to them. The most appropriate vehicle of entry should be selected according to the specific needs and objectives of the business. A common way for many companies to enter the Chinese market is through a Joint Venture (JV).

In this article we explore what a joint venture in China is, how to set up a JV and important considerations that should be made when setting one.

What is a Joint Venture in China?

A joint venture company in China, also known as a Sino-foreign joint venture, is a limited liability company which is established between a foreign investor and Chinese individual or company. It differs from a Wholly Foreign-owned Entity (WFOE) in that a local partner is required.

Previously joint ventures were separated in 2 different types, namely:

- An Equity Joint Venture (EJV) – which was governed by the Law on Sino-Foreign Equity Joint ventures. In this type of JV, the profits and losses are distributed between the parties, proportionally to their respective equity.

- A Co-operative Joint Venture (CJV) – which was governed by the law on Sino-foreign Co-operative joint ventures. This type of JV offered more flexibility to investors, in that the control, profit and risk, where not divide according to the equity held. Rather, it could be negotiated and amended contractually.

However, as of the 1st of January 2020, the distinctions between the two have been abolished and now Joint Ventures are established according to the Company Law.

How Does a Chinese Joint Venture Work?

According to the Company Law, JV’s may take the form of either a limited liability company (LLC) or a joint stock company. In accordance with the Company Law JVs are required to change their organizational structure to a 3-tier structure.

The management of a structure of this kind is more complex for companies with limited international experience, as the business environment in China presents many different challenges than experienced elsewhere in the world.

Companies entering the country are not only confronted with a different culture but may also be faced with managerial challenges, as they are not always able to exercise influence over the activities of the Chinese subsidiary.

Key Considerations When Setting Up a China Joint Venture

Shareholder Agreement

It is important for foreign investors to carefully define the rights and responsibilities of the shareholders during the establishment phase. Especially as there may be several shareholders with diverging interests.

The shareholder agreement describes the key agreements between the shareholders such as the equity investment, the ratio’s etc. This agreement must be drafted in accordance with Chinese legislation and must be prepared prior to the application for the Joint Venture Business License.

Articles of Association

The Articles of Association can be seen as a ‘constitutional’ document which sets out the rules of governance of the joint venture. It includes important information about the company’s business scope, the powers and responsibilities of investors, the amount of registered capital, and the rules regarding the board of directors, legal representatives, and supervisors of the company.

Companies need to maintain a good record of any changes or amendments in the Articles of Association. Any negligent actions by the company may result in negative consequences.

Business Scope

The business scope serves an official outline and description of the activities a company plans to engage in, in their operations in China. The business scope is mentioned on the business license of an enterprise and is accessible by any individual through the company registry on the website of the Chinese Administration for Market Regulation (AMR).

A company can only carry out the activities specified in its business scope. If a company conducts any activities outside its business scope it may be liable to pay a fine and some severe instances, the company’s business license may be revoked.

In order to determine which activities can be included in a company’s business scope, a foreign investor would need to look at the Negative List. The Negative List contains all the sectors and industries that are prohibited under Chinese law, for foreigners to invest in authorities (learn more about China’s Negative List).

It is important to not only carefully consider the business activities the company wants to conduct in China, but also consider future activities the company plans to engage in, in the future. It is important as retroactively amending a business scope can be complex and time-consuming.

Registered Capital and Investment

The registered capital of a company refers to the total amount of equity or capital contributions that need to be paid in full by the shareholders of the JV. Generally, this is a tax-free contribution which can either be paid in cash or contributed through technology, machinery, or other assets. It is recommended by our experts that the contribution is made in cash.

Companies are obligated to contribute the full amount of registered capital within a period of 30 years after establishment. Therefore, the capital contribution payments can be made in installments.

The total investment refers to the amount of funds which a JV needs to the company’s production or operational goals as set out in the Articles of Association. The company’s Articles of Association must specify the amount of registered capital as well as the total investment to be made.

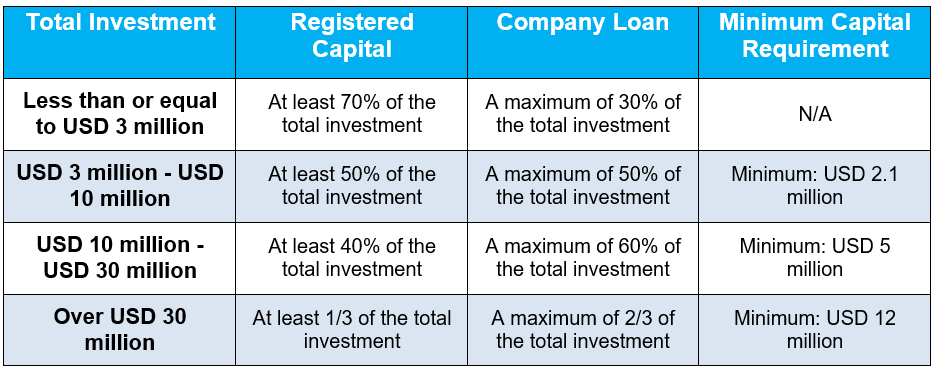

Table: Registered Capital and Total Investment Ratios

Registered Personnel

Joint ventures in China are required to establish a 3-tier structure in accordance with the Company Law act. The structure needs to include:

- A Board of Shareholders

- A Board of Directors

- Supervisors

Board of Shareholders

This is the highest authority for a JV and is made up of representatives of the shareholders. The details of the shareholders are generally included in the shareholders agreement as well as the Articles of Association of a company.

The Board of Shareholders possesses the authority to appoint the Board of Directors, who are responsible for the direct management of the JV. The following matters are to be presented to the shareholders for review and must be approved by two-thirds or more of the voting rights in a shareholders meeting:

- Any amendments to the company’s Articles of Association.

- Any changes to a company’s registered capital amount.

- A company merger, division, liquidation, or major change in a company’s structure.

Board of Directors

The management of a JV is carried out by the Board of Directors. The shareholders can choose to appoint either an Executive Director or a Board of Directors. The tenure of directors must not exceed 3 years and the number of board members differs on the type of entity. The following rules apply:

- For a limited liability company, the board shall comprise of no fewer than 3 and no more than 13 members.

- For a joint stock company, the board shall comprise of no fewer than 5 and no more than 19 members.

Legal Representative

A Joint Venture is required to appoint a Legal Representative, who is equal to either an Executive Director or the Chairman of the Board of Directors. The details of the Legal Representative are required to be filed with the local Administration for Market Regulation.

Supervisor

A Joint Venture is required to appoint at least 1 natural person as a supervisor or alternatively appoint a Board of Supervisors consisting of no fewer than 3 members, according to the New Foreign Investment Law.

A Supervisor is responsible for supervising the conduct of the Board of Directors or Executive Director in order to protect the interests of the shareholders. As such, a Supervisor of a JV is unable to simultaneously hold the position of Legal representative, General Manager or Directorship.

General Manager

A Joint Venture may elect to hire a General Manager to manage the day-to-day activities of the company, however, this is not a requirement.

Registered Address

A Joint Venture in China is required to have a registered address. Proof of such address must be furnished during the registration process. For a registered address to be suitable for company registration, it must meet the following 2 requirements:

- The address can be used for commercial purposes.

- No other company is registered at the same address.

Company Name

In China, the official company name of an enterprise will be in Chinese, and this name will be registered with all the relevant Chinese government authorities. The Chinese name of a business must follow the following format:

- The company’s chosen name

- Major area of business or business activity the company will perform (e.g., Consulting, Trading, Technology etc.).

- Region or place of incorporation (e.g., Shanghai).

- Legal structure of the company (e.g., LLC).

While companies must have a Chinese name, they are able to have an unofficial English name. The English name will be registered with Ministry of Finance and Commerce (MOFCOM), can be included in the company chop, and can be used when registering with a bank.

The Process of Settup Up a China Joint Venture

- Pre-approval and Registration of the Name – the company must file an online pre-approval for structural decisions and company name registration. At this stage, the company must upload digital scans of the identification documents of the relevant personnel, as well as a copy of the lease agreement.

- Application with the Administration for Market Regulation – after receiving the signed application documents and legalized documents from the investors the official application with the AMR can be made. If the AMR approves the business license will be issued and at that moment the Chinese subsidiary will come into existence, however, it will not be operational yet.

- Company Chops – once the business license has been issued the company can proceed with applying for the company chops. These chops serve as signatures on behalf of the company and make documents legally binding. The following chops need to be obtained: Company chop, Legal representative chop, Finance chop, Fapiao chop.

- Opening of Bank account – for a JV to be fully operational it will need to open a RMB basic account as well as a foreign capital account. Before the Chinese subsidiary can use capital funds in China, it must be converted from the foreign capital account into RMB, on the RMB basic account.

- Articles of Association – finalization of the JV contract and Articles of Association. This must include all info about the organization, the principles, the method of operation, management styles, and rules to be adopted.

- Tax Registration – any foreign invested company in China must meet tax filing compliance requirements and are required to commence with basic tax registrations within 30 days of the entity legally existing. In order to meet the requirements a company must follow the must apply for the following tax registrations:

- Basic registration with the National and Local Tax authority.

- Registration for General VAT Taxpayer status.

- VAT invoice fapiao registration.

- Company registration at the Social Security and Housing Fund.

- Other licenses (if applicable) – several additional licenses may be necessary such as an import/export license or a license dependent on the industry e.g., food and beverage, specific professional services, alcohol distribution etc.

Benefits of a Joint Venture in China

1. Access Additional Business Areas – you can gain access to additional business areas that may be restricted, not prohibited, in equity ownership by Chinese.

2. Access to the Market Amid Restrictions – due to the outbreak of the pandemic, many foreign investors have used a JV as a means of entry. This has allowed them to rely on local partners to access and manage activities in the market.

3. Insights & Expertise – a foreign partner will gain insights and expertise on how the Chinese market operates. This includes leveraging their partners’ contacts and distribution channels for growth of the business.

4. Reduced Risk – by having a partner in the market, the risk for the foreign partner is significantly reduced. Many foreign businesses that do not have experience in the Chinese market opt for a JV as a means of reducing risk.

Disadvantages of a Joint Venture in China

1. Finding the right partner – it can often be a lengthy process that may involve additional costs to find the correct local partner for your business.

2. Less control – as it is a partnership, a JV gives the foreign counterpart less control in decision making processes.

3. Conflicting interests – there may be some cultural differences, or differences in management styles that may emerge.

4. Incorporation process – the process of incorporation could be quite complex and even take up to 5 months.

Setting up a Joint Venture is not a simple task and can often end up being costly and time consuming. Understanding the incorporation process can be quite complex and may require knowledge of the laws and processes. As an established corporate services provider, we have the necessary expertise to help businesses enter and participate in the Chinese market. Find out all you need to know in our Joint Ventures in China white paper.

MSA in China

MSA is a financial advisory firm based in Shanghai. Since 2011, we have supported foreign enterprises across all provinces of China and in Hong Kong with Accounting, Tax, Compliance, Payroll, and Corporate Services. Our mission is to provide a full range of financial services to foreign enterprises, where we focus on delivering transparency, compliance, and sustainability to your business. We commit ourselves to provide our clients with a good understanding of administrative and reporting requirements in China and ensure they have full control over their finances.

For more information on this subject, please do not hesitate to contact us immediately.