Since the outbreak of Covid-19, the Chinese government has implemented various support measures to assist, especially small and medium-sized, enterprises weather the storm. Even though China saw a strong recovery in 2020, and an especially strong performance in 2021, companies are still experiencing difficulties due to global economic effects from Covid-19, as well as various local covid-related lockdowns across the country. Therefore, the government announced further support measures for the economy during this year’s Two Sessions.

One of the key goals highlighted by Li Keqiang in the Government Work Report was keeping the operations of market entities stable and maintaining job security by strengthening macro policies.

In this article we discuss the policies that have been announced by the authorities, that directly affect SMEs and their employees in China.

Support Measures for Businesses

As part of the goal of keeping the operations of companies stable, the government announced it will implement a new package of tax-and-fee policies to support enterprises. Firstly, the government stated it will extend tax and fee reduction policies that support manufacturing, micro and small enterprises, and self-employed individuals, and additionally expand the scale and scope of these policies. The actual specific implementation of this objective depends on each specific local jurisdiction and further announcements are expected in the near future.

Additionally, the government has issued several concrete tax and fee policies to support enterprises which we will discuss below.

Corporate Income Tax (CIT) reduction for small and low profit enterprises

The government has implemented several preferential policies for small and low profit enterprises in recent years. Following the 2021 Government Work Report, the CIT rate for companies with profit below RMB 1 million was halved from 5% to 2.5%. This year, the percentage for rate for companies with profit between RMB 1 million and RMB 3 million was halved from 10% to 5% until 31st December 2024.

Currently, the effective CIT percentages are as follows:

i. Company profit below RMB 1 million – will have an effective CIT rate of 2.5%;

This is based on a 20% CIT rate applied to 12.5% of a company’s taxable income amount for the proportion of their taxable income up to RMB 1 million.

ii. Company profit between RMB 1 million and RMB 3 million – will have an effective CIT rate of 5%;

This is based on a 20% CIT rate applied to 25% of a company’s taxable income amount for the proportion of their taxable income between RMB 1 million and RMB 3 million.

iii. Company profit above RMB 3 million – will have a standard CIT rate of 25%.

To learn more about China’s Corporate Income Tax framework and how small and low profit companies are defined, please refer to our CIT overview article.

Temporary VAT exemption for Small-scale VAT Payers

In 2020, right after the Covid-19 outbreak, the government released a temporary policy to decrease the VAT rate for small-scale VAT payers to 1%. This policy was subsequently extended on several occasions until the end of 2021. For the first 3 months of 2022, the policy was still implemented, until an announcement by the State Administration of Taxation on 24 March 2022.

According to the “Announcement of the State Administration of Taxation on the Exemption of Small-scale Taxpayers from Value-Added Tax and Other Collection Management Matters” small-scale VAT payers will be exempt from VAT on their taxable sales income until 31 December 2024.

Important to note here is that the exemption on VAT only applies to the issuing of normal fapiaos. If a small-scale VAT payer issues a special VAT fapiao, the tax rate will return to the standard rate of 3%. As such, there is no longer a lower VAT rate applied for special fapiaos, which was lowered to 1% under the previous policy. However, for companies issuing normal VAT fapiaos, the decrease to 0% VAT is a very much welcomed reduction.

Additionally, the announcement again highlighted that small-scale VAT taxpayers whose total monthly sales do not exceed RMB 150,000 (or quarterly sales that do not exceed RMB 450,000) are exempted from VAT on their sales income.

Further Implementation of VAT Refund Mechanism

To improve the cash flow of enterprises and promote employment and consumption-driven investment, the government is expanding the implementation of the VAT refund mechanism.

Since 1 April 2019, only qualified taxpayers could apply for a refund of excess input VAT, instead of carrying the full amount forward to the next accounting period. However, taxpayers were only allowed to refund 60% of the available uncredited input VAT. Additionally, there was also a requirement that the incremental uncredited input VAT had to remain positive for 6 consecutive months or 2 consecutive quarters, and the total amount should be no less than 500,000 RMB.

With the new policy, the scope of companies that can apply for VAT refunds has been expanded to include micro and small firms in all industries and qualified firms in the following industries; manufacturing, scientific research and technical services, electricity, heat, gas and water production and supply, software and information technology services, ecological protection and environmental governance and transportation, warehousing and the postal industry.

Following the implementation of this policy, all qualified companies as highlighted above can apply for (incremental) VAT refunds on a monthly basis starting 1 April 2022. Additionally, all companies that have built up outstanding VAT refund credits, will be able to apply for a one-time refund of the outstanding amount.

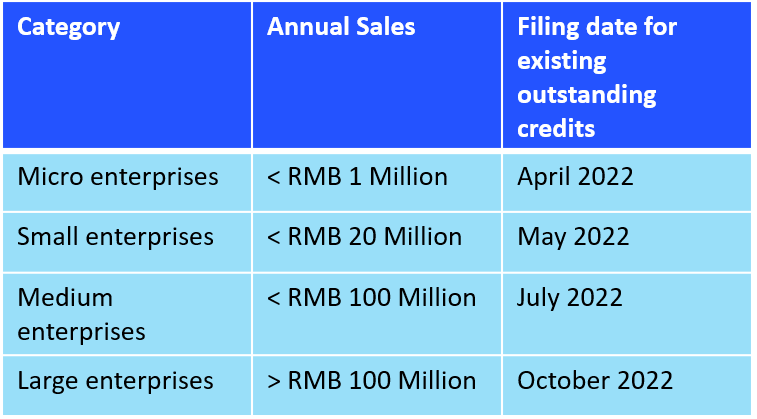

The government will give priority to micro and small enterprises, followed by medium-size and large enterprises according to the following schedule:

Taxes and Fees will be Reduced by 50% for Small and Low Profit Enterprises

As a way to further the tax and fee burden on small and low profit enterprises, the government announced the “Six Taxes and Two Fees” reduction and exemption policy. According to the policy, small and low profit enterprises can apply for a reduction of up to 50% for 6 applicable taxes and 2 applicable fees until 31 December 2024.

The reduced taxes include:

- Resource tax

- Urban construction and maintenance taxes

- Real estate tax

- Urban land use tax

- Stamp duty (excluding securities transaction stamp duty)

- Cultivated land occupation tax

The reduced fees include:

- Education surcharges

- Local education surcharges

As long as companies meet the conditions for being classified as a small and low profit enterprise, or are registered as individual industrial and commercial households, they can apply for the “six taxes and two fees” reduction and exemption.

Support Measures for Individuals

According to the 2022 Government Work Report, a key focus point for the government is ensuring and improving the people’s wellbeing and promoting better and new ways of conducting social governance. Policies will focus on the quality of education, improve medical and health services and improve social security and social services. Below we discuss the policies implemented which affect individuals working in China.

Itemized deduction for care of children under 3 years old

As a further supporting measure for the three-child policy, the government will implement a new itemized deduction for Individual Income Tax for the expenses related to the care of children under 3 years old.

Per 1 January 2022, parents can deduct a fixed amount of RMB 1,000 per month per child for their expenses related to caring for infants and children under the age of 3. They can enjoy this deduction from the month of birth to the month before the child turns 3 years old.

Parents can choose to deduct 100% of the deduction standard by one of them, or they can choose to deduct 50% of the deduction standard by both parties. Here it is important to note that the chosen method cannot be changed within a tax year.

Additionally, please note that this deduction only applies to Chinese employees and foreign employees who make use of the itemized deductions system, instead of the special expatriate allowances. To learn more about the differences and the IIT framework in general, please refer to our Individual Income Tax Overview article.

Final Considerations

Even though China has seen a strong recovery from Covid-19 and achieved positive economic growth in the past 2 years, where many countries around the world struggled, the country is expected to see further challenges to growth in 2022. Both due to the ongoing fight against Covid-19, as well as global economic and political headwinds, companies and individuals in China will continue to face challenges for the foreseeable future. As such, the Chinese government continues to implement further support measures to help companies, especially small and medium-sized enterprises. The measures highlighted in our article also apply to foreign-invested enterprises and at MSA we do support our clients with utilizing the available government support measures to the fullest. If you have any questions, please get in touch with us.