With China holding an increasingly significant position in the global economy, it is important for all companies conducting business in China to understand the Chinese tax system, the regulations that govern it and how it works.

Our team of tax experts have put together a specialized tax report for businesses operating in China, this report aims to provide you with comprehensive insights into the tax landscape, empowering you to make well-informed business decisions and gain a strategic advantage when structuring your Chinese operations.

Get in touch with us today, if you want to optimize your tax strategy for the Chinese market.

Taxes in China Overview

Our comprehensive guide covers the following topics:

- Taxes in China overview

- Tax rates in China

- VAT in China

- Individual Income Tax (IIT)

- Tax Incentives for Businesses in China

Individual Income Tax System

Individual Income Tax rates follow a progressive system based on an employee’s salary. Employers are responsible for withholding and paying taxes monthly on behalf of employees, with rates ranging from 3% to 45% for higher incomes.

All individuals, currently residing in China or earning income from the country must adhere to national tax regulations.

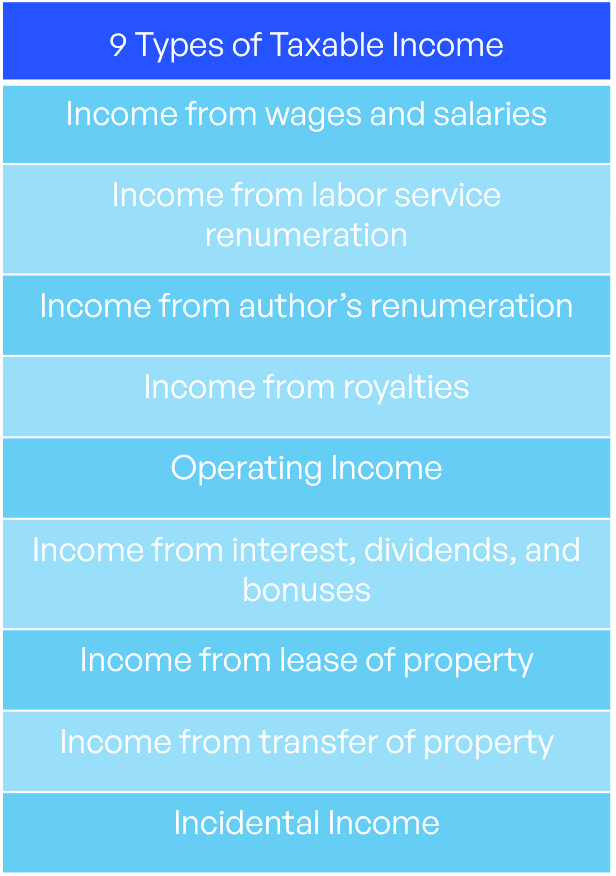

The 9 Types of Taxable Income:

Our Guide also outlines the relevant preferential income tax policy for foreign employees, IIT settlement and taxes on annual bonuses.

Corporate Income Tax

Companies in China are required to pay Corporate Income Tax (CIT) on their worldwide income, which is calculated by deducting expenses and exemptions from revenue. CIT can be settled either on a quarterly or annual schedule, with rates being derived from net profits.

Our guide discusses the applicable CIT rates, the formula to calculate CIT payable for corporate taxpayers, available CIT benefits and any relevant exemptions/reductions.

Corporate Taxpayers in China

VAT in China

China’s VAT system is widely considered to be quite a complex system. Over the...

Read moreWithholding Tax

Withholding tax is obligatory for all foreign enterprises operating in China, irrespective of whether they have an entity in the country. It is a tax that encompasses dividends, rents, interest, and royalties earned from China. While income tax applies to Wholly Foreign Owned Entities and Chinese-foreign joint ventures, withholding tax is applicable to income derived in China by non-resident enterprises.

Our guide provides extensive detail on different applicable rates for withholding tax in various applicable cases.

VAT in China

China’s value-added tax (VAT) system is widely acknowledged as a complex system, with ongoing developments aimed at establishing a more progressive tax framework.

A comprehensive understanding of the complexities of the Chinese VAT system is essential for businesses operating in China, given the differences between Chinese and Western accounting methodologies and the need to ensure full compliance with local regulations.

China Profit Repatriation

Our service offers strategic planning for profit repatriation from China, navigating the complexities of...

Read moreOur guide explores:

- VAT taxpayer categories

- VAT rates and calculation methods

- VAT Filing process

- VAT refunds

- Surcharge taxes

Tax Incentives for Businesses in China

A number of tax incentives are offered for businesses by the Chinese government for the support of small companies and to encourage the development of specific industries.

We highlight the specific incentives available for companies in China including:

- Individual income tax incentives for qualified talents

- Corporate income tax reductions, exemptions or deductions

- Temporary preferential policies for VAT

Download our China Tax Guide today

Our team of experts aims to provide you with a comprehensive understanding of the fundamental principles, regulations, and processes that your business needs in order to stay compliant with China’s continuously evolving tax landscape.

Through effective management of your tax responsibilities and gaining a strong grasp of tax in China, you will be able to effortlessly navigate the complexities of China’s tax system and operate with confidence.