Annual Audit and Compliance

At the end of the fiscal year, all foreign companies must complete the annual audit and other annual compliance procedures as set out by the Chinese government. The annual statutory requirements in China can be separated into the year-end statutory audit, annual Corporate Income Tax Filing and Annual Publication Report.

Tax Rate in China

In accordance with Chinese tax legislation, every company operating a subsidiary in the country is obligated to fulfill monthly tax filings and other related requirements. Compliance with local standards for tax legislation is imperative to maintaining control and minimizing risk for your business in China. This article will go over the primary types of applicable […]

Tax Incentives China 2022

Since the outbreak of Covid-19, the Chinese government has implemented various support measures to assist, especially small and medium-sized, enterprises weather the storm. Even though China saw a strong recovery in 2020, and an especially strong performance in 2021, companies are still experiencing difficulties due to global economic effects from Covid-19, as well as various […]

Preferential IIT Policy for Foreigners

There has been a great deal of public interest on the preferential tax policy for foreigners in China and whether it will be extended beyond December of 2021. In the past China has allowed expatriate employees to lower their tax burden by claiming a portion of their salary as tax-exempt allowances. After deliberation from the State Administration of Tax, the policy on non-taxable benefits has been approved for a further 2 years, Ending 31 December 2023.

A Complete Overview of the Tax System in China

We explore the tax system in China, giving you a brief understanding of the different tax categories that may apply to individuals and businesses, how tax laws are passed, as well as how the system works.

China’s Corporate Income Tax

China’s Corporate Income Tax (CIT) is generally applicable to all companies in China or those with business activities in China. A sound understanding of China’s Corporate Income Tax framework is essential to ensure full compliance in China. As such, this article discusses all key characteristics of China’s CIT framework, including the classification of taxpayers in China, the CIT calculation method, applicable CIT deductions and exemptions, applicable CIT in China and preferential CIT rates and withholding CIT rates.

China Cuts Pension Contributions for Employers across All of China: Implications for Businesses

China has lowered employer contributions to the country’s Pension Fund. These significant reductions to employer social security contributions may be one the country’s most underestimated tax reforms in recent times.

China’s Recent Tax Reforms and Implications for EU SMEs

China has recently implemented changes and reforms to the Individual Income Tax (IIT), the Value Added Tax (VAT) and Corporate Income Tax (CIT) in China. This webinar, addresses the main changes of these reforms and will elaborate on their impact for EU businesses operating in China.

SMEs Tax Cuts China

China’s State Council introduced tax cuts for SMEs and low-profit enterprises. Among others, Corporate Income Tax (CIT) and Value Added Tax were cut for SMEs.

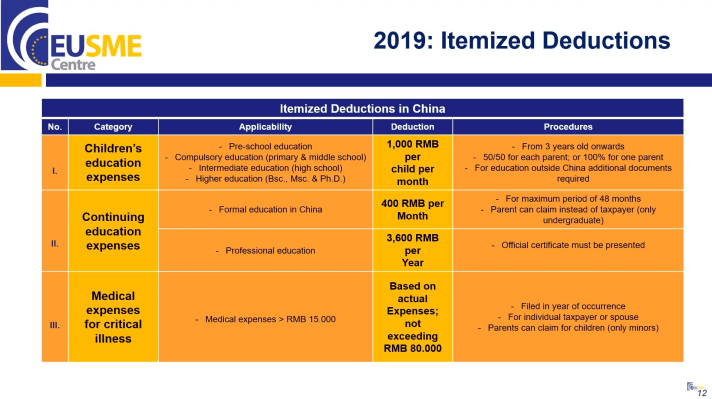

Implications of China’s Individual Income Tax Reform: IIT calculation, itemized deductions and expat allowances

China released another update to the country’s IIT Law. The new Individual Income Tax (IIT) Law outlines procedures to claim itemized deductions, introduces a new IIT withholding method and finalizes its reform to expatriate allowances.