In China, the only thing that is constant is change itself. During the last year these changes included new regulations, a slower economy, the Belt and Road Initiative (BRI) and a trade conflict between two of the largest trading countries in the world, the United States and China.

Despite being aware of most of the major changes in China, little is known about how companies from the Benelux are dealing with the threats and opportunities which arise. That is why the Sino Benelux Business Survey was initiated four years ago.

The Sino Benelux Business Survey addresses some of the most essential questions about the Chinese business environment. How have companies from the Benelux (Belgium, The Netherlands and Luxembourg) performed in 2018, and what are their expectations for 2019? What is the perception of the Benelux community in China towards the China-US Trade War and regarding continuous political and regulatory development? The remainder of this article will provide a comprehensive overview of the findings of the Sino Benelux Business Survey report.

ABOUT THE SURVEY

The Sino Benelux Business Survey is organized by the Benelux Chamber of Commerce in China (Beijing, Shanghai and PRD) in partnership with MSA, and is supported by the official diplomatic- and trade representations of Belgium, The Netherlands and Luxembourg in China.

The 2019 survey, being published for the 4th consecutive time, was conducted so that the Benelux business community and other important stakeholders can better understand the Chinese business climate and how they may improve within its challenging business environment.

This year’s survey consisted of 28 questions divided into 4 categories: Business Demographics, Business Performance in 2018, Business Sentiment and Onward Expectations for 2019. A total of 139 companies have participated in the survey, of which 74% directly come from or have beneficial owners from the Benelux countries. The other 26% have either strong ties to the Benelux or management from the Benelux countries.

SURVEY DEMOGRAPHICS

The majority of Benelux businesses are concentrated in the coastal regions, including the main economic clusters in the Yangtze River Delta, Beijing-Tianjin-Hebei region and the Pearl River Delta. The remainder of Benelux businesses in China are quite evenly spread across the rest of China. The results also indicate a similar trend of companies participating in the survey as compared to previous years, with 61% of companies coming from the Industrial Goods & Services as well as Consumer Goods sectors.

Based on revenues and employees, around 56% of respondents are SMEs in China. On average, we see that the number of expatriates per firm has decreased from 2017 to 2018; which is in line with the general trend experienced by foreign companies in China. The Benelux businesses in China are mainly driven by the size of the domestic market and unmet consumer demand.

BUSINESS PERFORMANCE IN 2018

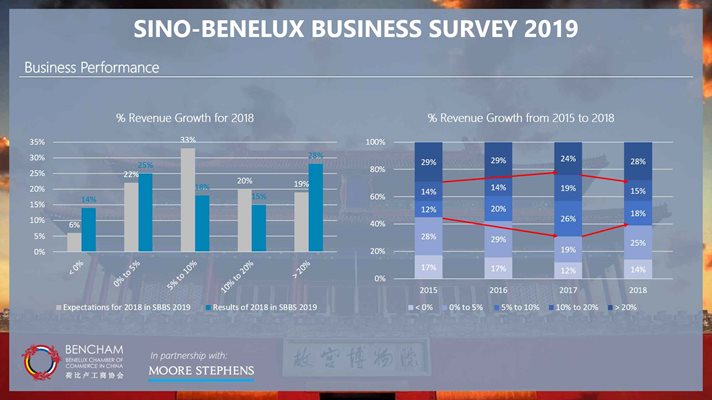

This year, 86% of respondents achieved revenue growth and over 60% achieved revenue growth of over 5%, whereas 69% achieved growth over 5% in 2017. It is important to note, that we observe a more volatile market with winners and losers – we can observe that for the first time since 2015, the percentage of companies reporting either no revenue growth or on the other hand revenue growth greater than 20 per cent has increased. Also, 85% of Benelux companies made a profit in 2018, which is slightly better than the average result of European businesses in China (77%).

Furthermore, increasing salary costs continue to be the most significant negative drivers for Benelux businesses in China, followed by administration/regulatory costs. On the other hand, increased turnover/economies of scale and use of technology remain important positive drivers.

BUSINESS SENTIMENT

The business sentiment examines the perception of the respondents about different aspects of the Chinese market and the Chinese business environment. Overall, 58% of respondents are optimistic about the Chinese market, down from 66% last year. Interestingly, there seems to be a correlation between size of a business and the perception of the Chinese market, where SMEs generally view the Chinese market with more optimism than larger businesses.

The survey further analyzed whether Benelux businesses perceived certain aspects of the Chinese business environment as restricted. The results show that 84% of respondents find every-day business either very or somewhat restricted. Also, 80% of respondents perceive that there is an unleveled playing field.

Only 18% of respondents indicated they encountered projects in the Belt & Road Initiative (BRI). Of these companies, 45% are from the Industrial Services industry and over 60% of these companies are SMEs. The findings seem to reaffirm that Benelux businesses are generally not involved in the BRI project, and that it is mostly beneficial for Chinese businesses.

On the other hand, 37% of respondents reported they were impacted by the China-US Trade War. Most of the companies impacted were located in the coastal regions. Although some companies were directly impacted by the tariffs, numerous respondents indicated that they were affected by reduced customer demand as a result of lower confidence in the economy as well as increased patriotism which makes it more likely that Chinese consumers purchased domestic goods.

ONWARD EXPECTATIONS FOR 2019

Despite a worsening business sentiment, Benelux companies in China were still more optimistic about their future performance compared to the actual results of 2018. 65% of the respondents expect revenue growth greater than 5 per cent in 2019, whereas 61% achieved this result in 2018. On the country level, both Belgian and Dutch companies are expecting an increase in revenue growth compared to the actual results in 2018. Luxembourg companies are less optimistic for 2019, which may be caused by the fact that their performance in 2018 exceeded their expectations for the year.

The profit expectations also show a more positive outlook. Here, the percentage of companies that expect to make profits in 2019 has increased by 8%, creating a more confident outlook for Benelux companies in China. Most of these companies linked their expectations on profit increase to revenue growth (49%), or a combination of both revenue growth and cost savings (38%). This could be a signal to potentially unmet demand.

CONCLUSION

Despite recent reforms, we observe a continuous more negative perception of the Chinese business environment as compared to previous years. In particular, salary costs and administration costs are again a major concern for businesses in China. We also observed that Benelux businesses did feel the impact of the China-US Trade War.

On the upside, 2018 was again a profitable year for Benelux companies here in China. In addition, the respondents have positive expectations for the growth in 2019, which is mostly driven by continuous use of technology and increased turnover which arises due to a very receptive market.

As such, we observe a more volatile market, which results in more winners and more losers. We can conclude the results of the Sino Benelux Business Survey as following: “Negative perception, but good results”.