As part of the efforts of the Chinese authorities to improve the legal framework in China, many regulatory aspects have seen changes over the past years. One of these is the framework governing China’s Individual Income Tax (IIT).

Due to the specific method to calculate IIT in China, it can be quite complicated for foreigners to understand how the Individual Income Tax system in China works.

Taxable Income in China

The legal framework governing Individual Income Tax (as noted by China’s tax system) recognizes that income is derived from a number of different sources and levies different tax rates for different sources. According to the China’s Individual Income Tax law, there are 9 types of income:

- Income from wages and salaries

- Income from labor service remuneration

- Income from author’s remuneration

- Income from royalties

- Operating income

- Income from interest, dividends and bonuses

- Income from lease of property

- Income from the transfer of property

- Incidental income

The first 4 categories of income together are referred to as ‘Comprehensive Income’. The fifth category, operating income, refers to income from production or business operations conducted by entrepreneurs or income from contractual or leasing operations to enterprises and institutions.

Deductions Practices to Lower the Income Tax in China

To lower the tax burden, there are several deductions to decrease the amount of taxable income in China. Firstly, there is the monthly tax-free amount for salary which amounts to RMB 5,000 per month for both foreign and Chinese nationals and to both domiciled and non-domiciled individuals.

Contributions made to social security and the housing fund scheme lower the taxable income as well. As explained in our article on China’s Social Security System and Housing Fund Scheme, both employees and employers contribute to social security and the housing fund. Here the costs for the employer are higher than the gross salary since the employer contributions are calculated on top of the gross salary. Since two of the social security insurances are only paid by the employer, employees only make contributions to the basic pension insurance, basic medical insurance, unemployment insurance and the housing provident fund, and these contributions are deducted from the gross salary.

Currently, most Foreigners in Shanghai are not required to make contributions to social security or housing fund. In the past, on the level of payroll calculation, residents from Hong Kong, Macao and Taiwan were treated the same as foreigners with respect to social security. However, starting from 1st January 2020, residents from Hong Kong, Macao and Taiwan must make contributions to social security. Nevertheless, they can still opt out of housing fund contributions in Shanghai.

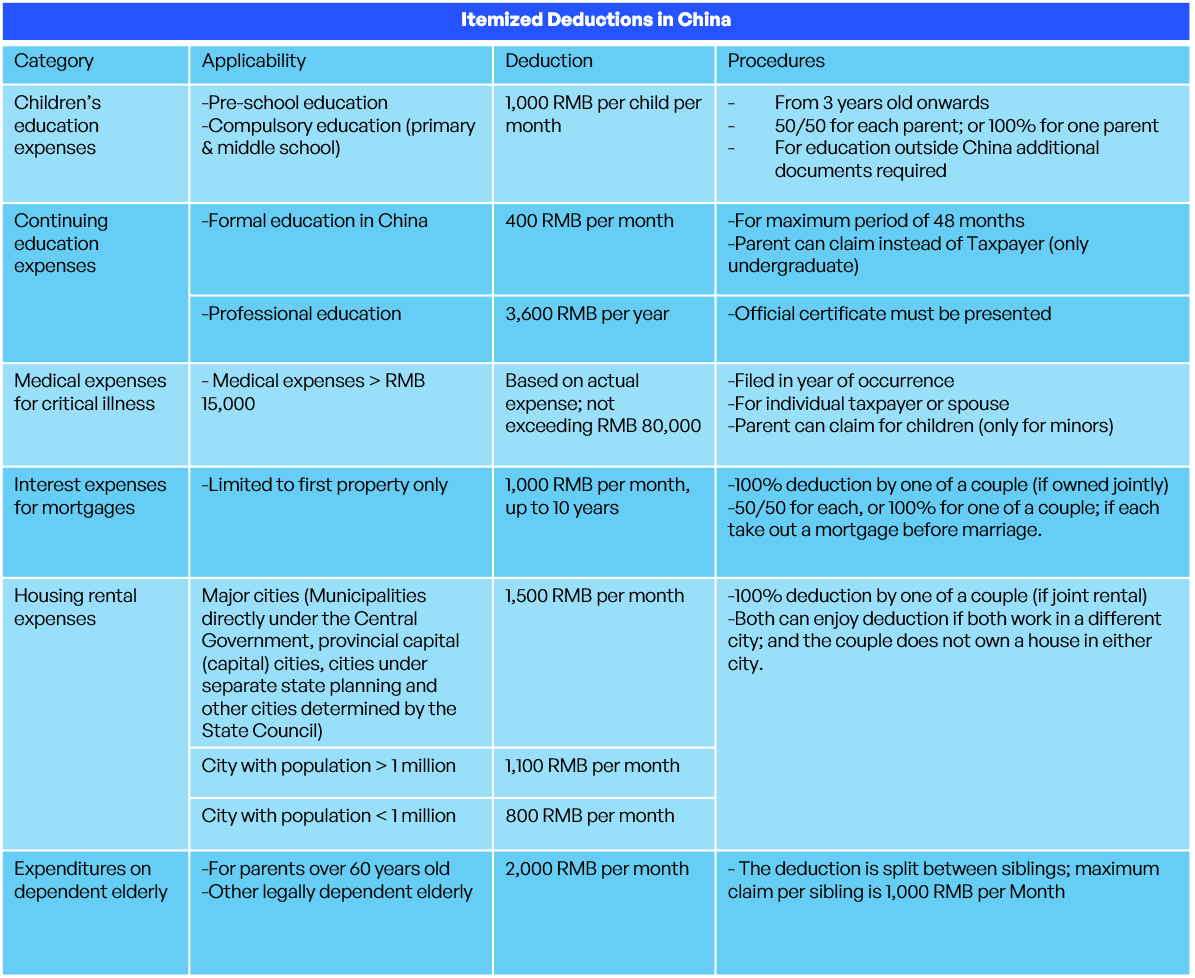

Moreover, to further lower the tax burden, individuals can use special additional deductions (or so-called “itemized deductions”). In the table below we elaborate on the different types of itemized China income tax deductions:

Under the PRC Individual Income Tax Law, the individual taxpayer can either choose to declare deductions by himself when making the annual reconciliation filing (as due to privacy concerns) or may ask their employer to make preliminary deductions on a monthly basis.

If the individual employee chooses to claim the income tax deductions via their employer, they are required to confirm any changes to their itemized deductions the latest by December of the fiscal year. The IIT Law also states that individual taxpayers bear the responsibility to ensure the authenticity, accuracy and completeness of the information provided when claiming itemized deductions.

Currently, in an effort to attract foreign talent, the government offers special additional allowances for expatriates (as well as to residents from Hong Kong, Macao and Taiwan). Foreign employees may claim up to 30-35% (depending on location) of their salary in allowances. To claim these allowances, foreigners must obtain fapiaos to prove the authenticity of the expenses. It is up to the discretion of the relevant tax bureau to judge whether expenses are reasonable. Non-taxable allowances are divided into the following categories:

- Housing rent

- Children’s education expenses

- Language training

- Home flight

- Meal and laundry expenses

- Relocation expenses

Currently, according to the information available to us, starting from 2022, expatriates can no longer claim all of the tax-exempt allowances and instead will be subject to the same law as Chinese taxpayers. This entails that after 2021, expatriates will need to adhere to the itemized deductions model of non-taxable allowances.

It shall be noted that currently, foreign employees may already choose to adhere to the taxation model using the itemized deductions. They can apply and will need to visit their local tax office to make the registration. It is important to note that if foreign employees choose to use the itemized deductions, they would not be able within the same fiscal year to use any of tax-exempt expatriate allowances. Since the existing benefits for expatriates are more beneficial to the individual taxpayer under general circumstances, it might not be interesting to claim the itemized deductions until the respective change of law comes into effect.

China Income Tax Rates

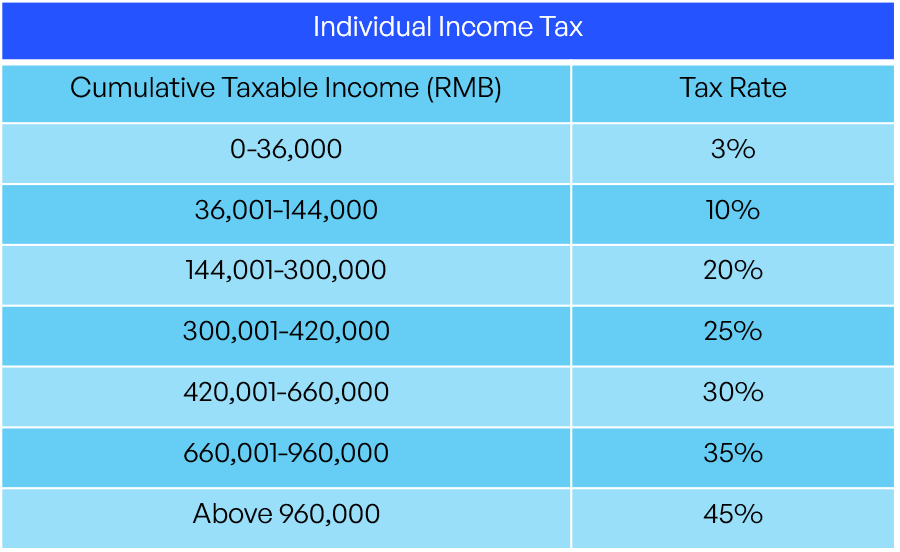

Depending on the source of income, China levies different tax rates. Comprehensive income is taxed based on a progressive tax rate system from 3% to 45%. Operating income will also be taxed according to a progressive tax rate, from 5% to 35%. Lastly, income from interest, dividend and bonuses, income from the transfer of assets, income from leasing of property, and incidental income is taxed separately at a fixed rate of 20%. In general, for most individuals, the most important source of income is comprehensive income. As such, in the table below we highlight the tax rates that are applied to comprehensive income per tax bracket:

IIIT Calculation Method: How to Calculate Individual Income Tax in China

China’s Individual Income Tax system differs from most countries in that it withholds tax based on the cumulative withholding method. This effectively means that as the year progresses and the individual’s cumulative income increases, so will the tax rate increase. The tax payable is then calculated as per the example below :

1. Withholding tax current period = cumulative tax payable – cumulative tax withheld in the previous period;

2. Cumulative tax payable = (cumulative taxable income * tax rate) – quick deduction;

3. Cumulative taxable income = cumulative income – cumulative applicable deductions.

For example, a foreigner in Shanghai earning RMB 25.000 per month and not using any special additional deductions, they would pay the following amount of tax in January:

Taxable income = 25.000 – 5.000 = 20.000 RMB

Tax payable = 20.000 x 0.03 = 600 RMB

Tax Residency

Whether an individual is required to pay Individual Income Tax in China depends on whether he/she is classified as a tax resident. People who are not domiciled in China will be classified as a resident taxpayer if they stay in China for over 183 days per calendar year. This would mean that individuals who have not stayed in China for over 183 days in per year, for a period of six consecutive years, may be exempted from paying IIT over their foreign-sourced income paid in a foreign country.

When a non-domiciled individual leaves China for a period greater than 30 consecutive days, the count for the six-year period will reset. To be eligible for this IIT exemption, foreign residents are required to file the information about the periods of time at which the individual has left China at the tax authorities.

If an individual is present in China for 24 hours, this will be counted as a day of residence in China. Consequently, any time an individual is present in China for less than 24 hours, this will not be counted as a day of residence.

Annual Tax Return

If an individual, based on the tax residence rule, is in fact a tax resident, he or she must perform an annual IIT reconciliation filing. The IIT reconciliation filing must be completed between March 1 and June 30 of the following year. The purpose of this annual Individual Income Tax filing is to perform a reconciliation of tax paid versus tax payable. In general, all tax residents should do the filing. However, there are certain exemptions on this rule. Individuals are exempt from the annual IIT filing for comprehensive income received during a year if one or more of the following applies:

- The individual’s annual comprehensive income does not exceed RMB 120,000;

- The individual’s annual tax reimbursement amount does not exceed RMB 400;

- The individual has paid a pre-tax amount that is in line with annual payable tax amount or does not apply for an annual tax refund.

To learn more about the process of this filing, read our article on the Annual Individual Income Tax Settlement.

Conclusion on Individual Income Tax in China

Obtaining a solid understanding of the IIT framework is essential to ensure that individuals do not pay more tax than legally required while taking advantage of their legal rights. Particularly the use of the special additional deductions or expatriate allowances can make a difference for the amount of tax payable. With the implementation of the annual tax reconciliation, it has further become easier to determine whether an individual has the appropriate amount of Individual Income Tax. Care must be taken of course that full compliance is achieved and that taxes are correctly calculated during the year to avoid any reconciliation in the subsequent year. To optimize the use of deductions and ensure correct tax payments throughout the year, we advise companies to work together with a specialized payroll service provider. Through our IIT & Payroll services we support foreign-invested companies with payroll calculations, monthly & annual tax declarations, expat salary cost reimbursements and individual tax & benefits planning.

If you have any questions about Individual Income Tax in China, please do not hesitate to contact us.