The year 2016 has demonstrated again to be a year of many changes. The Chinese economy has been steering more and more towards domestic consumption, new regulations have been implemented (i.e. VAT Reform and Transfer Pricing) and many developments have taken place in terms of innovations (mobile payments, e-commerce, artificial intelligence etc.). But not only the changes in China impact our way of doing business. Developments such as the “Brexit” and the US presidential elections and the impact on US politics might profoundly impact geopolitical and economical balances. Also, 2017 is promising to be a hectic year with again much changes expected.

How have Benelux (i.e. Belgium, the Netherlands, Luxembourg) companies performed within this context? How are Benelux companies adapting to these changes in the Chinese market and how would it affect them in 2017?

Sino Benelux Business Survey 2017

In collaboration with 1421 Consulting Group in Beijing and in Shenzhen (‘Pearl River Delta’), and with the Benelux Chamber of Commerce in Beijing, Shanghai and the Pearl River Delta in China, MSA organized this year again the Sino Benelux Business Survey and has asked these questions via in-depth interviews and questionnaires to Benelux companies active across China.

We have distributed our questionnaire from early March 2017 until 1st of April among the Benelux business community and 68 respondents completed the survey. Different from previous years of the Sino Benelux Business Survey, we also have conducted 12 in-depth interviews with entrepreneurs and senior managers from Benelux companies within China. The objective has been to get a better understanding of how companies manage changes within their environment and to have a better idea of the most pressing issues and circumstances for Benelux businesses.

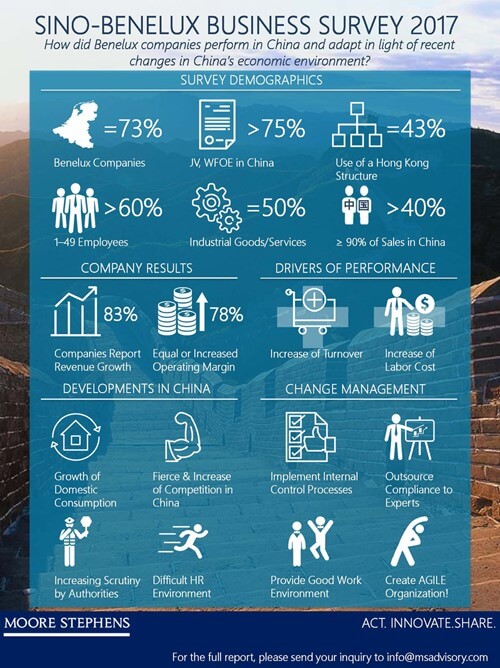

Approximately 73% of the respondents from the questionnaire are directly linked to the Benelux countries, other companies either have management or strong ties with this region. Most of the respondents are based in Shanghai (52%), other respondents are located in Beijing (25%) and Guangdong Province (12%). Based on its size per revenue and employees, most companies can be considered as an SME within China. Approximately 75% of the respondents have revenue size up to 100 million RMB (approx. 13 million EUR) and 69% of the respondents have less than 50 employees within China. Also on average the companies have been active within China for 9.7 years and the most represented industry sectors within the survey are industrial services (38%), industrial goods (18%) and consumer goods (15%).

Results of the Sino Benelux Business Survey

Though there has been a slight decrease compared to the performance as of last year’s business survey, the Benelux companies have still performed well in China with 54% of the respondents reporting revenue growth above 5% and 52% reporting a profit margin above 5%. They are mostly positive on staying in China (75% of the respondents do not consider moving their activities in other Asian countries) and continue to invest in this market. On the long run, depending on the sector of activity, they see many opportunities to grow. This is also reflected in their overall revenue growth expectations for 2017, wherein 67% of the respondents expect their revenue to grow more than 5%. This is considerably more positive compared to the expectations in the Sino Benelux Business Survey 2016.

The survey also confirms that the Chinese economy is still growing and changing rapidly, but competition is becoming tougher. Particularly during the interviews, many interviewees mentioned that Chinese companies are becoming more innovative, more risk-taking and overall more competitive within their market and against their business. They mentioned the innovation gap is rapidly shrinking and requires more skills and capabilities to effectively gain market shares and sell their goods and services. Combined with the rising salaries and other costs within China, it creates a challenging environment for Benelux businesses.

China is also becoming more and more a developed country with strict rules and regulations. For instance, more than 50% of the respondents have indicated that the enforcement of rules and regulations and foreign exchange controls in China have increased in 2016 (against 2% to 3% experience decrease). Compliance on doing business and working in China is an important topic for foreign enterprises and will remain a challenge to manage properly by having the right information and right organization.

Overall the results of the Sino Benelux Business Survey 2017 show us that the way to do business in China is changing. People need to be flexible and adapt their organization to the local reality. Also, companies already active in China, must adapt to this changing environment. They need to find the right way to reach their targets by looking for the markets’ opportunities, stay ahead of the challenging competition and manage the local compliance. Companies willing to enter the Chinese market need to be well prepared with a good understanding of their market and the right information on how doing business in China.

To receive the full report on the Sino Benelux Business Survey 2017 edition, you can reach out to us directly.