There are many reasons why a foreign invested company may decide to suspend their Chinese business activities. This can be due to challenges of establishing a strong presence in China, the need to focus on the home or other markets, in preparation of liquidating the company in the future, or to just simply put the company plans in China on hold for the time being and to pick them back up in the future, among other reasons.

If a company decides to continue operations and not to liquidate, the company will still be required to satisfy the ongoing compliance requirements. In order to mitigate costs for the companies there are two options: decreasing activities and costs to the lowest level possible, while continuing to satisfy all normal requirements or to make use of the new business suspension policy (company dormancy), that was introduced nationwide in 2022.

In this article we discuss the implications of both of these options in depth in order for companies to make a well-informed decision on what fits their current situation best.

Dormant Company Definition

A dormant company can be defined as a company that ceases trading and operations and does not receive any income, for a period of time. A dormant company is not closed nor obsolete, rather placed on hold as it still remains officially registered. As such, the company may be exempt from making specific tax payments and other contributions.

Ongoing Compliance Requirements

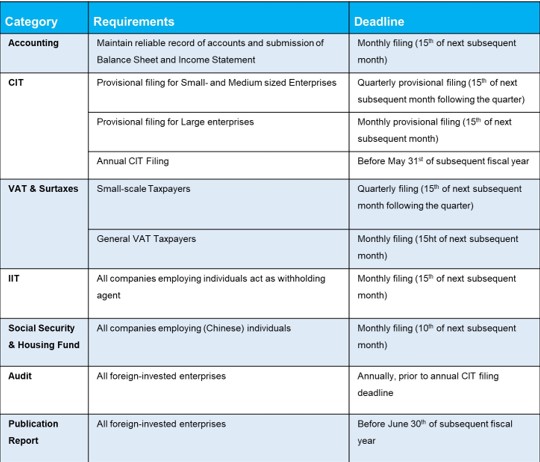

There are several ongoing compliance requirements that companies in China need to satisfy. In the table below we summarize key monthly, quarterly and annual compliance requirements:

To learn more about these requirements, please refer to our Compliance in China for Foreign Companies article.

In addition to the requirements highlighted above, another key compliance requirement is that the authorities must be able to get in touch with a company and its representatives. This includes having a general and financial contact person registered with the authorities, as well as a registered company address where the authorities could visit the company if required.

Both maintaining an address as well as satisfying the compliance requirements can incur significant costs for your company. Below we discuss the options available to mitigate these costs.

Unofficial Dormancy

Before the introduction of an official dormancy process (as explained below), it was not possible for companies to change their status to dormant. As such, this left companies only with the choices of liquidating the entity or lowering the costs as much as possible, while continuing to satisfy the minimum compliance requirements.

If a company completely stops its operations and neglects its compliance requirements for more than 6 months, the business license could be revoked by the authorities. In such a case, various problems may arise, such as a company losing its brand and company name in China or the company may be blacklisted. As such, it is essential for your company to ensure that it continues to satisfy compliance requirement to avoid any adverse consequences. Below we summarize key items to consider when deciding for an “unofficial dormancy”.

Registered Address

According to regulations, a company is required to have a registered office in the district the company is registered. However, companies may be renting a relatively expensive office which serves as a registered address. If your company would become dormant, there is no longer the need for office space, which would be an opportunity to save costs. There are two key factors to consider in this case:

-

Type of Address

When finding an alternative address, the company will naturally be looking for the most cost-effective solution. In most cities in China there are providers offering so-called “virtual addresses”. These are not actual physical locations and as such are a much cheaper alternative to an actual office.

However, the use of virtual addresses is not compliant with regulations, as the authorities should be able to contact the company at its business premises. Additionally, when changing the registered address, the bank is required to visit the company address to take pictures, as required by PBOC (People’s Bank of China) regulations. As such, we advise clients to find a small office that can satisfy these requirements while still providing a relatively cost-effective solution.

We do have to note that certain localities may accept virtual addresses or even facilitate the use of such addresses. We always advise companies to only use solutions that are provided by, or specifically licensed or approved by the authorities to avoid any negative impact or unforeseen circumstances arising in the future.

-

Change of Registered Address

If a company decides to change its registered address, it will need to update the company records with different authorities to complete the process. The company will need to update its articles of association and update the company record with the AMR, MOFCOM, Tax Bureau, the company’s bank, as well as the customs bureau or other authorities the company is registered, if applicable.

Here it is important to note that if the company would move to another district within a city, it will need to file for a tax deregistration in the current district before making a new application in the new district. From our experience the tax deregistration can be a challenging and time-consuming process. As such, it is generally advised to find an address within the same district.

Compliance Requirements

If a company is not officially dormant, it will still be required to satisfy all the compliance requirements as mentioned above. Even if the company has no operations, it will still be required to complete a so-called “zero filing” with respect to VAT and IIT. Moreover, as the company will likely still retain small expenses such as the rent, it will continue to have a limited number of transactions, so a CIT declaration will still be required.

Additionally, the company will also still be required to complete all annual requirements, such as the annual statutory audit, the annual CIT filing and the annual publication report. Even though these items will be simpler for a company with limited to no activity, they will still need to be completed, which may generate costs for the company.

If a company intends to continue business in China in the future, it is essential to satisfy all the compliance requirements. Therefore, it is advised to engage a third-party service provider that can ensure all these requirements are met.

Official Dormancy in China

After a successful trial period in Shenzhen, the authorities have implemented an official “dormancy” process for companies active in China. According to the “Regulations of the People’s Republic of China on the Administration of Registration of Market Entities” and the “Implementation Rules for the Regulations of the People’s Republic of China on the Administration of Registration of Market Entities”, companies can make use of this concept starting from 1 March 2022.

Conditions to Apply and Applicable Period

Companies that are experiencing difficulties operating due to natural disasters, accident disasters, public health incidents and social security incidents, etc. are eligible to apply for dormancy.

The regulation applies to the following company types:

(1) Companies, non-company enterprise legal persons and their branches;

(2) Sole proprietorship enterprises, partnership enterprises and their branches;

(3) Farmers’ professional cooperatives (associations) and their branches;

(4) Individual industrial and commercial households;

(5) Branches of foreign companies;

(6) Other market players as prescribed by laws and administrative regulations.

Companies can retain the dormant status for a period of up to 3 years. After the 3-year period the company will automatically resume operation unless a decision to liquidate the company has been made.

Company Liquidation in China

When a Foreign Invested Enterprise decides to discontinue its operations in China, the company...

Read moreAccording to the implementation rules it may be possible to extend the period after 3 years, but it is currently unclear what the requirements are for such an extension. If a company would like to extend the dormancy period, an application must be filed within 30 days before the expiration of the 3-year period.

Alternatively, if the company resumes business activities during the closing period, it must announce the termination of the dormancy in the National Enterprise Credit Information Publicity System (NECIPS) within 30 days. Failure to announce business resumption may result in fines from the AMR.

Dormancy Application Process

If a company decides to temporarily suspend business operations through dormancy, it must file an application with the AMR. Subsequently the AMR will report the period of business closure and address for delivery of legal documents in the NECIPS.

Legal implications

A filing for dormancy will have the following legal implications:

-

Company Address

During the period when companies are dormant, the address for service of legal documents may be used instead of a physical registered address, which may result in a significant reduction in costs. In certain cities, including Beijing, Shanghai and Shenzhen, the local authorities also allow the use of an email address as the address to receive legal documents.

If the company decides to use an address for the service of legal documents instead of a registered address, it is required to submit a confirmation letter of the address for service of legal documents. If the legal documents service address is in a different district, the registration jurisdiction of the company will not be changed. After business is resumed, the company will need to arrange a new address either in their original district or a different district. As mentioned above, the procedures to change to a different district may be more complex.

-

Staff Considerations

According to the regulations, companies shall negotiate with employees on labor relations and other relevant matters before the temporary business closure. Entering into dormancy will not be considered a legal reason for termination, so the company will have to follow normal termination procedures when firing staff.

In theory a company could still maintain labor relationships over the dormancy period. However, the company will then still be required to make contributions to social security and the housing fund, which will be challenging while the company is in a dormant state. The Beijing authorities have announced that companies could apply for a reduction in the payment ratio or delay payment. However, it is advised to avoid maintaining employees if possible, to avoid difficulties with such payments.

-

Tax and Reporting Requirements

According to the implementation guidelines, dormant companies are still required to publish their annual reports on time.

The national regulations do not specify the implications for dormant companies with respect to tax and other reporting requirements. However, the Beijing authorities have issued local implementation guidelines regarding reporting. In Beijing dormant companies are not required to report to the Tax Bureau and other departments, as the relevant departments can obtain relevant business closure information through data sharing.

-

Company Legal Status

If a company becomes dormant, it will maintain the business license. The business license will not be revoked after 6 months of no activities. Additionally, the dormancy period does not affect the qualifications of companies, nor does it affect the companies’ claim to creditor’s rights and performance of debts, administrative penalties, administrative reconsideration decisions, judgments, arbitration documents and other statutory or agreed obligations.

Dormant Company Example

Company X is a trading company which has been operating in Zhejiang province, China since 2016. Due to the resurgence of COVID-19 and the lockdowns experienced in various parts of China, Company X decides it would like to put its China operation on hold for some time, while it considers what to do next.

Company X then files an application with the AMR for official dormancy, which is subsequently approved. For the following 11 months, they do not conduct any operational activities, downsize their labor force and ensure their taxation and reporting obligations have been fulfilled. Thereafter they make the decision to liquidate the company and start the company liquidation process.

Conclusion

The implementation of an official dormancy status is a new measure in a range of policies issued by the authorities aimed at optimizing the business environment. Where in the past companies could only choose a “de facto dormancy” by scaling down all operations as much as possible, now companies can officially file for a dormancy of business suspension. The exact implementation of the regulation on a local level has not been issued in all regions of the country yet, but this is expected to be announced soon.

Whether your company is active or dormant, we specialize with assisting you with your business needs in China. At MSA we assist businesses with various needs, whether switching to dormant status, company set up, business advisory or more, we make achieving your goals in China easier. Get in touch with us right away and find out how we can help you reach your targets.