Effectively managing human resources (HR) is an important part for every organization around the world. This task becomes increasingly difficult when managing personnel and payroll of expatriates whom work across borders and whom would become subject to various rules and regulations different from the home country. To manage this effectively, this requires in-depth understanding of various HR compliance issues and requirements on an international basis as well from a local perspective.

For many foreign companies, China’s legal and tax environment on hiring & paying staff is very different. As a result, we have seen that many foreign companies have been facing difficulties to manage their HR administration and ensuring compliance in their organization.

In this two-part series, we will address these typical issues and aim at providing foreign companies with a better understanding about important considerations for expats and local staff and misconceptions we encountered in China. In the first part, we will address typical legal issues foreign companies should carefully to take in mind, as well as how to determine employee compensation. In Part 2, we will explain more about individual income tax and social security requirements in China to consider.

1. Signing of Labor Contract

A limited liability company in China, which includes a Wholly Owned Enterprise (WFOE), Joint Venture and Domestic Company, are allowed to hire local and expatriate staff in China. A Representative Office can only hire local staff via labor dispatch organizations such as FESCO or EFESCO, but can hire a maximum of four foreign nationals directly.

To make sure the employment agreement with the employee is valid, it is very important that during the first month of employment an agreement is SIGNED which is in CHINESE language according to Chinese rules and regulations. This employment agreement can be bilingual (i.e. English and Chinese), but always the Chinese language will be prevailing.

What happens if no employment agreement is signed after 1 month of employment?

According to Article 10 of PRC Labor Contract Law, the employer would then be required to pay its employee double the employees’ monthly salary; if the employee refuses to sign the employment contract after the second month, the employer must still pay this economic compensation if deciding to terminate the employment agreement. If an employee goes without a contract for more than one year, according to Chinese Labor Contract law it would be deemed that the employee has entered into an open term contact with the employer.

Particularly for companies with many employees, it is very important to make sure the employment agreement is signed during the onboarding.

2. Probation Period & Renewal of Labor Contract

Under Chinese labor laws, an employer can unilaterally terminate the employment relationship with the employee who does not satisfy the conditions of employment during the probation period without being obliged to make severance payments to this employee. Once the employee has completed his or her probation period, it becomes very complicated to dismiss an employee without a good reason and is normally required to pay severance to the employee.

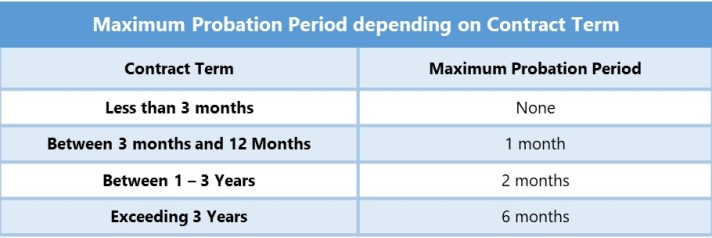

It is therefore very important to have a good understanding about the probation periods allowed per employment contract length, as this has an impact on your HR management.

The permitted probations periods per contract length are as follows:

Since generally employers would seek to have new staff on board for at least 2 to 3 years, it could be more interesting to agree on a longer-term initially and as a result be legally allowed to propose a longer probation period.

This longer term could also be interesting to consider, since generally within China (differences may apply in other provinces in China) the employer is only allowed to extend employment agreement twice (up to 10 years in total), the third signed contract will become open-end term contract.

3. Employee Handbook

Though not all foreign companies have an employee handbook in place within their organization, it is generally recommended for an employer to also issue this document to its employees in China. This handbook defines the job of the employees and describes the company’s rules and regulations. Basically, the employee handbook can be regarded as the “Code of Conduct” for the employees.

An employer has to ensure that all of the employees have read the terms of the handbook and have agreed to this document by signing acknowledgment letter.

This handbook provides clarity to the staff and serves as a constitution in case of disputes between the employer and the employee. If there is any change made to the company’s handbook, it is recommended to have all the employees read this updated version and sign acknowledgment letter again.

4. Employee Termination & Severance Payment

As mentioned earlier, terminating an employee in China whom has completed his or her probation period is difficult. Contrary to the belief, employees are well protected under Chinese Labor Law and generally can only be laid off when there is a good reason/cause and as well a severance payment.

Even when the employment term ends, the employee may be entitled to a severance payment. This severance payment serves as a financial compensation for termination and is computed by multiplying the monthly salary of the employee (capped up to three times average salary in province) by the years of service in the company.

It is also important to realize that severance payments generally have a beneficial tax treatment for companies and may even be tax exempted up to three times yearly average salary of the respective city in China.

5. Employee Compensation

Though it seems a straightforward process to determine the compensation package for new employees within China, we have however seen that many foreign companies having challenges to determine the right amount. As you can expect, and as between all countries globally, the salary and benefits expectations of staff within your sector in China will certainly be different from your home country. Since also country is developing very fast, this is developing fast and is changing almost every year. Therefore, it is important to do diligent research on the expectations or consult specialists within China who can help you to determine the right amount.

In Part 2 of our series, we will proceed to explain more about individual income tax and social security in China.

Please click on the following link to visit Part 2 of our series.