Tax Filing Deadlines in China for 2024

The State Taxation Administration made an announcement on the 21st of December 2023, regarding the tax filing and payment deadlines for companies in 2024. In order to remain compliant, companies must ensure that the filings are made correctly and on time, especially to avoid any penalties that may arise. General information on tax filing in […]

Tax Rate in China

In accordance with Chinese tax legislation, every company operating a subsidiary in the country is obligated to fulfill monthly tax filings and other related requirements. Compliance with local standards for tax legislation is imperative to maintaining control and minimizing risk for your business in China. This article will go over the primary types of applicable […]

VAT China Frequently asked Questions

In light of the constantly changing tax and regulatory environment, and in an effort to provide a better understanding of how VAT works in China, we sat down with Harm Hoonstra, Manager at MSA China, to provide some insights on VAT in China. For a complete overview of VAT in China check out our China […]

VAT in China

China’s VAT system is widely considered to be quite a complex system. Over the past few years, it has undergone and will continue to undergo more developments, in efforts for it to be a progressive tax system. Due to the differences between Chinese and Western accounting practices, it is important for companies operating in China […]

Tax Incentives China 2022

Since the outbreak of Covid-19, the Chinese government has implemented various support measures to assist, especially small and medium-sized, enterprises weather the storm. Even though China saw a strong recovery in 2020, and an especially strong performance in 2021, companies are still experiencing difficulties due to global economic effects from Covid-19, as well as various […]

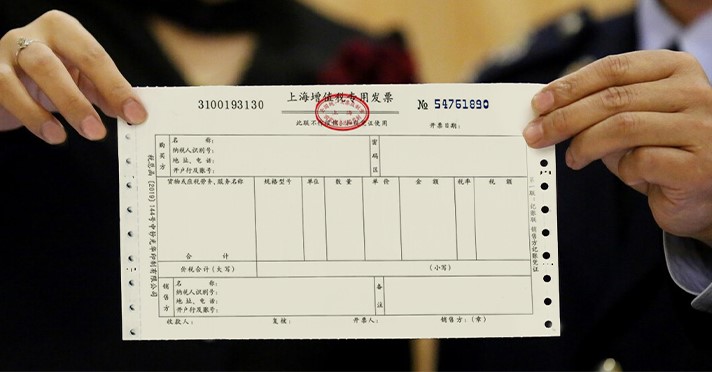

Fapiao in China

We discuss what a fapiao is, how it is different from an invoice, how to use fapiaos and where their importance comes from.

China Cuts Pension Contributions for Employers across All of China: Implications for Businesses

China has lowered employer contributions to the country’s Pension Fund. These significant reductions to employer social security contributions may be one the country’s most underestimated tax reforms in recent times.

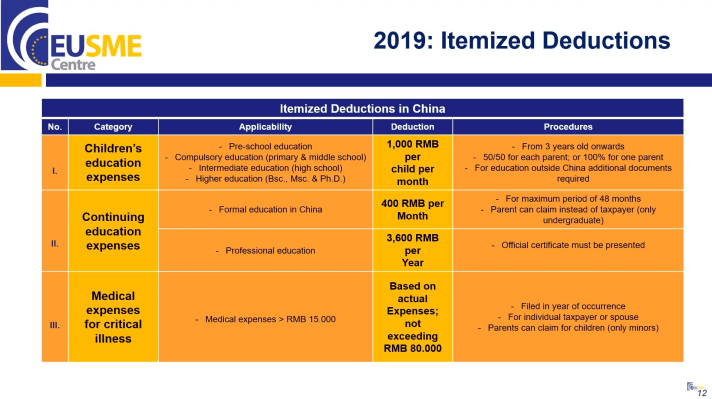

China’s Recent Tax Reforms and Implications for EU SMEs

China has recently implemented changes and reforms to the Individual Income Tax (IIT), the Value Added Tax (VAT) and Corporate Income Tax (CIT) in China. This webinar, addresses the main changes of these reforms and will elaborate on their impact for EU businesses operating in China.

China VAT reform: the 2019 Value Added Tax reforms

China’s VAT reform continued with new Value Added Tax policies, such as lowering of China’s VAT rates in 2019, increased scope of VAT credits and the introduction of a VAT refund pilot scheme from April 1st of 2019.

China announces further reductions to the Value Added Tax (VAT): from 16% to 13% and from 10% to 9%

On March 5th, 2019, China announced reductions to the Value Added Tax (VAT). The VAT rates of 16% and 10% will be decreased to VAT rates of 13% and 9%. In the announcement, no specific date on which the new VAT reductions will come into effect was provided, but it could be expected to still come into effect in 2019.