Under a tax treaty to which the People’s Republic of China (PRC) is a contracting party, PRC tax residents and foreign tax residents may be able to benefit from foreign tax relief and exemption or a reduction in tax in the PRC. Social security agreements, also known as totalization agreements, have the purpose of avoiding double taxation income with respect to social security taxes. In other words, the totalization agreements eliminate dual Social Security taxation when a worker from one country works in another country and is required to pay Social Security taxes in both countries on the same earnings.

In this article, we explain the social security exemptions applicable for foreign tax residents in Mainland China and how to make use of these.

China’s Social Security System Explained

The framework for the social security system was officially implemented with the Social Insurance Law issued in 2011. China’s social security system is comprised out of five distinct categories of social insurances as well as the housing provident scheme. The categories of social insurance are:

- Pension;

- Medical Insurance;

- Unemployment Insurance;

- Maternity Insurance;

- Work-related Injury Insurance.

The first three insurances are contributed by both the employer and employee, whereas the latter two insurance are solely contributed by the employer. Please refer to our article Explaining China’s Social Security System and Housing Fund Scheme for Employers to learn more about the system.

Social Security Obligations for Foreign Individuals in China

According to article 97 of the Social Insurance Law, foreign individuals employed in China shall participate in social insurance in accordance with provisions of the law. According to the “Interim Measures for the Participation of Foreigners Employed in China in Social Insurance”, foreigners who are employed in China shall participate in all five social insurances. Therefore, in principle, employers and foreign employees should pay various social insurance contributions in accordance with the relevant legislative provisions. Whereas foreign individuals are required to contribute to the five social insurances, they are generally not required to contribute to the housing provident scheme. However, they can opt in to contribute on a voluntarily basis.

Even though the law is implemented nationally, the implementation of the social security is managed at a regional. Therefore, differences in implementation exist based on locality. For example, in Dalian foreign employees are only required to contribute to the pension and medical insurance. Moreover, in Shanghai social security contributions for foreign employees have not been enforced. As such, foreign nationals employed in Shanghai have not been required by the authorities in the city to make social security contributions. Similarly, employers in Shanghai who employ foreign nationals have not been required to make employer contributions to social security. However, following recent development, this may change in the future. To learn more, read our article on whether foreigners in Shanghai need to contribute to social security.

Bilateral Social Security Agreements

For foreign employees to avoid paying social security contributions in two countries simultaneously, China has entered into social security agreements with 12 countries, of which 11 have been already implemented. These countries include Germany, South Korea, Denmark, Canada, Finland, Switzerland, the Netherlands, Spain, Luxembourg, Japan, and Serbia. Furthermore, China has already signed an agreement with France, but this agreement is not yet in effect. The agreement will come into effect after both countries have completed the necessary domestic procedures for implementation.

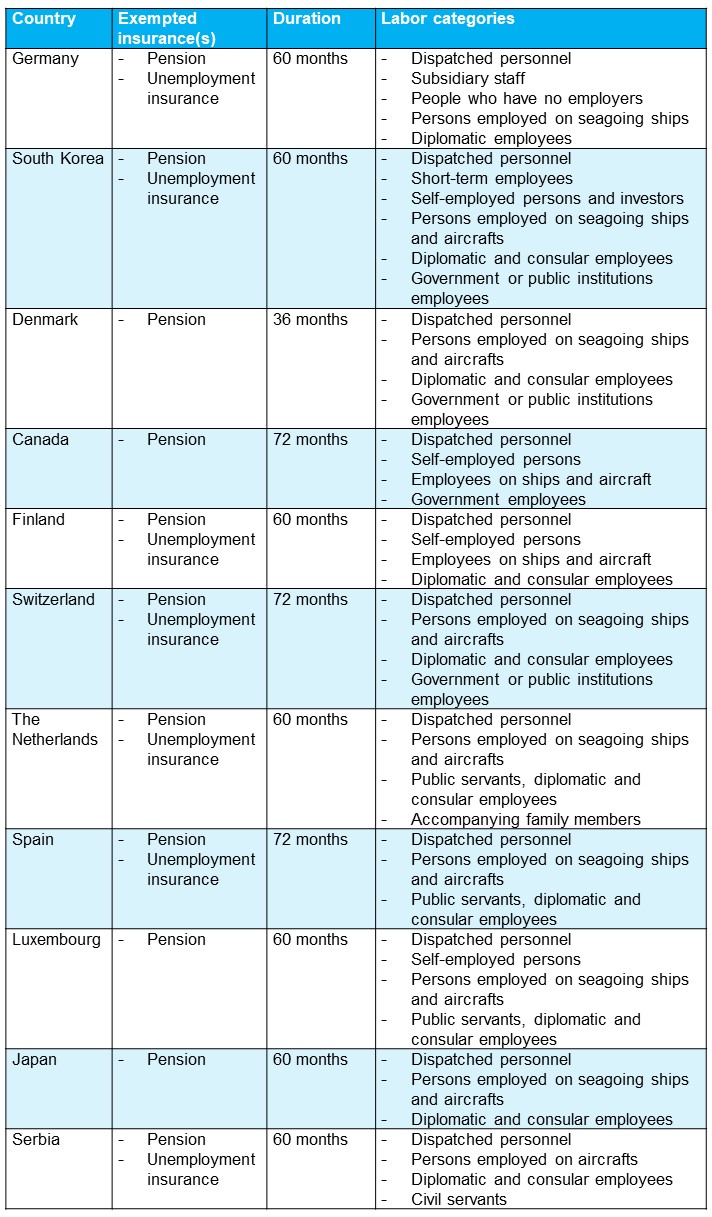

According to these social security agreements, foreign employees who are citizens or assigned by employers of one state can be partly exempted from social security contributions in the other state. For social security in China, the agreements generally specify only exemptions to pension and unemployment insurance, depending on the country.

Important to note is that the social security exemptions only apply to a specific group of labor categories. The labor categories that are eligible for exemptions differ per country. The applicable labor categories are defined in each specific agreement. In the table below we highlight per country the insurance(s) which can be exempted, the duration of such exemption and labor categories eligible for exemption according to the relevant agreements per country:

According to the social security agreements, individuals can claim the social security exemptions for a pre-specified period as highlighted in the table above. However, most of the agreements specifies that eligibly individuals can file for an extension of these benefits, which is generally conditional on the consent of the competent authorities or agencies.

How Can You Benefit from the Exemptions in Mainland China?

Exemptions for social security contribution under these totalization agreements are not applied for automatically. A foreign employee must apply for these exemptions through their employer and there are certain steps that must be followed by the companies when applying for social security exemption for their foreign employee.

Step 1: The legal entity that employs the foreign employee in China must submit the original certification of insurance issued by the relevant entity in the country of origin to the Chinese social security bureau.

Step 2: The Chinese social security bureau will verify the certification of insurance and hold a copy. During this process, however, the Chinese social security bureau may question the documentation and further verifications is required.

Step 3: After the original certification of insurance is verified and accepted by the Chinese social security bureau, the foreign employee will be exempt from the relevant social security contributions.

The duration of the exemption also varies from country to country. For example, for Germany, the Netherlands and Luxembourg the maximum length of exemption period is 60 months. When exceeding this period, an extension may be possible but will require further approval by the relevant social security contributions. For example, German employees staying in the German social security system are exempted from paying the Chinese pension and unemployment insurance by application with the certificate by the German social security authority. The initial maximum exemption period is 60 months, but the period can be extended to a total of 96 months upon approval.

Important Considerations

While implementation guidelines are established on a national level between the two countries when discussing the totalization agreements, the actual implementation is done by the relevant regional authorities. This frequently results in unclarities when the local responsible authority does not have previous experience with the exact implementation procedures and requirements.

Currently, there are exemptions for 11 countries excluding France that have social security exemptions applicable to certain insurances and type of categories. It is strongly advised for employers and their foreign employees that want to apply for social security exemption in China to carefully study these agreements and contact the local social security bureau to understand the required process and documentations.

MSA supports foreign SMEs in China with advice on the social security agreements as well as with the application procedures as part of our Global Mobility Services. If you have any questions about the agreements in China and how this affects you or your employees, please do not hesitate to reach out to us.