It is generally not complicated to determine and calculate Individual Income Tax (IIT) and Social Security due of local Chinese employees. Local Chinese employees can only work for companies registered within China and as they are domiciled within China, IIT is calculated based on their worldwide income and social security is calculated based on their previous year’s monthly salary.

It becomes, however, quickly difficult for expatriates to determine the correct amount of taxes due. In most cases, the taxes due are dependent on their tax resident status. It can become increasingly complicated to address the questions, whether the foreigner will be required to pay taxes in China or in his or her home country; whether the foreigner is required to pay taxes only on the income earned in China or on his or her worldwide income. Establishing compliance in HR administration can become a difficult endeavor.

We have seen many times foreign companies struggling to have a good understanding about these specific rules and regulations and as a result pay on the hand too much taxes in the home country, and too little taxes within China.

To provide a better understanding about this, we will explain in Part 2 of our HR Compliance series 5 important considerations about individual income tax and social security which should carefully be kept in mind before hiring staff in China.

6. Determining the Tax Resident Status

Individual Income tax in China is calculated based on progressive rates from 3% to 45% based on the total income of the employee. Different from local employees, the standard deduction of the salary for expatriates working in China is RMB 4.800 rather than RMB 3,500.

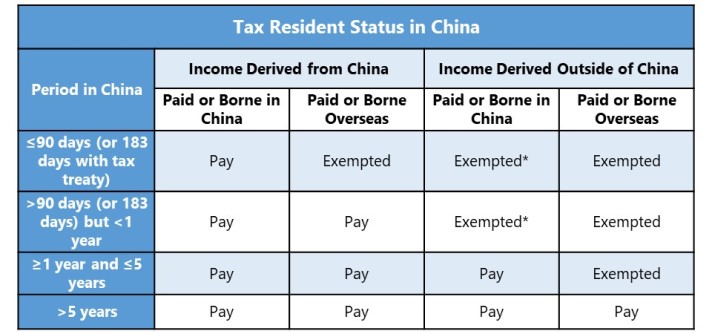

The below table explains how the resident status of expatriates is determined within China, and would also determine the individual income tax due of the individual.

One of the most typical misconceptions within this table as that income derived outside of China is considered to be equal as income paid overseas. An employee can have all his income derived or sourced from China, but have all his income paid by overseas entity. In this case the employee would need to pay 100% of individual income tax in China.

To determine when the individual income tax is due, we would have to look at the different periods within this table. When the expatriate resides in China for less than 90 days (or 183 depending on DTA) in a calendar year, income not borne or paid by the Chinese company is not liable to IIT in China. When he or she is working for 183 days or more within China, then individual income tax over the sourced in China days need to be paid in China.

When expatriate lives for more than 5 years within China, he or she would become liable to pay tax on his or her worldwide income. This requirement can be broken via the ‘tax break principle’, this means that the expatriate have to leave China for either 30 consecutive days (calculated in actual days 31 days) or for a cumulative of 90 days (calculated in actual days 91 days) in a fiscal year. These “tax break” strategies and principles are discussed in greater depth at MSA’s issued blog post.

The asterix within this table explains that managers or people holding senior management positions in Chinese company, would have to pay IIT on their income paid in China regardless whether it is derived in China or not. This requirement also applies to Chief Representatives of a Rep Office in China, even when they visit China for several days or weeks in a year.

7. Individual Income Tax Planning

There are various allowances possible for expatriates in China, however, it is important to make sure you first have a good understanding about what is allowed (i.e. need to be mentioned in the employment contract) and always make sure to collect the right and valid official VAT invoice ‘the fapiao’. Though there has not been an official statement about this, what seems to be acceptable by the tax authorities are allowances up to 30-35% of the salary.

The type of deductible allowances are the following:

(a) Housing Allowance: The amount spent on rental of a residence can be deducted from the taxable income of the expatriate.

(b) Meal Allowance: expatriates are allowed to deduct monthly reasonable amount spent on their meals from their taxable income.

(c) Laundry Allowance: Monthly laundry expense can also be deducted.

(d) Education Allowance: Expatriates are allowed to deduct the tuition spent on learning Chinese and any amount spent on education of their children from their monthly taxable income.

(e) Travelling Allowance: Expatriates can also deduct each year up to two round-trip tickets for only themselves to their home country.

Different than in many other countries, a bonus can be provided to employees at a beneficial tax rate. This can only be provided once in a fiscal year. If an an additional bonus is to be provided, this amount will be added up to the monthly taxable income.

8. Taxable Income in China

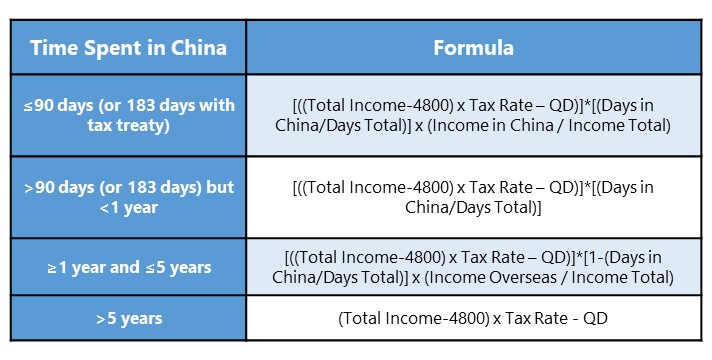

IIT calculation is based on the total income of the expatriates. The table below provides the standard formulas for calculation of IIT that an expatriate is liable to pay in China. It is dependent on the total income received and the duration of their stay.

9. Individual Income Tax filing

Companies registered in China are required to withhold the individual income tax on behalf of their employees and make monthly tax payment to the tax authorities. This is usually due by the 15th in the following month.

If an individual is working in China (for a foreign company) and is not working for company registered within China, and he or she becomes liable to pay individual income tax within China, he or she would need to report this foreign sourced income by the end of the tax year to the relevant tax authorities in China.

Local employees and most foreign employees are required to complete annual IIT return by the 31-March (by end of February if requested by tax officer) when their annual salary has exceeded RMB 120,000 in prior fiscal year. Expatriates can break this annual IIT return requirement by either leaving China for 30 days (31 in actual days) or 90 days (91 in actual days) in total in a fiscal year.

10. Social Security & Housing Fund

Companies in China are generally required to withhold on a monthly basis (i.e. employee and employer’s contribution) on behalf of all their employees the social security, which consists out of (1) Pension, (2) Medical, (3) Unemployment, (4) Employment Injury and (5) Maternity, and housing fund, which is only is required to be withheld for local Chinese employees. The amount of contribution can quickly become up to 30% to 40% of the salary of the employee in China.

It is important to realize that social Security & housing fund are calculated based on the previous year’s monthly salary. Though in practice we have heard many stories of companies doing otherwise, you CANNOT choose yourself the rate of contribution. If the company does not pay the social security correctly, even the General Manager can be liable and the company can become blacklisted.

For expatriates, there are several exemptions to take in mind. In Shanghai, different from all other regions in China, have chosen not to enact the requirements for social security payments for expatriates. This means that in Shanghai expatriates are effectively exempted from this requirement. In addition, several countries, including Germany, the Netherlands and Korea, have signed with China social security treaties. This means that expatriates may be exempted from several categories as pension or unemployment contribution. An application for this needs to be made in China and usually certificate needs to be obtained as well from the home country to be able to benefit from this treaty.

Our Thoughts

Though there are also other important considerations, we hope by this document to have shown that there are many different and specific rules and regulations to take in mind before hiring staff in China. As of this reason, we always recommend foreign companies to carefully study and continuously track of your organization, taxes and the rules and regulations to make sure you remain compliant.

At MS Advisory, we have the experienced professionals to provide you advice about these issues and can support foreign companies to become compliant. For more information and if any questions, please do not hesitate to contact us at [email protected].