Starting from the 1st January 2019, several changes to China’s Individual Income Tax (IIT) came into effect. Our last article addressed the changes to the individual income tax withholding calculation, itemized deductions, expatriate allowances and filing of individual income tax.

On 14 March 2019, China’s Ministry of Finance (MoF) and State Administration of Taxation (SAT) jointly released two announcements with updates to the aforementioned IIT reform. These announcements provide further clarification regarding IIT exemption on foreign-sourced income and the Tax Residence rule as well as further guidance for calculating the individual income tax for individuals not domiciled in China.

The primary aim of the individual income tax announcement in March is to clarify any issues regarding the tax treatment of non-China residents and non-China domiciled individuals. In this article we will elaborate on the following:

1. Clarification of the Tax Residence Rule – “Six-Year Rule”;

2. Determining PRC-sourced income for individuals not domiciled in China;

3. China’s IIT calculation method for China tax resident vs non-resident;

4. Policy update for the IIT calculation for bonuses;

5. Administrative obligations related to IIT in China;

Clarification of the Tax Residence Rule – ” Six-year Rule”

In line with our previous article, people who are not domiciled in China will be classified as a resident taxpayer if they stay in China for over 183 days per year. This would mean that individuals who have not stayed in China for over 183 days in per year, for a period of six consecutive years, may be exempted from paying IIT over their foreign-sourced income paid out in a foreign country.

Once a non-domiciled individual leaves China for a period greater than 30 consecutive days, the count for the six-year period will reset. To be eligible for this IIT exemption, foreign residents are required to file the information about the periods of time at which the individual has left China at the tax authorities.

The announcement also specifies that if an individual is present in China for 24 hours, this will be counted as a day of residence in China. Consequently, any time an individual is present in China for less than 24 hours, this will not be counted as a day of residence.

Determining PRC-Sourced Income for Individuals Not Domiciled in China

The second announcement from the Ministry of Finance and State Administration of Taxation determines how employment income sourced from the People’s Republic of China (PRC) by individuals who are not domiciled in China and who are at the same time employed by either domestic or overseas entities, will be taxed according to Chinese IIT law.

The announcement clarifies that an individual’s workdays in the People’s Republic of China will be the basis for the calculation of income subject to Chinese IIT. Workdays are defined as days which are physically spent in China for business, as well as public holidays, and days of personal leave and training related to an individual’s employment in China (including leave and training outside of China).

Furthermore, the position which a non-China domiciled individual holds also determines how PRC-sourced income is calculated.

If the individual is a senior executive who has physically stayed in China less than 90 days, the calculation will be as follows:

- Monthly taxable income = income paid in China or borne by China.

If the individual is a senior executive who has physically stayed in China for over 90 days, but less than 6 consecutive years; or a non-senior executive who have physically stayed in China for over 183 days, but less than 6 consecutive years; the calculation will be the following:

- Monthly taxable income = total income paid in China and abroad * (1 – (income paid abroad / total income paid) * (workdays spent outside of China in current month / total days in current month)).

If the individual is a non-senior executive who has physically stayed in China less than 90 days, the calculation will be as follows:

- Monthly taxable income = total income paid in China and abroad * (1 – (income paid in China / total income paid) * (workdays spent inside China in current month / total days in current month)).

Finally, if the individual is a non-senior executive who has physically stayed in China for over 90 days, but less than 183 days, the calculation will be the following:

- Monthly taxable income = total income paid in China and abroad * (workdays spent inside China in current month / total days in current month).

China’S IIT Calculation Method for Tax Resident vs Non-resident

Based on the tax residence rule described above, an individual can determine whether they are a tax resident of China or a non-tax resident. In line with previous announcements, individual income tax for tax residents will be withheld based on the cumulative withholding method, which we describe below:

1. Withholding tax current period = cumulative tax payable – cumulative tax withheld in the previous period;

2. Cumulative tax payable = (cumulative taxable income * tax rate) – quick deduction;

3. Cumulative taxable income = cumulative income – cumulative applicable deductions.

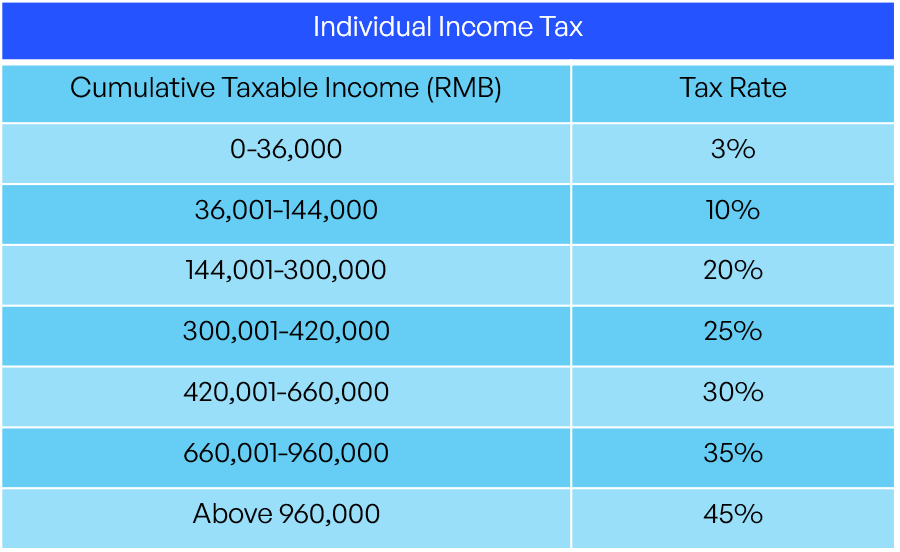

The table below provides an overview of tax rates applicable to income earned by China tax residents:

On the other hand, individuals who are not a tax resident of China must pay IIT monthly according to the following calculation:

- Monthly tax payable = monthly taxable income – applicable deductions.

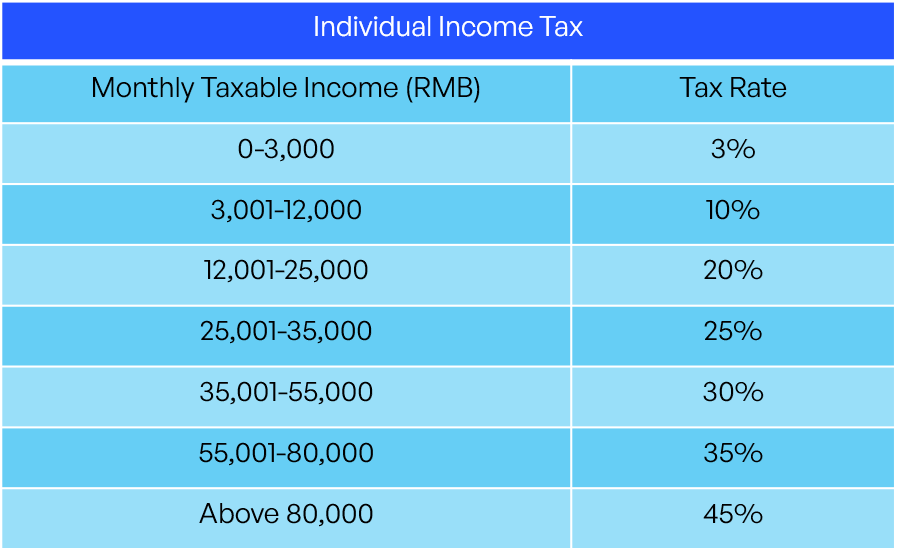

The table below provides an overview of tax rates applicable to income earned by non-residents:

Policy Update for the IIT Calculation for Bonuses

For individuals who are not a resident of China, first one would have to calculate the income from bonuses sourced from China. This calculation is like the calculation of regular income sourced from China, namely:

- China-sourced bonus income = bonus income * (workdays spent in China in sourcing period / total days in sourcing period).

After one has determined the amount of income derived from bonuses in China, the individual can the amount of due taxes according to the following method:

- Tax payable for bonus = ((China-sourced bonus income / 6) * tax rate – minus quick deduction) * 6.

The announcement further specified that the amount of tax payable over a bonus shall be calculated separately from other comprehensive income in the same month.

Administrative Obligations Related to IIT in China

When an individual who is not domiciled in China files taxes in China for the first time, they must estimate the amount of days physically present in China during that tax year. Based on this information, the individual will either be classified as a tax resident or non-resident.

If the estimate differs from the actual amount of days physically present in China, the individual may be required to make an adjustment to their filing.

If the individual, based on the tax residence rule, is in fact a tax resident, he or she must perform an annual reconciliation filing. In the circumstance that the individual is in fact a non-resident, the individual is required to inform the tax bureau within 15 days after the end of the tax year – consequently overdue taxes must be paid or a refund must be applied for.

Conclusion

The recent updates to China’s Individual Income Tax law will mostly impact individuals who are not a tax resident of China or non-China domiciled.

The above updates to the IIT law have become retroactively effective from 1 January 2019. Although some challenges will remain for non-China domiciled individuals and non-residents to determine which portion of income is taxable in China, we can observe that the general trend of the tax authorities is to become stricter in enforcing the Chinese IIT law.

Therefore, we will still have to await the full implementation of these new IIT regulations.

If you have any questions about Individual Income Tax in China, please do not hesitate to contact us at [email protected].