The quarterly economic data for the first quarter of 2022 was released by the Chinese government on 18 April 2022. Analysts predicted a growth of 4.4% for the first quarter, and GDP growth measured at a rate of 4.8%. Modest but stable growth rates come at a time of immensely challenging public health crises regarding recent COVID-19 outbreaks as well as an increasingly insecure international environment.

Generally Stable GDP Growth in the First Quarter

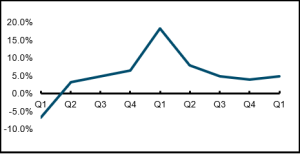

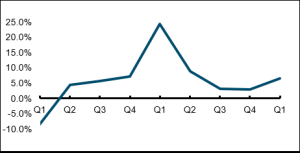

Graph 1. Quarterly GDP 2020-2022

Gross Domestic Product (GDP) experienced a positive growth trend of 4.8% from the previous year, reaching an annual estimate of RMB 27 trillion. In terms of value add for individual sectors, the nation’s primary industries saw a 6% rise of GDP, reaching RMB 1 trillion. Secondary and tertiary industries similarly experienced consistent growth of up to 5.8% and 4.0% respectively.

Imports and Exports Experiences Considerable Growth

Overall value of imports and exports in the first quarter of 2022 remained strong, with an increase of over 10.7%, relative to the previous year. The value of total exports was up by 13.4% while total imports was up by 7.5%. General trade, making up the highest proportion of overall value of imports and exports had seen an increase of 1.8% when compared to the same period of the previous year.

Moderate Increase in Unemployment

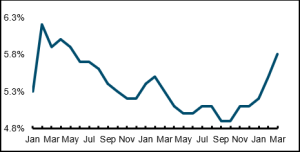

Graph 2. Unemployment rate 2021 – 2022

During the first quarter, over 2.85 million individuals were newly employed in urban areas. The unemployment rate amongst surveyed individuals averaged at 5.5%. Based on survey results in March, unemployment rate was 5.8%, a 0.3% increase from February.

Purchasing Managers Index Show Slight Disruption in Manufacturing With Other Industries Performing Strongly

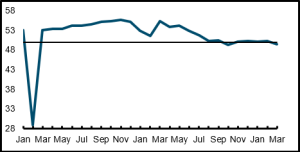

Graph 3. PMI 2020-2022

Purchasing Manager Index (PMI) is used to weigh the performance of large enterprises based on five key criteria: production, new orders, supplier deliveries, inventory levels and production. While equally weighing each factor, a figure of 50 is designated to suggest no change, whereas a figure higher or lower than 50 indicates a relative increase and decrease of performance respectively. The PMI is separated into two indices, namely the index for manufacturing output and index for expectations of production or business activities (non-manufacturing).

As of March, the Manufacturing Purchasing Manager’s Index stood at 49.5 percent, suggesting a marginal decline in overall performance whereas the Index for Production and Business Activity Expectations stood at 55.7 during the same period, indicating a steady rise in overall performance for non-manufacturing industries.

Active Retail Sales Levels with Marginal Decline

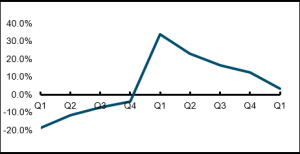

Graph 4. Retail sales 2020-2021

The total value of retail sales for consumer goods experienced a year-on-year growth of 3.3% for the first quarter. However, in March, total retail sales of consumer goods was down by 3.5% year on year and 1.93% month to month. Overall retail sales of physical goods, which amounted to over 23.2% of total retail sales of consumer goods was up by 8.8%.

Industrial Production Growth Remains Consistent in Major Sectors

Graph 5. Industrial Production 2020-2022

Total growth over the first quarter of 2022 for industrial enterprises above the designated size is 6.5% year on year. The industrial growth rate represents the overall economic gains for certain sectors of industrial enterprises with annual revenue amounting to over 20 million yuan in their core business. As per each sector, the high-tech and equipment manufacturing sectors saw a growth rate of 14.2% and 8.1% respectively. Total value from mining grew by 10.7% and manufacturing increased by 6.2%. Innovative products including new-energy automobiles, industrial robots and solar cells all experienced consistent year on year growth of 140.8%, 10.2% and 24.3% respectively.

MSA in China

As a business advisory that helps foreign companies overcome their challenges in China, our experts can help you navigate the employment laws in China. We have a comprehensive understanding of the business, legal and employment landscape in China and can provide you with the right advice to keep you fully compliant. For all your accounting, HR and company setup needs, get in touch with us today so we can assist you.