In an effort to attract foreign talent, the Chinese authorities currently allow expatriates to claim part of their salary in tax-exempt allowances. According to China’s existing Individual Income Tax (IIT) law, which came into effect on 1 January 2019, expatriates in China can continue to claim these tax-exempt expatriate allowances until the end of the transition period, ending 31 December 2021.

The discontinuation of the ability for expatriates to claim tax-exempt allowances will have a profound impact on the amount of IIT payable and the disposable income of expatriates in China. Therefore, we have prepared an overview of the current preferential Individual Income Tax (IIT) regime for expatriates. Subsequently, this article will demonstrate the impact of the forecasted changes in China’s preferential IIT policy and discuss the likelihood of the discontinuation of the preferential tax regime as well as key considerations for employers.

Overview of Existing Tax-Exempt Expatriate Allowances

Individuals who are a tax resident of China are obliged to pay Individual Income Tax (IIT) over their China-sourced income. In China, Individual Income Tax is calculated based on the cumulative calculation method and IIT filing must be completed on a monthly basis (a comprehensive overview on IIT can be found in our full article on Individual Income Tax).

Several deductions can be applied in order to lower an individual’s taxable income over which Individual Income Tax will be levied. Firstly, every employee in China, both Chinese and foreign, enjoys a standard monthly deduction of RMB 5.000 over their taxable income.

In addition, special additional deductions are available. Chinese citizens can claim 6 different types of “itemized deductions”, whereas the applicable legislation offers expatriates the opportunity to claim part of their salary by means of tax-exempt expatriate allowances.

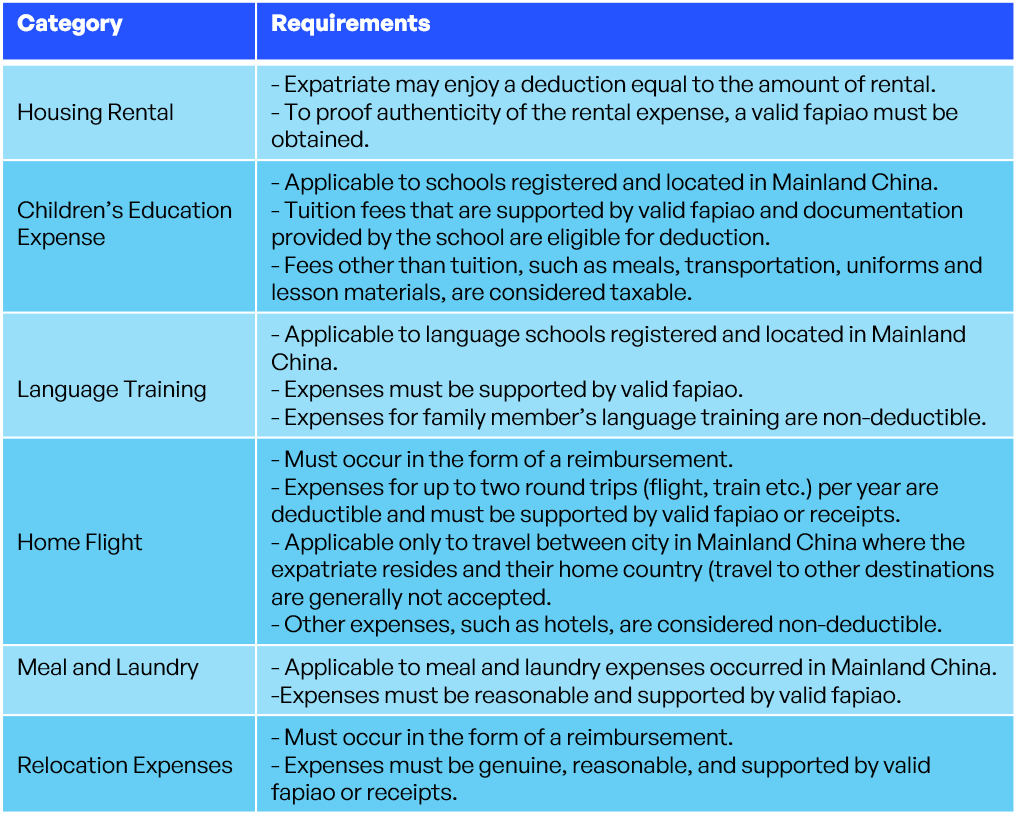

The Chinese law does not provide any limitation on the proportion of income that can be claimed via the aforementioned tax-exempt expatriate allowances, but instead states that these expenses must be “reasonable”. In practice, the Chinese tax authorities will allow expatriates to claim up to 30%-35% of their income via tax-exempt allowances. It should be noted that foreigners must obtain proof of the authenticity of the expenses in the form of a fapiao.

The table below provides an overview of the available tax-exempt allowances for expatriates:

IIT Preferential Treatment using Expatriate Allowances

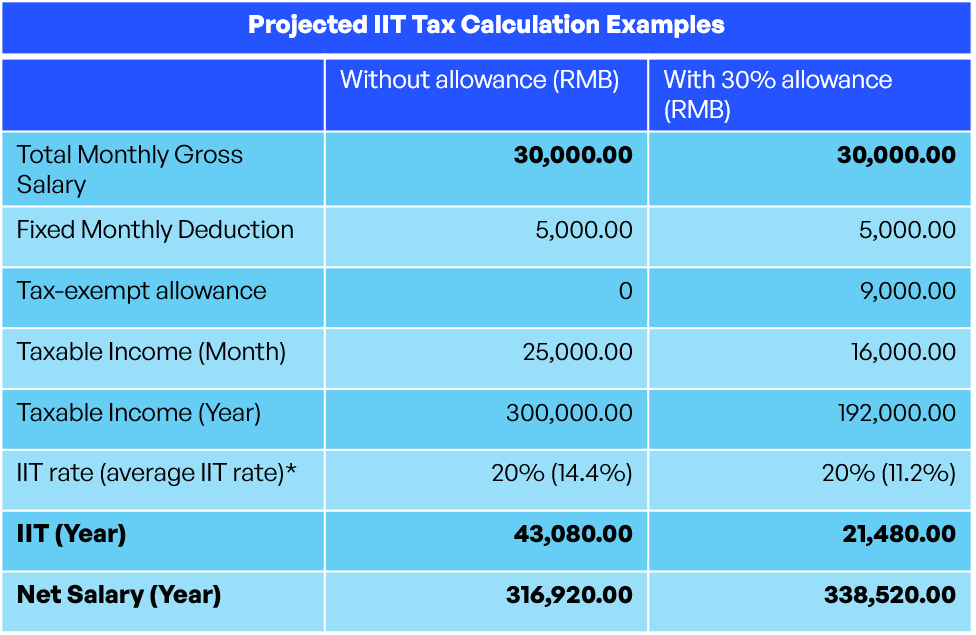

Thus far, expatriates have been able to enjoy the IIT preferential treatment which lowered the amount of IIT payable and increase their disposable income. We have constructed an IIT Tax simulation to showcase the benefits derived from the existing expatriate allowances.

The below example displays a calculation of the applicable tax rate and IIT payable based on the use of current expatriate tax-exempt allowances. The calculation is based on the assumption of a gross salary income of RMB 30,000 per month. The current average deduction rate for expatriates lies at 30-35% of the monthly gross salary income, which in our example results in a monthly RMB 9,000 deduction of taxable income.

Note 1: All calculations are based on the assumption of the expatriate working in Shanghai. Tax deductions may vary per Municipality.

* Since China uses the cumulative withholding method, the applicable IIT rate at the start of the year will be lower compared to the end of the year. This results in a greater amount of disposable income received at the start of the year and an average IIT rate which is lower compared to applicable tax rate at the end of the year.

Forecasted Change to IIT Preferential Tax Treatment: End of Expatriate Allowances

According to Circular 164 on “the issues concerning the transitional policies on preferential tax treatment under the amended PRC IIT Law” for both the preferential calculation method for determining IIT payable on annual bonuses and the preferential IIT tax treatment using tax-exempt expatriate allowances would be applicable until 31 December 2021. More specifically, according to our current understanding the preferential treatment of the housing rental, children’s education expenses and language training would be discontinued, whereas we are awaiting further implementation guidelines with regards to the other tax-exempt allowances.

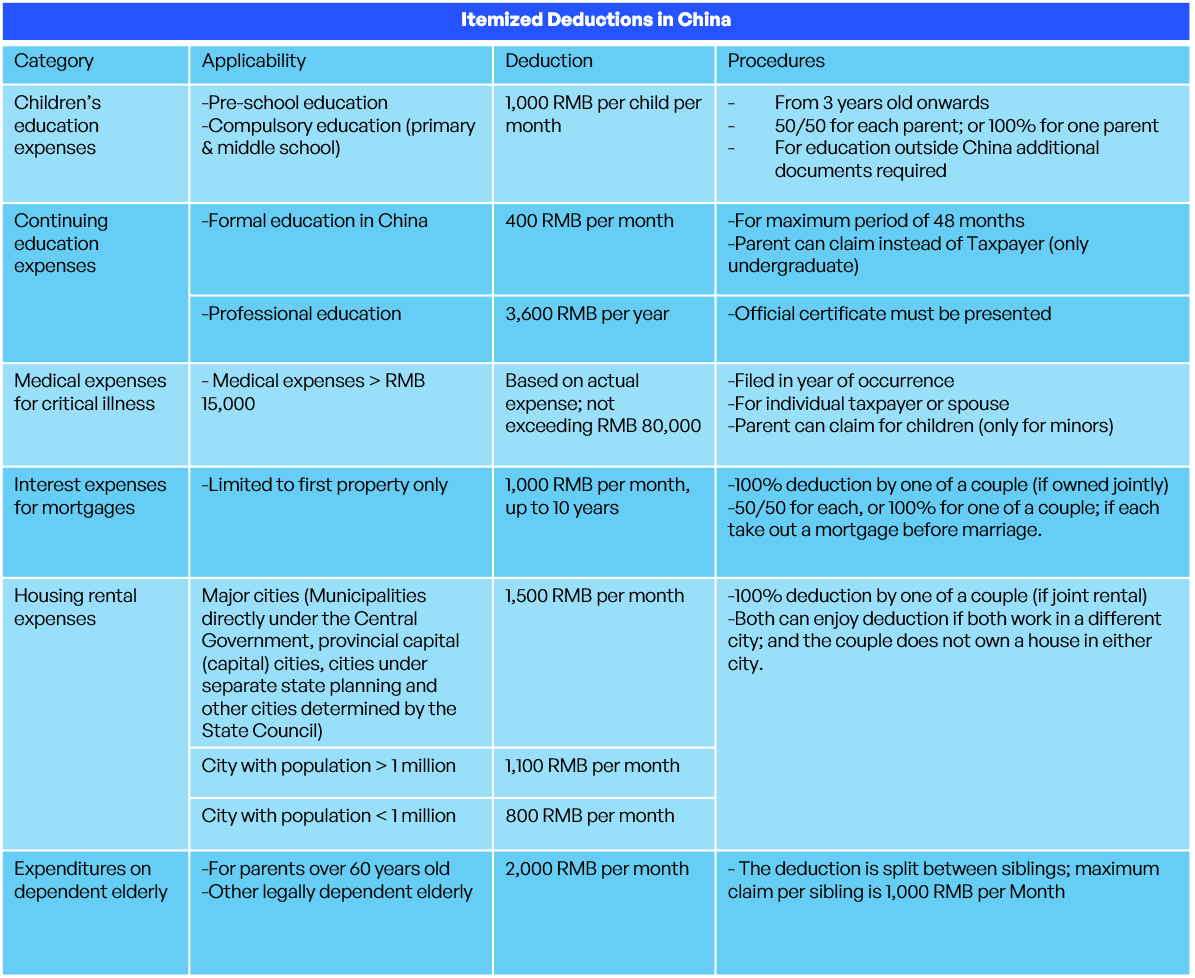

Since foreign taxpayers cannot simultaneously enjoy both the itemized deductions and the tax-exempt expatriate allowance, this means that if the current arrangement is not extended, foreign tax residents in China will likely only be eligible to claim itemized deductions (similar as Chinese nationals).

The table below provides an overview of the available itemized deductions:

Because the existing tax-exempt expatriate allowances are seen as more favorable, both in terms of applicable scope of the expense category and the potential amount of available deduction, there can be a profound impact on the disposable income of expatriates after the end of the transition period.

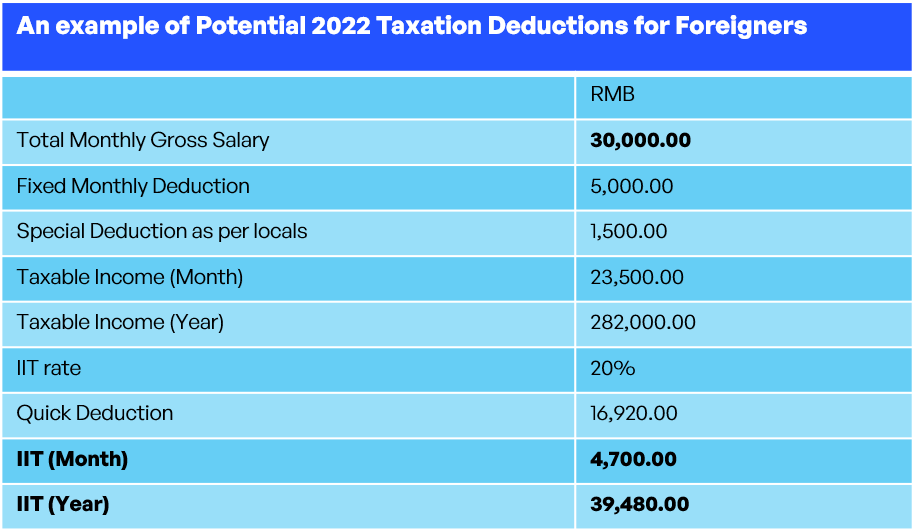

In our next example we have followed the Chinese guideline for itemized deductions, which is far more complex and differs depending on each individual’s current circumstances. In the tax simulation below we consider a single male (foreigner) living and working in Shanghai, who is a tax resident of China. His gross salary is RMB 30,000 per month and he has no dependents. He is renting an apartment, which entitles him to a projected RMB 1,500 deduction.

Should the forthcoming policy changes be implemented as of 2022 this will result in a decrease of total available tax deductions for foreigners. In our example above, the total yearly tax contributions would increase by RMB 18,000 per year. The above calculations merely offer a projection of possible changes and are subject to change depending on the publication of further implementation guidelines on the end of expatriate allowances or an extension of the current preferential IIT tax treatment of tax-exempt allowances.

Our Thoughts

The recent policy trajectory leads to the plausible assumption that expatriates’ current preferential IIT treatment of tax-exempt allowances across China are likely to end when the current policy as per circular 164 expires on 31 December 2021.

Nevertheless, uncertainties remain regarding the application of the preferential calculation method for annual bonuses and the preferential IIT treatment for expatriates in 2022. In particular, it should be noted that the Chinese authorities will generally announce policies or provide Implementation Guidelines in relation to major pending policy alterations. As of this moment, such further guidance from the Chinese State Administration of Taxation has not yet been provided and based on our experience would still be expected around Q4 of 2021.

Furthermore, the Chinese authorities will generally grant the public the availability to comment on major policy alterations and as such it is encouraged for company’s employing foreign individuals to contact their local in-charge tax officer on these matters.

Despite the uncertainties, both companies and individuals should carefully consider in advance the possible consequences of the forecasted alterations and prepare for 2022, including:

- Remain up to date on policy announcements concerning the cancellation or possible extension of tax-exempt expatriate allowances.

- Review of labor contracts and assessment of legal impact of potential policy alteration.

- Ensure appropriate company budgeting and review company policies regarding the retention of foreign talent.

- Assess the availability and eligibility for existing financial subsidies (incl. preferential policies in areas such as the Greater Bay Area and Lingang New Area in the Shanghai Free Trade Zone) and potential alternatives to provide employee benefits (e.g. Employee Welfare Payments).

At MSA, we will continue to provide you the latest insights into the forecasted Individual Income Tax policy changes. Our team offers support to foreign-invested enterprises throughout Mainland China in all areas of IIT to ensure full compliance from an employer perspective and advises on the structuring of individual employee benefits packages.

If you have any questions about Individual Income Tax in China or the forecasted policy changes to the preferential tax treatment of expatriate allowances, please do not hesitate to contact us.