China’s VAT system is widely considered to be quite a complex system. Over the past few years, it has undergone and will continue to undergo more developments, in efforts for it to be a progressive tax system. Due to the differences between Chinese and Western accounting practices, it is important for companies operating in China to better understand how the Chinese tax system works in detail, to ensure they properly comply with Chinese tax regulations. In this article we take a look at the VAT framework in China, how it is calculated, how VAT is filed and other important aspects of VAT in China.

Background of China VAT

China’s Value Added Tax (VAT) regulations have seen several reforms since the opening up of the economy. In 1993 the government issued the Interim Regulations of the People’s Republic of China on Value-Added Tax (GuoWuYuan Ling No. 134), which still form the main basis for the regulations today. New Interim Regulations were passed on 5 November 2008 and implemented on 1 January 2009. At the end of 2018 and start of 2019 the government made further changes to the VAT regulations, lowering the applicable VAT rates for certain goods and services, increasing the VAT exemption threshold for small-scale taxpayer, increasing the scope of VAT credits and implementing pilot schemes for VAT refunds.

To this date, the applicable VAT framework is governed by interim regulations. The current regulations have not been formally entered into law, but it is expected that the authorities will formalize a VAT law in the foreseeable future.

VAT Taxpayer Categories

In China there are 2 categories of VAT taxpayers, based on their annual sales; general taxpayers and small-scale taxpayers. The threshold of general VAT taxpayers is now unified at RMB 5 million in annual sales (previously it varied across industries between RMB 500,000 and RMB 5 million).This means all companies with annual sales exceeding RMB 5 million will be a general taxpayer, companies below the threshold will be small-scale taxpayers. However, companies with an annual sales level below the threshold, can apply for general taxpayer status.

The difference between general VAT and small-scale taxpayers

The key difference between general and small-scale taxpayers is that for small-scale taxpayers VAT is payable with 3% instead of the category specific VAT rate, and they are not able to deduct input VAT from output VAT. In the past, small-scale taxpayers were not able to issue any special fapiaos. Nowadays it is possible to either issue special fapiaos at the tax bureau or apply with the tax bureau to be able to issue special fapiaos by the company itself. However, in such a case the VAT rate will remain at 3%.

Small-scale taxpayers with monthly sales of below RMB 150,000 (or quarterly sales of below RMB 450,000, will be exempt from paying VAT. Previously the threshold was RMB 100,000 per month, but was raised in the 2021 Government Work Report.

After the emergence of Covid-19, the government implemented a temporary preferential policy where the VAT rate for small-scale taxpayers was decreased to 1%. This policy was implemented in February 2020 and subsequently extended several times until the end of 2021, and effectively in place until end of March 2022. After the 2022 Government Work Report, it was announced that small-scale taxpayers will be exempt from VAT on their taxable sales income until 31 December 2022. Important to note here is that the exemption on VAT only applies to the issuing of normal fapiaos. If a small-scale VAT payer issues a special VAT fapiao, the tax rate will be the standard rate of 3%.

General VAT Fapiao versus Special VAT Fapiao

In China there are two types of fapiaos, the General VAT fapiao and the Special VAT fapiao. The main difference is that the Special VAT fapiao gives right to input value added tax deduction, whereas the General VAT fapiao cannot. Because small-scale taxpayers are not legally able to deduct input VAT from output VAT, they can only use the General VAT fapiao. Moreover, it should be noted that General VAT taxpayers selling specific consumer goods such as cigarettes, alcohol, food, clothing, shoes and hats, cosmetics, etc. are also not allowed to issue Special VAT fapiaos.

To learn more about how fapiaos work in our article explaining the Chinese invoicing system.

What is the VAT rate in China?

As highlighted above, for small-scale taxpayers the applicable VAT rate will generally be 3%, although currently small-scale taxpayers can issue normal fapiaos with 0% VAT.

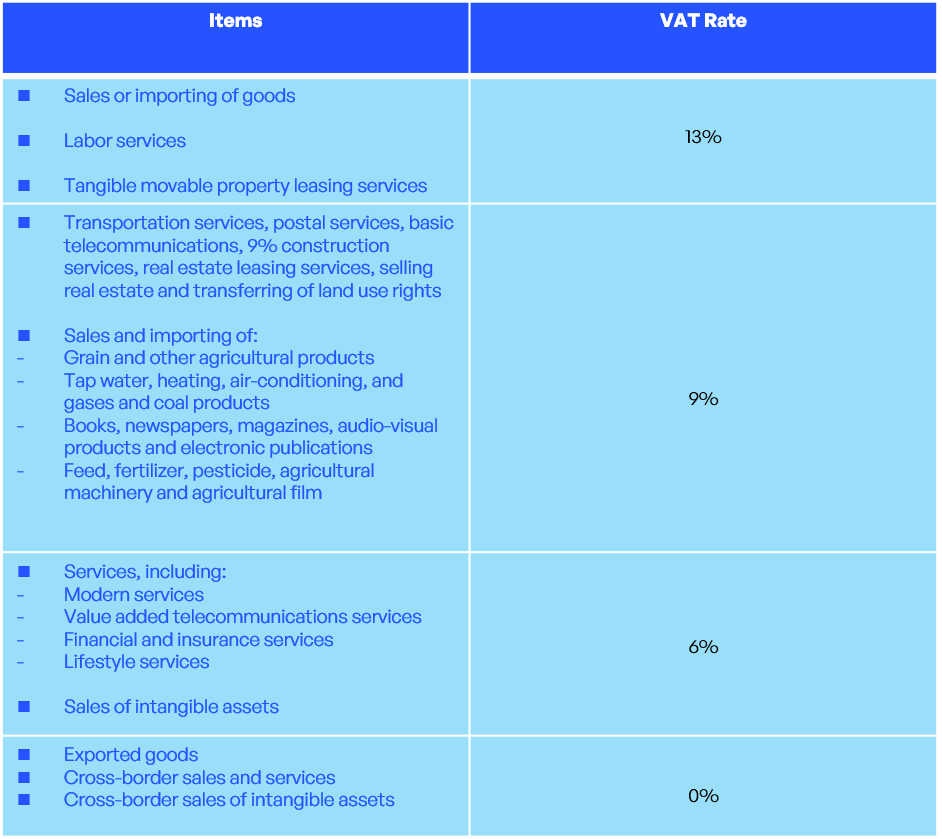

Since the changes made in 2019, the applicable standard rate of VAT is set at 13% for all VAT taxpayers. For general taxpayers the rate may vary, as such the following VAT rates apply:

How is VAT Calculated in China?

The calculation for VAT payable differs between general and small-scale taxpayers. Below we elaborate on how these calculations work:

General VAT taxpayer calculation method

For general taxpayers, the calculation formula is as follows:

Tax payable = current output VAT – current input VAT

The output VAT is calculated as follows:

Output VAT = sales volume x tax rate

Where the sales volume is determined as follows:

Sales volume = sales volume including taxes / (1 + Tax rate)

The input VAT can be deducted from the output VAT to arrive at the tax payable. However, not all input VAT can be deducted. In order to deduct any input VAT, the company must receive a special VAT fapiao where the tax amount is specified, and this amount must be verified in the online system of the tax bureau.

If the current output VAT is higher than the current input VAT, this will result in a payable for the company. If the current input VAT is higher than the output VAT, the amount of input VAT that is not deducted can be carried forward to the next period. Since April 2022, specific companies have the added possibility to apply for a refund in excess of input VAT amount.

Small-scale VAT taxpayer calculation method

The calculation method for small-scale taxpayer is a simplified calculation, as they are not able to deduct input VAT. Therefore, the calculation formula is as follows:

Tax payable = sales volume x tax rate (3%)

Where the sales volume is determined in the same manner as in the general taxpayer calculation method above.

How to file VAT in China?

Companies in China will have to file VAT on monthly or quarterly basis. General taxpayers are required to submit their VAT filings on a monthly basis, whereas small-scale taxpayer can submit their VAT filings on a quarterly basis.

The monthly or quarterly tax filing deadline is the 15th day of the subsequent month (i.e., the tax filing deadline for the month of February is March 15th and the deadline for the first quarter is April 15th). If the 15th falls on a weekend, the deadline will be moved to the next Monday. Furthermore, due to public holidays, the monthly/quarterly tax deadline may be altered pending a notification from the tax authorities.

Is VAT in China Refundable?

In China there are two mechanism for VAT refunds. The first and most common VAT refund scheme is for exported goods, while the second mechanism is for excess input VAT. Below we discuss both these mechanisms in greater detail.

China Export VAT Refunds

In order to promote the export of goods, in China there is no VAT applicable to exported goods. However, when a company sources products in China, it will have to pay VAT. Normally, the input VAT could be deducted from the output VAT, but for exported goods there is no output VAT. Therefore, the government has set up a system for the refund of export related VAT refunds. Companies can claim back the input VAT paid for export sales through the monthly export VAT refund claim.

In China there are 2 types of VAT refunds for exports:

1. VAT refunds for manufacturing companies

When manufacturing companies purchase material from suppliers, they will receive an input VAT fapiao. After processing the materials, the company will sell final products either domestically or export to overseas markets. When selling in the domestic market, the company will have to pay output VAT. However, for exporting there is no output VAT.

The VAT refund is calculated as: input VAT – output VAT. Thus, if output VAT is bigger than input VAT, the company will not receive any VAT refund. However, for exported goods no output VAT applies, so the VAT refund will consist of the input VAT.

However, for manufacturing companies that sell both domestically and internationally, the Chinese Tax Bureau cannot separate which materials are used for domestic sales and which are meant for exporting. So, in that case, it is unclear how much input VAT can be attributed to domestic or export sales. Therefore, the Tax Bureau uses a simple calculation to determine the VAT refund. The VAT refund is equal to input VAT – output VAT. If output VAT is bigger than input VAT, the company will not receive any VAT refund.

2. VAT refunds for trading companies

For trading companies, the VAT refund will be equal to input VAT paid for goods that are subsequently exported, as there is no output VAT on exports. Normally the VAT refund is calculated by subtracting output VAT from input VAT. Since for export sales there is no output VAT, input VAT could in theory not be deducted.

Therefore, Chinese tax policy has created a VAT refund system based on the so-called “refund rate”. The authorities set refund rates for product categories. Depending on the refund rate of the products that are exported, a difference can exist between the input VAT and the VAT refund. In case the refund rate is lower than input VAT, the difference will be a cost to the company.

At MSA we can support your company with the export VAT refund claims. We help numerous clients on a recurring basis to successfully obtain such refunds.

China Domestic VAT Refunds

If a company’s input VAT is higher than the output VAT, the excess amount of input VAT can be carried forward to the next period. In the past, it was only possible to carry these amounts forward until it could be used to deduct the amount from output VAT. However, since 1 April 2019, certain qualified taxpayers could apply for a refund of excess input VAT, instead of carrying the full amount forward to the next accounting period. However, taxpayers were only allowed to refund 60% of the available uncredited input VAT. Additionally, there was also a requirement that the incremental uncredited input VAT had to remain positive for 6 consecutive months or 2 consecutive quarters, and the total amount should be no less than 500,000 RMB.

In April 2022 the government announced a further expansion on this policy. According to the new policy, the scope of companies that can apply for VAT refunds has been expanded to include micro and small firms in all industries and qualified firms in the following industries; manufacturing, scientific research and technical services, electricity, heat, gas and water production and supply, software and information technology services, ecological protection and environmental governance and transportation, warehousing and the postal industry.

Following the implementation of this policy, all qualified companies as highlighted above can apply for (incremental) VAT refunds on a monthly basis starting 1 April 2022. Additionally, all companies that have built up outstanding VAT refund credits, will be able to apply for a one-time refund of the outstanding amount. The requirements described above for an input tax refund are no longer valid with this regulation and can be refunded in full, regardless of the amount carried forward so far.

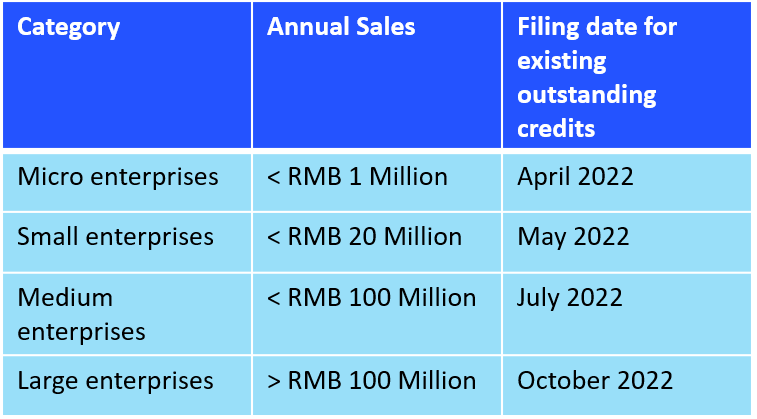

The government will give priority to micro and small enterprises, followed by medium-size and large enterprises according to the following schedule:

What is China’s Business Tax?

Business tax is no longer applicable in China due to a major reform of the VAT system. Most of the areas where business tax was relevant and applied are now found under the VAT regulations.

Business tax was applicable to businesses that provided services, as well as the transfer of intangible properties and the sale and transfer of real estate in China. (Although it applied to the provision of services, it did not apply to processing services and repair and replacement services). Business tax rates previously ranged from 3% to 20%.

Future Outlook on China VAT

At the end of 2019 the State Tax Administration (STA) and the Ministry of Finance (MOFCOM) released a new draft law for the VAT law. This implementation will put the VAT rules into the legislation and harmonizes rules for goods and services. Moreover, the draft law for VAT is a step towards implementing the OECD VAT/GST guidelines. An important aspect of this, is it determines that VAT only applies when the consumption actually takes place in China and allows for refunds of excess input VAT credits.

However, despite the law having been drafted and closed for comment, to date the new VAT regulations have not been brought into law yet. A main reason for this delay is the outbreak of COVID-19. Currently there is no information available as to when the laws will be implemented.

Conclusion

While the VAT system remains comparatively complexed, proper management of your company’s VAT is essential to ensure it remains compliant with local regulations. The enactment of the substantive changes into law, may see further or additional developments of the VAT framework in China. Businesses need to be aware of all changes and stay up to date with other tax changes that may have an impact on their operations or financial activities in China.

MSA in China

At MSA, we deliver on exceptional accounting, financial advisory and business set up services, ensuring that our clients are always best positioned for success in China. Our mission is to uphold transparency, compliance and sustainability and the highest standards of service. Contact us today so that we are able to connect you with one of our consultants and propel your business towards growth.