Understanding China’s tax system is not as straightforward as someone might think. It is, thus, essential that SMEs grasp how the system works, which taxes apply to foreign enterprises in China and which taxes apply to a foreign individual living in China.

The recent developments in China show that the Chinese government seems to be picking up speed to reform and improve the business environment for local and foreign businesses. China has recently implemented changes and reforms to the Individual Income Tax (IIT), the Value Added Tax (VAT) and the Corporate Income Tax (CIT).

In particular, we have seen the following recent reforms among others:

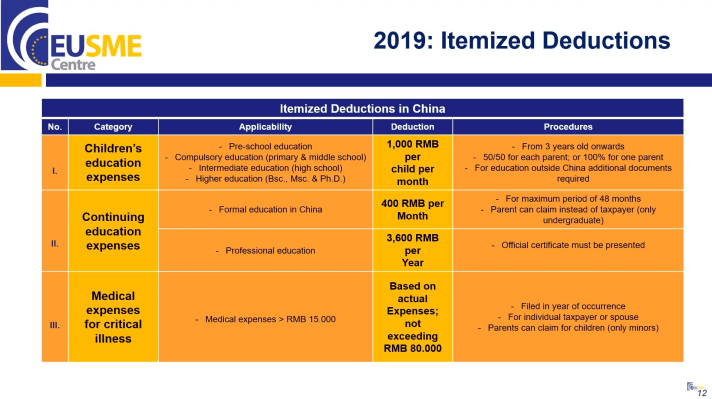

- Implementation of the IIT Reform, with the aim of easing the tax burden for low income earners, starting from 1 January 2019.

- Reduction of VAT rates from 16% and 10% are reduced to 13% and 9%, starting from 1 April 2019.

- Tax cuts for SMEs and low-profit enterprises, starting from 9 January 2019.

This webinar, which was brought to you in cooperation with the EU SME Centre, and by implementing partner of the EU SME Centre, the Benelux Chamber of Commerce in China, addresses the main changes of these reforms and will elaborate on the impact for EU businesses operating in China.

KEY TOPICS

- Background: Recent Tax Reforms;

- Individual Income Tax (IIT) Reform;

- Reforms on Value Added Tax (VAT);

- Reduction of Corporate Income Taxes (CIT) for SMEs;

- Our Thoughts.

* When watching from China, you will need to access VPN first to see the YouTube video of the webinar.