The draft amendments to the PRC Individual Income Tax (IIT) Law, which had been published in June this year, has been passed by the National People’s Congress on August 31, 2018. The amendments to the IIT Law will officially come into effect on January 1st, 2019, while a pilot program with several amendments will take effect from 1st October 2018.

The passed amendment attempts to ease the tax burden for low-income earners and take a tougher stance towards the high-income earners, including expatriates. The amendments can have a significant impact on both companies and foreign nationals working in China.

What are the Amendments?

The amendments introduce a number of potential important changes, of which the main changes to the IIT law can be divided into the following:

1. Standard Deduction and Deductible Expenses;

2. Adjustment of income tax brackets;

3. Simplifying taxable income categories;

4 .Updating the tax residence rule;

5. Adding clauses for anti-tax avoidance.

The first two changes will already come into effect starting from October 1st, 2018, whereas the other amendments will take effect on January 1st, 2019.

1. Standard Deduction & Deductible Expenses

The standard deductions Comprehensive Income will go up to RMB 5.000 per month. This will both be for local (previously RMB 3.500) and foreign employees (previously RMB 4.800) in China.

The new law also introduces a number of deductible expenses for children’s education, housing mortgage interest, elder care, and rental for employees in China. Currently only expatriates may use their housing rent as deductible expense in China.

The amendments might have a result that foreign expatriates may not have access to other deductible expenses, such as relocation, home flight, and laundry expenses. We are still awaiting interpretation from central and local tax authority what would be the exact impact on expatriates in China.

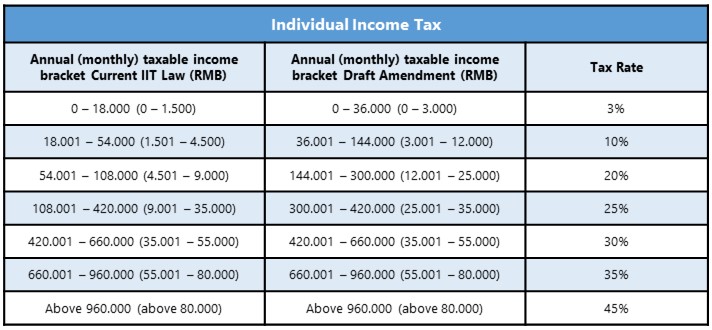

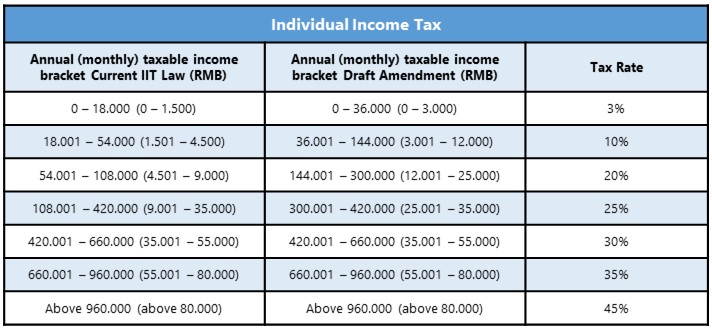

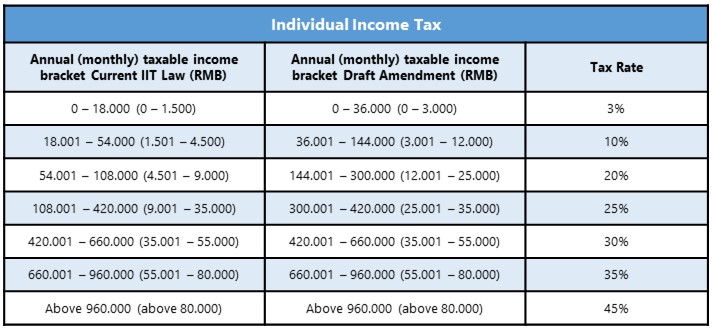

2. Adjusting Income Tax Brackets

The tax brackets with the rates of 3%, 10%, and 20% are widened, while narrowing the 25% tax bracket and maintaining the higher tax brackets. Also,

3. Simplifying Taxable Income Categories

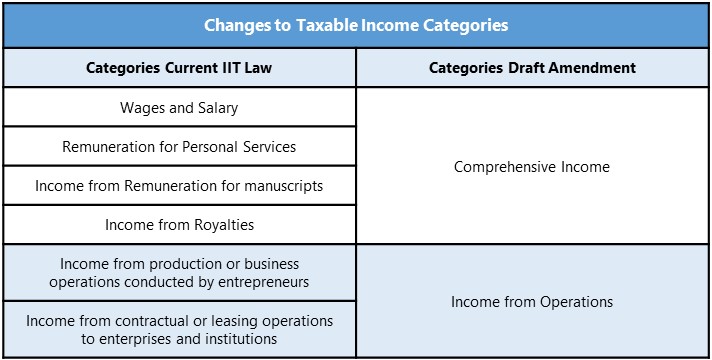

This amendment seeks to consolidate four categories of labor income, (i) namely wage and salary, (ii) remuneration for personal services, (iii) income from remuneration for manuscripts, (iv) and income from royalties into one category called “comprehensive income”. For this category one set of progressive tax rates will apply instead of taxing the old categories with different tax rates.

At the same time, “income from the production or business operations conducted by entrepreneurs” and the “income from contractual or leasing operations to enterprises and institutions” will be reclassified as “income from operations”.

Income from interest, dividend and bonuses, income from the transfer of assets, income from leasing of property, incidental income, and other income will still be taxed separately at a rate unchanged from the current IIT Law.

4. Updating the Tax Residence Rule

After January 1st, 2019, individuals would be classified as a resident if they have stayed in China for 183 days or more. This would change the existing rules for residence (1 year) and puts this closer to the requirements as in many other countries.

This could effectively mean that the five-year rule would not be applicable anymore to foreign residents in China.

We are still awaiting further interpretation of Chinese authorities on this matter, and whether certain cities (i.e. Shanghai when the social security law came in place requiring all employees of Chinese companies to pay social insurances in China, Shanghai have chosen not to follow these regulations) will use a different interpretation.

5. Adding Clauses for Anti-Tax Avoidance

Finally, the amendments signal the intent to introduce more anti-avoidance rules aiming to empower tax authorities with their assessment of tax on individuals. These changes especially target transactions which do not involve the arm’s length principle of asset transfers and transactions where inappropriate tax benefits might be obtained.

Conclusion

The new IIT Law can have far reaching impact on employees and their employers in China. It is therefore crucial to keep an eye on the developments and interpretations of the new IIT law. It will be important that individuals and employers review their existing situation and assess what would be the impact of the IIT amendments on their personal situation.

MSA has vast experience with the ever-developing landscape within China. If you have any questions about this or other subjects, please do not hesitate to contact us at [email protected]