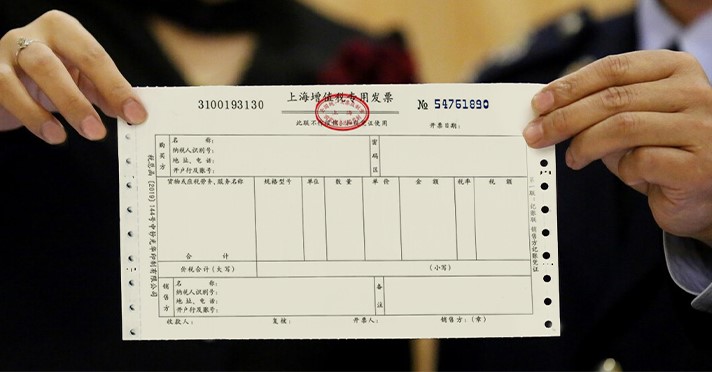

For foreign companies setting up operations in China, many aspects are new to them and can be confusing, as it is often different from the standards in other countries. Perhaps the most confusing topic is that of the fapiao (发票). The literal translation of the word fapiao (发票) is “invoice” and therefore is known as the official Chinese invoice.

Although a fapiao looks very different from a commercial invoice as known in other countries, the fapiao plays an essential role in China’s invoicing system. In China, companies must record all business transactions on a fapiao. Here the fapiao serves as both the legal receipt and tax invoice, fapiaos are required to have expenses recognized on an accounting level and the fapiao determines when VAT is due. As such, it is imperative that foreign businesses understand the fapiao invoicing system. In this article we discuss what a fapiao is, how it is different from an invoice, how to use a fapiao and where their importance comes from.

What is a Fapiao?

A fapiao is a business voucher issued and received by all parties involved in the purchase and sale of goods or services. The fapiao is the original document accounting for a cost, an expense, or revenue. In essence, the fapiao has three purposes:

1. A fapiao is used by individuals to reimburse business expenses;

2. Companies use fapiaos for accounting purposes and tax deductions; and

3. The Chinese authorities use fapiaos to track transactions for tax purposes and to prevent tax evasion.

How Does the Fapiao Invoicing System in China Work?

The State Administration of Tax (SAT) oversees the printing, distribution, and administration of fapiaos in China. The central system used by the SAT for the administration of fapiaos is called the “Golden Tax System”.

When businesses want to issue official invoices in China, they must first obtain empty sheets of fapiao paper at the tax bureau, with only a range of fapiao numbers associated specifically with the current batch of fapiaos for the company. Subsequently, companies must (in)print the fapiao sheets with a special printer that is linked to the tax system. Companies will have a device, typically in the form of a USB-stick, called the “Golden Tax Device” (see image below), to login to the printer program which identifies the company and is connected to the tax system. The system will automatically indicate the next fapiao number that can be used for printing and should be placed in the printer. The authorities give companies the freedom to choose the (services) category themselves, however, according to PRC legislation you cannot perform business activities which are outside of your business scope.

Therefore, it is essential that the category chosen is in line with the company’s business scope and the responsibility to act in accordance with the law rests with the company.

The old Golden Tax Device (left) and the new version (right).

Because the printer and Golden Tax Device identify the company and link directly with the tax system, a transaction is recorded in the records of the tax bureau and VAT is due upon printing a fapiao and is payable in the following month.

After a customer receives a fapiao, he/she will have to login to their tax system and use the tax program to verify the transaction, after which the tax will be deductible, and the deduction will be applied in the next month against the tax payable.

The fapiao system is also linked to the VAT declaration system. When companies file figures with the monthly VAT declaration that are inconsistent with the issued fapiaos, the declaration system will notify the company and prohibit the declaration process. Subsequently, the company will not be able to issue fapiaos until the discrepancy is resolved. It is essential that the physical fapiao is kept in the company’s records, as companies are required by law to maintain physical records for 30 years.

Since the literal translation of fapiao is “invoice” and there is no comparable document in most other countries, the fapiao may cause confusion at times. In China, there are also invoices that resemble the commercial invoices used in other countries around the world. For example, there are international invoices (账单) and receipts (收据or 小票). However, although these invoices document the amount of goods/services provided and the price, they are not official tax invoices with according legal validity and do not determine when taxes are due. In China, these types of invoices are different from the fapiao and can be viewed as a payment notice or are comparable to a proforma invoice.

Small-scale vs. General Taxpayer: Who Can Issue a Fapiao

VAT taxpayers in China are categorized as VAT General taxpayers and VAT small-scale taxpayers. Businesses with annual taxable sales exceeding the pre-determined ceiling for small-scale taxpayers must apply for General VAT taxpayer status.

Prior to May 1, 2018, the ceiling differed based on your type of taxpayer category, however, the ceiling has since then been unified at RMB 5 million. Businesses with annual sales below the ceiling or those who are newly established, may voluntarily choose to apply for General VAT taxpayer status, provided that they keep a legitimate and accurate bookkeeping.

VAT rates for General VAT taxpayers are 6%, 9% and 13%. Small-scale taxpayers are subject to a VAT rate of 3% (currently 1% for the years 2020 and 2021 in light of COVID-19 support measures), but are unable to deduct input VAT from output VAT. In the past, small-scale taxpayers were also not able to print VAT invoices by themselves (and instead had to visit the tax office to print them). Nowadays they can apply with the tax office to be able to print fapiaos themselves as well.

The Difference Between General VAT Fapiao and Special VAT Fapiao

The Chinese invoicing system recognizes two types of fapiaos, the General VAT fapiao and the Special VAT fapiao. The main difference is that the Special VAT fapiao gives right to input value added tax deduction, whereas the General VAT fapiao cannot. Because small-scale taxpayers are not legally able to deduct input VAT from output VAT, they can only use the General VAT fapiao. Moreover, it should be noted that General VAT taxpayers selling specific consumer goods such as cigarettes, alcohol, food, clothing, shoes and hats, cosmetics, etc. are also not allowed to issue Special VAT fapiaos.

Furthermore, it is interesting to note that a fapiao is not just constituted by one sheet of paper, but rather 3 different sheets. The special VAT fapiao consists of the following sheets:

- Accounting sheet, this sheet will be kept by the issuer for accounting purposes.

- Deduction sheet, this sheet is proof of the input VAT paid by the buyer.

- Invoice sheet, this is a copy of the transaction for accounting purposes of the buyer.

On the other hand, a General VAT fapiao only has 2 sheets, where it does not have the deduction sheet because the tax is not deductible on General VAT invoices.

What is the Difference Between an Invoice and a Fapiao?

Generally, an invoice is a list of the goods or services that are to be supplied to a customer, with the amount that’s due. A fapiao is different as it serves as proof of the transaction and can only be issued once the transaction has taken place.

As such, in China a distinction is made between a fapiao and receipt, where a receipt can be issued before a transaction has taken place.

Important Considerations when Using Fapiaos

There are no rules on payment terms in China as set out by the law, and therefore these terms are up to discretion of the parties involved in a transaction.

It is Recommended to Provide a Fapiao to Customers After Receiving a Payment

In general, we advise receiving payment prior to issuing a fapiao. The reason for this is because the moment a fapiao is printed the obligation to pay VAT arises in the current period. If the seller has not received payment from the buyer in the current period, this may create a cash flow problem.

Moreover, it is important to note that the process to cancel a fapiao is complicated and time-consuming. The level of difficulty to cancel a fapiao depends on whether the cancellation will be done in the same accounting period as the moment of issuance and whether the fapiao has already been verified by the customer. If the fapiao already has been verified by a customer, the customer must file an application to cancel the fapiao. Therefore, it is even more recommendable to only provide fapiao to customers after receiving payment.

The Customer is Responsible to Request a Fapiao

Fapiaos are not issued by default and therefore it is the customer’s responsibility to officially request to receive a fapiao. On the other hand, in accordance with Chinese tax law, you are obligated to issue a fapiao when services have been rendered or ownership of goods has been transferred. This means that refusal to issue a fapiao is illegal in these circumstances and any uncooperative company can be reported to the local tax authority.

Eeach Company has a Fapiao Quota

The number of fapiaos a company can issue and maximum monetary amount per fapiao is subject to a quota set by the local tax bureau, and differs considerably per province-, city- and district level, as well as the in-charge tax officer. Additionally, unwritten requirements will generally also influence the tax authorities’ judgement on the quantity and value of fapiaos to be issued to a company, such as the company’s registered capital, office size and number of employees.

Conclusion

A fapiao (or 发票 in Chinese) is an official Chinese invoice which is used to recognize expenses, used for accounting purposes and tracks transactions for tax purposes and supports to prevent tax evasion. It is important to note that although you may encounter as well other types of commercial or proforma invoices in China, these fulfill a different function compared to the fapiao. Therefore, it is recommended that all foreign businesses in China understand the impact the fapiao has on the company’s tax- and financial position.

Due to the particulars of the Chinese invoicing system, invoicing in China is more complex and requires a greater workload compared to many other countries. For this reason, many small- and medium-sized foreign-invested enterprises in China elect to outsource the fapiao procedures to a third-party while maintaining control over issuance of payment notices and payment collection. For any further questions about fapiaos, please do not hesitate to contact us at [email protected]